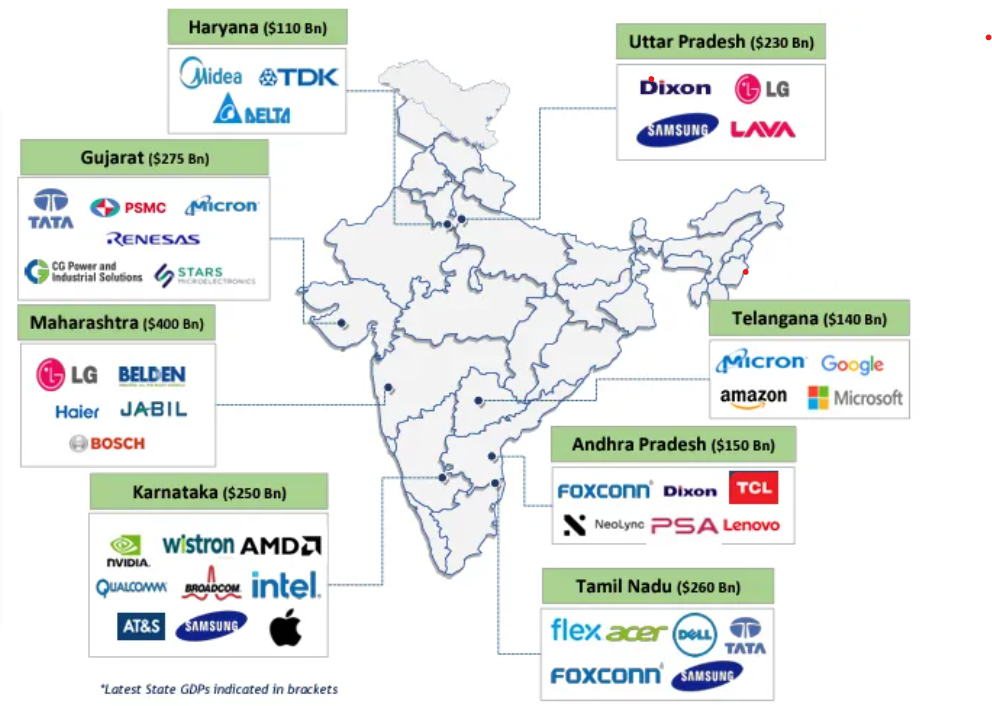

Synopsis: India’s semiconductor sector is driving rapid industrial growth across new regions. This article highlights 7 emerging hubs that are growing the semiconductor industry and are attracting major investments, transforming into the next manufacturing powerhouses.

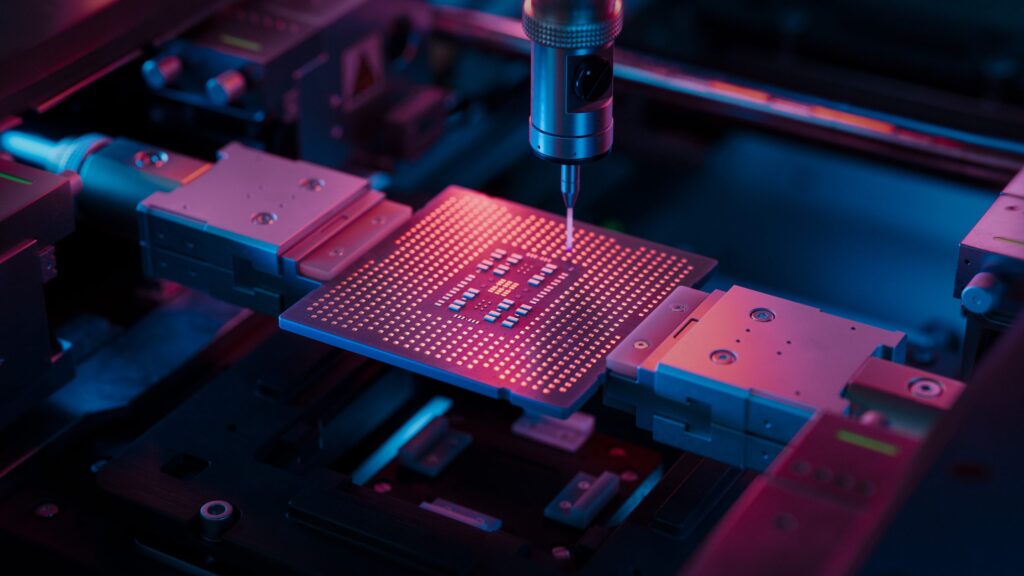

Semiconductors are the heart of modern technology. They power essential systems in healthcare, transport, communication, defence, and space. As the world moves toward digitalization and automation, semiconductors have become integral to economic security and strategic independence. India’s semiconductor ecosystem is undergoing an unbelievable transformation with 13 approved projects representing ₹1.69 lakh crore in cumulative investments across 10 specialized industrial hubs spanning six states.

1. Dholera, Gujarat

Dholera, Special Investment Region (SIR), has emerged as India’s most strategically significant semiconductor destination, hosting the Tata Electronics and Powerchip Semiconductor Manufacturing Corporation (PSMC) joint venture, which represents the Country’s first full-scale water fabrication plant with an investment of ₹91,000 crore.

This plant will achieve a manufacturing capacity of 50,000 wafers per month at peak production, incorporating next generation factory automation deploying data analytics and machine learning to optimise manufacturing efficiency.

