Synopsis: Malta rejects Binance Charity’s $33 million crypto donation to protect national reputation amid Binance’s legal troubles, sparking political debate over ethics versus urgent healthcare funding.

What began as a generous $200,000 crypto pledge in 2018 has turned into Malta’s latest political controversy. Binance Charity’s donation to the Malta Community Chest Fund (MCCF) is now worth around $33 million, thanks to the surge in the price of Binance Coin (BNB). However, the MCCF has rejected the gift, calling it a risk to the nation’s reputation.

Finance Minister Clyde Caruana supported the decision on Tuesday, describing it as “the right call.” He said, “You either give to charity or you don’t. Don’t dance around it.” His stance aligns with Malta’s President Myriam Spiteri Debono, who called Binance’s gift a “bogus donation.”

Their reasoning seems simple but fisrt Malta must protect its financial credibility. I can’t deny that reputational caution makes sense here, given Binance’s global troubles. Yet, a $33 million refusal feels like a lost chance for patients in urgent need.

Blockchain Dreams and Bitter Fallout

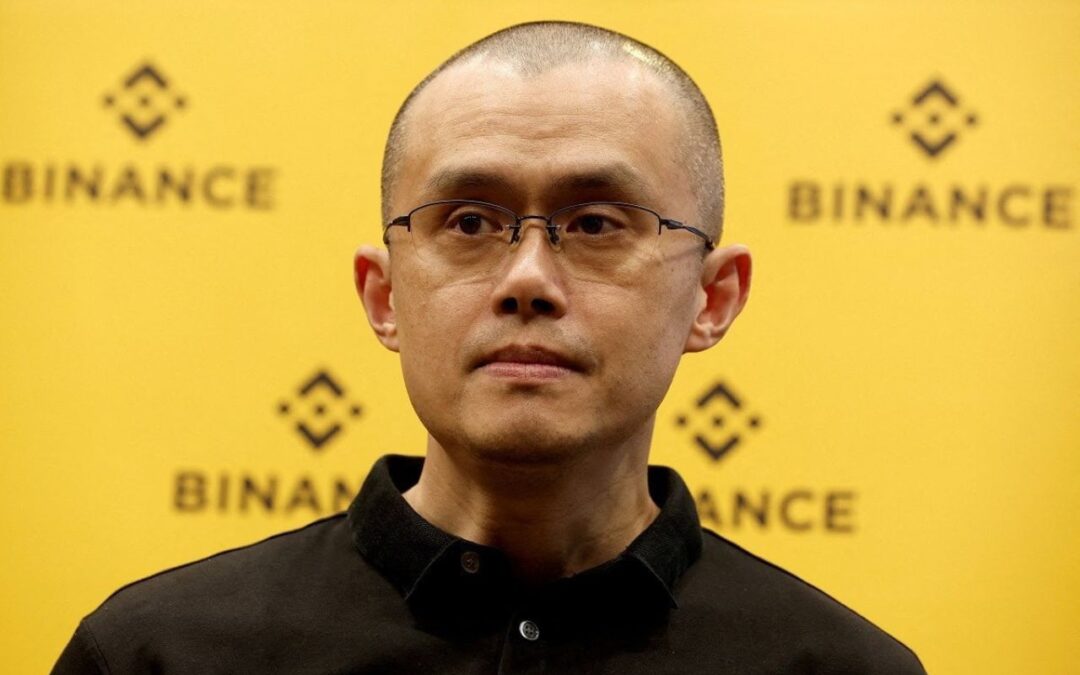

The controversy traces back to 2018 when Binance’s then-CEO, Changpeng Zhao, pledged 30,644 BNB tokens to the MCCF for terminally ill cancer patients. Back then, Malta proudly branded itself as “Blockchain Island,” eager to welcome crypto innovation.

However, the goodwill soon ran into disagreement. Binance demanded the charity share patient wallet and health data so it could transfer the funds directly calling it a transparency measure. The MCCF refused, citing privacy and ethical concerns. Binance later admitted talks had stalled, saying the charity never provided the required wallet details for disbursement.

By 2020, the issue landed in court. The MCCF feared the funds might disappear if transferred out of Malta, while Binance accused the charity of delays. After years of legal tension, the matter reached an out-of-court settlement earlier this month. Then came the final blow the MCCF announced it no longer had any relationship with Binance’s Blockchain Charity Foundation.

Frankly, Malta’s transformation from crypto champion to careful skeptic feels dramatic. But perhaps this shift reflects lessons learned after years of regulatory trouble and public distrust.

Political Rift Over Rejection

The charity’s decision has split the government. Prime Minister Robert Abela urged the MCCF to reconsider, warning that the country might be acting “too puritanical.” He said it upset him that “a sum like that could possibly be lost.”

A few lawmakers echoed his sentiment, including Edward Zammit Lewis, Rosianne Cutajar, and Opposition Leader Alex Borg. They see the funds as a rare opportunity to expand healthcare resources.

Still, President Debono and Finance Minister Caruana insist that ethics must guide policy. They argue that accepting money tied to a company facing criminal fines could stain Malta’s recent push for clean financial governance.

This divide between Malta’s moral guardians and practical policymakers has turned a simple donation dispute into a national debate. For a small nation, it’s remarkable how deeply €33.5 million can shake politics.

Ethics Over Windfall

Behind the political theater lies a bigger concern how Malta handles its crypto legacy. Binance once symbolized the island’s technological ambition. Today, its association brings more scrutiny than celebration.

Regulators remain wary. Binance’s history of money-laundering violations, legal fines, and leadership scandals have made countries rethink generosity from crypto-linked entities. Experts have even called such gifts “reputation laundering.”

In that light, the MCCF’s cautious stand looks almost inevitable. The charity wants to keep its donor base credible and its image untarnished. Rejecting the donation might not fund patients today, but it may preserve trust tomorrow.

As this story keeps unfolding, it’s hard not to feel conflicted. Turning away $33 million sounds absurd in tough economic times. But choosing integrity over influence especially in a crypto-tainted context might prove Malta’s most valuable gain yet.

Written By Fazal Ul Vahab C H