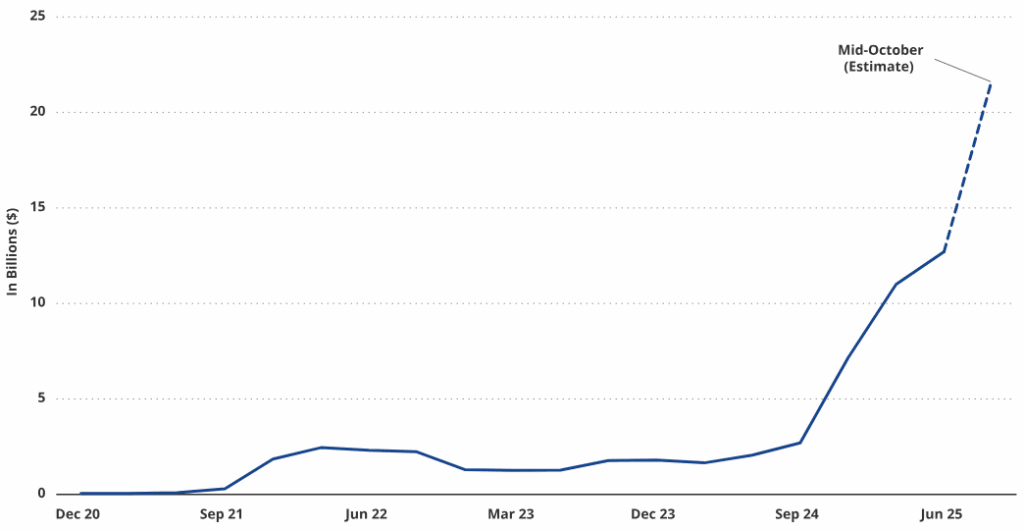

Synopsis: Bitcoin miners have taken on $12.7 billion in debt a 500% surge to fund upgrades and pivot into AI infrastructure, diversifying revenues amid shrinking Bitcoin rewards and soaring energy demands.

Bitcoin miners are racing to upgrade. Over the past twelve months, their total debt has jumped from $2.1 billion to $12.7 billion, a staggering 500% surge, according to VanEck. This massive borrowing spree highlights how the mining industry is changing fast to meet two major pressures artificial intelligence expansion and Bitcoin’s intense hashrate competition.

Source: VanEck

VanEck analysts Nathan Frankovitz and Matthew Sigel describe this shift as the “melting ice cube problem.” As miners fail to upgrade their machines, their share of Bitcoin production melts away, just like ice under heat. It’s no secret that mining rewards have grown harder to capture, especially after the 2024 halving cut daily rewards to 3.125 Bitcoin.

Frankly, this scale of borrowing feels risky. Still, miners view it as essential. Without fresh capital, they lose ground in the global hashrate race, which defines how much of the Bitcoin network they can control and profit from.

The Great AI Pivot Begins

After last year’s halving, many miners realized they couldn’t rely only on Bitcoin. The answer? Artificial intelligence. Increasingly, mining companies are converting their facilities to run AI and high-performance computing (HPC) equipment. “Miners have secured more predictable cash flows backed by multi-year contracts,” said Frankovitz.

This shift is visible across the board. Bitfarms recently closed a $588 million convertible note deal to expand its AI infrastructure across North America. TeraWulf followed with a $3.2 billion offering to fund a new data center in New York. Even IREN raised $1 billion in convertible notes, planning to deploy some toward general operations and AI projects.

It’s a fascinating pivot. By diversifying into AI hosting, miners access steadier income and reduce their dependence on Bitcoin’s volatile price cycles. As someone who’s followed crypto mining markets, this feels like the most logical evolution yet gritty survival through smarter energy use.

Energy, Efficiency, and Expansion

The numbers confirm this energetic expansion. Global power consumption by Bitcoin miners rose 7% this month, while mining difficulty climbed 10%, hitting new all-time highs. As miners blend AI workloads with Bitcoin operations, they’re pushing the limits of available energy.

Interestingly, despite these energy pressures, analysts at VanEck argue AI’s rise actually helps Bitcoin. “AI’s priority for electrons is a net benefit,” they wrote. By powering shared data center infrastructure, miners make better use of existing electricity and capture value from what would otherwise go to waste.

I find that a refreshing perspective. Mining critics often worry AI will drain resources, but here, the two seem to complement each other in unexpected ways.

Cash Flow Strains

To fund upgrades and pivot toward data-heavy AI centers, miners have begun offloading more Bitcoin to exchanges. Transfer volumes from miners to exchanges jumped 14% this month. It shows miners monetizing what they mine instead of holding for future gains a move that makes sense when capital costs are this steep.

Some firms are also testing creative ideas to manage excess power. During low AI demand, they hope to monetize spare energy rather than rely on costly backups like diesel generators. “It’s still conceptual,” VanEck noted, “but could improve efficiency in both financial and electrical capital.”

In simple terms, miners are reinventing their business model. They’re chasing profit not only in Bitcoin blocks but across the growing AI universe. Debt-driven or not, it’s a high-stakes strategy one that could define the next era of digital infrastructure.

Written By Fazal Ul Vahab C H