2. Sanand, Gujarat

Sanand has evolved into India’s most dynamic semiconductor assembly, testing, marking, and packaging (ATMP) hub, hosting three major complementary projects aggregating ₹33,423 Cr in investments and creating 11,500 direct jobs.

Micron Technology’s invested ₹22,516 cr ATMP facility represents the first facility of its kind under the India Semiconductor Mission. Construction completion is scheduled for December 2025, with cleanroom validation entering critical stages during the second half of 2025.

CG Semi OSAT facility invested ₹7,600 cr represents a joint venture between CG power and Industrial Solution, Japan’s Renesas Electronics and Thailand’s Stars Microelectronics, providing end-to-end solutions for chip assembly, packaging, testing, and post-test services across both traditional and advanced packaging technologies.

Kaynes Semicon OSAT Invested ₹3,307 cr achieved a significant milestone in October 2025 by becoming India’s first semiconductor company to commercially export domestically manufactured Mult-Chip Modules (MCMs).

3. Morigaon, Assam

Hosts Tata Semiconductor Assembly & Test (TSAT) ₹27,000 cr project specializing in advanced packaging technologies like flip chip and ISIP. Expected to produce 48 million chips/ day by Mid-2025 and generate 15,000 jobs, significantly boosting Northeast India’s significantly boosting Northeast India’s industrial landscape.

4. Bhubaneswar Info Valley, Odisha

There are focuses on compound semiconductor with SiCSem’s ₹2,067 cr silicon carbide fab (60,000 wafers/year) operational by 2027-28 and 3D glass solution ₹1,533 crore advanced packaging unit. Target sectors include defense, EVs, data centers.

Also read: Top 10 Major Companies Fueling India’s Rapidly Growing $30 Billion Data Centre Industry

5. Bengaluru and Mysuru, Karnataka

Bengaluru is India’s most mature semiconductor design and R&D hub. Innovation Centre for Semiconductor Manufacturing (ICSM) will establish a facility with an investment of ₹4,851 crore on R&D fab for cutting edge chip display innovation.

Bharat Semi Systems’ compound semiconductor fab in Mysuru which invested ₹ 2,342 cr. These facilities nurture innovation and design skills, supporting defense and climate tech sectors.

6. Noida- Yamuna Expressway, Uttar Pradesh

The upcoming project HCL- Foxconn joint venture of ₹3706 cr OSAT facility near Jewar airport producing 158 million units/ year serving EV and renewable markets. Primary product focus includes display driver chips for mobile phones, laptops, automotive electronics, and consumer devices.

7. Sulur and Palladam,Tamil Nadu

Both Sulur and Palladam have around 100 acre parks planned for developing advanced semiconductor equipment manufacturing ecosystems. Clocking the highest ever electronics exports of 12.62 billion in the first 11 months of FY2024-25 that’s nearly 37% of the country’s total.

The state is moving steadfastly towards achieving $20-22 billion in annual electronics exports by 2027-28, making it one of the top electronics zones for investment. The parks aim to create a cluster supporting part suppliers, integrators innovation, prototyping, testing labs, and skill development centers.

| Date | Company | Location | Investment | Output Capacity |

| JUN 2023 | Micron Technology | Sanand, Gujarat | ₹22,516 crore | ATMP Facility, with phased ramp-up. |

| FEB 2024 | Tata Electronics (TEPL) with Powerchip Semi- conductor Manufacturing Corp (PMSC) of Taiwan | Dholera, Gujarat | ₹91,000 crore | 50,000 wafers/month |

| FEB 2024 | CG Power & Industrial Pvt Ltd in partnership with Renesas & Stars | Sanand, Gujarat | ₹7,600 crore | 15 million chips/day |

| FEB 2024 | Tata Semiconductor Assembly and Test Pvt Ltd (TSAT) | Morigaon, Assam | ₹27,000 crore | 48 million chips/day |

| SEPT 2024 | KaynesSemiconPvt Ltd | Sanand, Gujarat | ₹3,307 crore | 6.33 million chips/day |

| MAY2025 | HCL-Foxconn JV | Jewar, Uttar Pradesh | ₹3,700 crore | 20,000 wafers/month |

| AUGUST 2025 | SicSem Private Limited | Bhubaneshwar, Odisha | ₹2,066 crore | 60 thousand wafers per year; ATMP capacity: 96 millionUnits/year |

| AUGUST 2025 | 3D Glass Solutions Inc. | Bhubaneshwar, Odisha | ₹1,943 Cr | Glass panels: 701000 units/year; ATMP: 50 million units/ year |

| AUGUST 2025 | CDIL (Continental Device) | Mohali, Punjab | ₹117 Cr | 158 million units /year |

| AUGUST 2025 | ASIP (Advanced System in Package Technologies) | Andhra Pradesh | ₹468 Cr | 96 million units /year |

Conclusion

With an approximate evaluation of ₹38 billion in 2023, the domestic semiconductor market is expected to grow to ₹100-110 billion by the year 2030. This growth will be supported by the newly created hubs which will be the drivers of this expansion through the creation of integrated supply chains, thereby lessening the need for imports.

Thus, these manufacturing hubs will enable India to take a significant portion of the projected $1 trillion global semiconductor market, hence, moving the country from a software services dependency to that of advanced hardware manufacturing capabilities.

Written by Yatheendra N