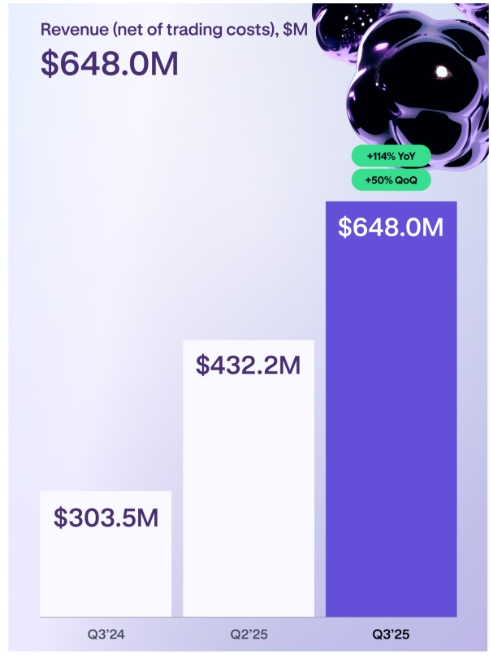

Synopsis: Kraken delivered record Q3 2025 results with 114% revenue growth to $648 million, boosted by higher trading volumes, institutional flows, and expanding derivatives and tokenized securities platforms.

Crypto exchange Kraken has caught the spotlight again. The company reported its strongest-ever quarter, posting a 114% revenue jump to $648 million in Q3 2025. The numbers reflect growing trading activity and its expanding global footprint. It is fair to say Kraken’s performance shows how far the company has come since its early days in 2011.

Source: Q3-2025 Company Filling of Kraken

According to its Q3 filing, Kraken’s adjusted EBITDA reached $178.6 million, sharply improving from last year’s loss. Profit margins widened by nine percentage points to 27.6%, signaling stronger efficiency and cost control. For a crypto exchange that often faces volatility, this kind of margin growth looks impressive.

Trading volume soared 106% year-over-year to $561.9 billion, with daily average revenue trades up 42% from the previous quarter. Assets on the platform climbed 89% to $59.3 billion, while the number of funded accounts reached 5.2 million. Kraken’s management must be feeling confident as these numbers show broad participation from both retail and institutional users.

Expanding Reach and Product Upgrades

Kraken’s strong performance did not happen by chance. The exchange has been expanding aggressively throughout 2025 with new products and acquisitions. It launched a U.S. derivatives division in July, allowing traders access to CME-listed crypto futures. This expansion pushed Kraken beyond spot trading and opened the door to new revenue streams.

In September, Kraken acquired Breakout, moving into proprietary trading and strengthening its institutional tools. It also announced a platform for tokenized securities, giving European investors access to digital representations of U.S. stocks. This move shows that Kraken is not just chasing short-term growth but preparing for the digital finance era.

Earlier, Fortune reported that the company raised $500 million at a $15 billion valuation. That funding boosted speculation about a possible initial public offering (IPO) in 2026. Many investors believe this IPO could position Kraken among the most valuable players in global crypto markets.

Clear Signals from Market Trends

This surge reflects not only Kraken’s internal strength but also a wider recovery in the crypto sector. Increased institutional inflows, improved regulations for stablecoins, and renewed investor confidence have created a supportive environment. Interestingly, over 60% of Kraken’s spot trading volume came from stablecoin or fiat pairs, showing steady participation even during volatile market periods.

Its tokenized equities platform, xStocks, also gained traction. Operating across 160 countries, xStocks recorded over $5 billion in trading volume and $1 billion in on-chain transactions. It shows how global traders are warming up to tokenized real-world assets a segment with growing interest amid digital finance innovation.

CEO Dave Ripley credited the success to strong institutional flows, new product launches, and market momentum around major cryptocurrencies like Bitcoin and Ethereum. He added that Kraken remains focused on compliance and transparency, which stands as one of its long-term strengths.

IPO (Initial public offering)

As Kraken moves closer to a much-anticipated IPO, attention is turning to how it will perform alongside competitors like Coinbase. Analysts expect Coinbase’s Q3 revenue to rise by about 50%, less than half Kraken’s growth. That signals a clear shift toward more diversified platforms like Kraken that operate beyond traditional spot markets.

For investors and traders, Kraken’s results seem to confirm that the crypto recovery is not just speculative noise but real activity. The exchange’s proof-of-reserves audits, global partnerships, and new launches point to a maturing business prepared for mainstream finance. Personally, I think Kraken’s sharp focus on transparency and innovation could make it a market leader once it goes public.

In many ways, Q3 2025 marks a turning point. Kraken has shown that disciplined expansion and smart timing can turn volatility into opportunity. If this pace continues, its 2026 IPO could be one of the most watched listings in the digital asset world.

Written By Fazal Ul Vahab C H