The Trump family’s second run in the White House is linked to a new kind of boom—one built on digital currency rather than real estate or television. According to a Financial Times investigation, the family’s crypto ventures have generated over one billion dollars in pre-tax profit since early 2025.

The White House

President Donald Trump’s administration has aligned itself closely with the digital asset world. Regulatory rollbacks, including the resignation of SEC Chairman Gary Gensler early in 2025, have paved the way for friendlier crypto policies. The administration’s push to make America the “crypto capital of the world” transformed digital assets into both a political and financial prize.

That shift benefited World Liberty Financial (WLFI), a decentralized finance company launched in late 2024 and co-founded by Trump’s sons. Trump is listed as “co-founder emeritus” on its website. The firm has sold over two point seven billion dollars in WLFI tokens and stablecoins like USD1. Its success has made WLFI one of the fastest-growing players in global crypto finance.

A Billion-Dollar Fortune

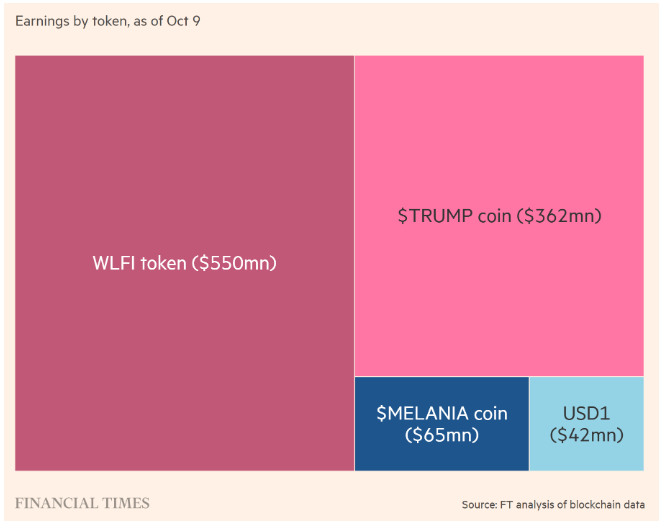

In June 2025, Trump disclosed earning $57.4 million in income from his WLFI involvement. By September, his family’s stake in the company surged in value to around $5 billion following a token unlock event. Reports estimate WLFI alone generated over $550 million in profit this year.

The Trump family also profited handsomely from memecoins. The Solana-based Official Trump (TRUMP) token and the Official Melania Meme (MELANIA) together pulled in hundreds of millions through sales and trading fees. TRUMP trades near $5.96, while MELANIA sits closer to $0.11, both down sharply from early peaks, yet still producing significant returns.

Political and Ethical Concerns

Critics argue that the blending of presidential policy and private crypto profit blurs ethical lines. Trump’s assets remain under a revocable trust managed by his children instead of a blind trust. Democratic lawmakers have voiced concern, pointing to favorable policy shifts that appeared to aid companies linked to Trump-family investors.

Still, the White House insists that all actions comply with ethics rules. Officials argue that Trump’s pro-innovation stance merely supports American competitiveness, especially as other nations race ahead in blockchain adoption. Even so, questions linger about specific investors. Notably, Chinese-born crypto billionaire Justin Sun and UAE-backed MGX Capital have poured large sums into WLFI; both saw investigations against them dropped afterward.

Brand Power

Despite market volatility, the “Trump brand” continues to magnetize crypto speculators worldwide. Supporters take the family’s ventures as symbols of American innovation and financial independence. Others see them as risky experiments built on personality-driven hype.

Regardless of stance, few can ignore the scale of this digital empire. The Trump family’s combined crypto profits, spanning DeFi, stablecoins, and memecoins, now exceed $1 dollars in under a year. Such figures highlight how political power and digital finance can intertwine more closely than ever before.

Written By Fazal Ul Vahab C H