As the crypto market nears the final quarter of 2025, many investors are beginning to shift focus from overextended assets to emerging opportunities. Solana (SOL), once one of the fastest-growing top cryptocurrencies, is now showing signs of slowing momentum after a strong year.

While SOL remains a leading player in the blockchain space, analysts say a new DeFi project, Mutuum Finance (MUTM), could become one of the potential best cryptos to buy ahead of Q1 2026 due to its strong fundamentals and upcoming product launch.

Solana (SOL)

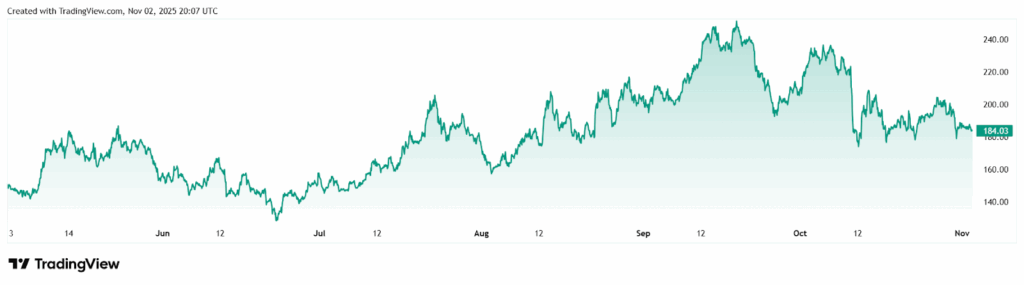

Solana is currently trading around $200, holding a market capitalization of roughly $90 billion, making it one of the top five cryptocurrencies by value. The network remains a favorite among developers for its high transaction throughput and low fees, powering thousands of decentralized applications, NFTs, and DeFi protocols.

However, Solana has been facing growing resistance levels near $210–$230, with heavier resistance at $250. While the asset has maintained a steady upward trend for most of the year, analysts note that its growth rate has slowed compared to previous bull cycles. The support zone sits between $180 and $190, and if momentum weakens further, the next support could drop closer to $160.

Despite its strong fundamentals, Solana’s large market cap means explosive upside potential is becoming more limited. Investors who once saw 10x–20x gains during Solana’s early surge are now turning to new crypto projects that offer similar innovation but at a much lower entry price.

Mutuum Finance (MUTM)

Mutuum Finance is a decentralized lending and borrowing protocol designed to make digital-asset markets more efficient, secure, and transparent. It connects lenders and borrowers directly through smart contracts, allowing users to earn yield or borrow funds without relying on intermediaries.

The platform operates on two complementary lending models — a Peer-to-Contract (P2C) system for deep liquidity pools and a Peer-to-Peer (P2P) marketplace for isolated, asset-specific loans. This dual structure gives users more flexibility and helps balance risk across different asset types.

When users deposit crypto assets like ETH or USDT, they receive mtTokens, which serve as yield-bearing receipts. For example, depositing 15 USDC into the protocol would generate 15 mtUSDC, which gradually accrues value as borrowers pay interest. On the borrowing side, rates and limits are determined dynamically by pool utilization and loan-to-value (LTV) ratios.

If a borrower’s collateral drops below the liquidation threshold, a Liquidator Bot automatically steps in to repay the debt, ensuring the pool stays solvent. This system not only protects lenders but also stabilizes the overall protocol, one of the reasons analysts view Mutuum Finance as a serious contender in the DeFi space.

Inside the Mutuum Finance Presale

Mutuum Finance is currently in Phase 6 of its presale, with each token priced at $0.035. The next stage will raise the price to $0.04, followed by a confirmed launch price of $0.06. The token’s performance since the start of the presale has been impressive. MUTM launched at $0.01 in Phase 1, meaning it has already surged nearly 300% to date.

Out of the total 4 billion MUTM tokens, 45.5% (1.82 billion) are allocated for the presale. So far, the project has raised over $18.4 million and attracted more than 18,000 holders. Over 790 million tokens have already been sold, marking roughly 85% completion of Phase 6.

Mutuum Finance has also implemented several mechanisms to ensure transparency and engagement. Its 24-hour leaderboard rewards the top daily contributor with $500 worth of MUTM tokens, encouraging steady participation. In addition, investors can buy directly with card payments and face no purchase limits, removing the friction often seen in early-stage DeFi projects.

The project’s credibility is reinforced by its CertiK audit, which awarded it a 90/100 Token Scan score, signaling a strong level of smart-contract security. The team has also launched a $50,000 bug bounty program to encourage ethical testing and continuous improvement before mainnet.

Why Analysts Favor MUTM Over Solana

While Solana remains one of the leading altcoins in terms of adoption, it’s no longer the high-upside opportunity it once was. With its current market cap near $90 billion, SOL would need significant institutional inflows or a major ecosystem breakthrough to see substantial price appreciation.

By contrast, Mutuum Finance’s smaller valuation and growing ecosystem provide a much larger margin for growth. Analysts highlight three major reasons why Mutuum Finance (MUTM) could outperform Solana in 2026.

First is its early-stage entry point — with tokens priced at just $0.035, investors can participate at a fraction of the cost of established cryptocurrencies like SOL. This lower entry price leaves significant room for upside as the project gains traction.

Second, Mutuum Finance’s utility-driven demand separates it from speculative tokens. Its ecosystem is built around lending, borrowing, and yield-generating mechanics that create continuous token demand and strengthen long-term sustainability.

Finally, the project’s revenue-linked tokenomics add another layer of growth potential. Through a buy-and-distribute model, part of the platform’s revenue is used to purchase MUTM tokens from the open market and redistribute them to stakers. This system helps maintain steady buying pressure, encouraging price stability while rewarding active participants in the ecosystem.

Once the platform’s adoption grows as expected, many believe MUTM could rise 600–700%, potentially reaching $0.25 to $0.30, similar to how Solana moved from cents to dollars during its early phase.

Why MUTM Could Be a Key Player in 2026

Mutuum Finance’s V1 launch is scheduled for Q4 2025 on the Sepolia Testnet. This major milestone will introduce the platform’s core components, including the Liquidity Pool, mtToken system, Debt Tokens, and the Liquidator Bot. Once live, users will be able to interact directly with the system — a major credibility boost that many presale projects lack before launch.

The team also plans to roll out a USD-pegged stablecoin, which will be overcollateralized by platform loans and minted or burned on demand. This feature will improve liquidity within the ecosystem while generating additional yield for the treasury. Future plans also include deploying the protocol across multiple Layer-2 networks to lower transaction costs and boost scalability.

With a functioning roadmap, strong presale momentum, and a clear product vision, Mutuum Finance (MUTM) is becoming one of the top cryptocurrencies to watch heading into Q1 2026. If the project continues to meet its milestones, it could be among the most talked-about new cryptos in the next DeFi cycle.

For more information about Mutuum Finance (MUTM) visit the links below:

- Website: https://www.mutuum.com

- Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Always conduct your own research before investing in digital assets.