Synopsis – India’s export-driven industries are poised for strong growth amid rising global demand in 2025. This article explores seven key sectors expected to benefit the most from shifting international trade trends and opportunities.

Despite the uncertainty in the world, the outlook for India’s exports is optimistic. In 2025, India is well-positioned to benefit from increased demand and support in the electronics, pharmaceuticals, and engineering sectors. As India pivots to high-value manufacturing and services, new export opportunities are being created. Exports increased by 5.19% to USD 346.10 billion in April-August 2025 in comparison to April-August 2024.

Overview of India’s Export Outlook (2025)

- Merchandise exports from India increased steadily in early 2025, and have the potential to breach $1trillion by FY26.

- The various initiatives from the government around the Production-Linked Incentive (PLI) schemes, new trade agreements and investments around modernization of logistics to remain competitive in terms of exports all provide opportunities for increased exports.

- India’s role as a manufacturing and services hub for the common “China + 1” Strategy will facilitate diversified supply chains.

Top 7 Export-Oriented Sectors Primed for Growth in 2025

1. Pharmaceuticals and Biotech

- Export Value & Growth: With growth projected at 10% or higher, India is a world leader in generic and biosimilars exports, serving the USA, Europe, and Africa markets.

- Global Demand Drivers: Aging populations, increasing healthcare needs, and patent expirations are anticipated to drive global pharmaceutical demand.

- India’s Advantage: Low-cost R&D, scale of manufacture, and willingness to comply with regulations.

- Major Players: Sun Pharma, Dr. Reddy’s, Cipla, Biocon, Zydus Lifesciences.

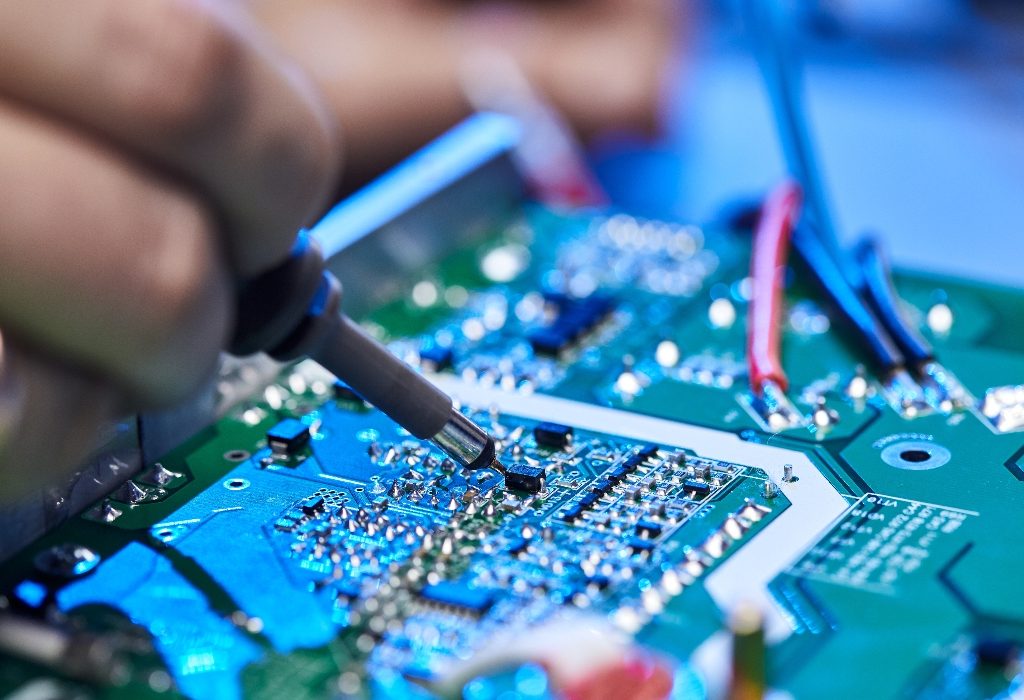

2. Electronics and Electrical Goods

- Export Value & Growth: Growing rapidly at 20-25% year-on-year; key products include mobile phones, components, consumables, etc.

- Global Demand Drivers: Expanding digitization, the roll-out of 5G infrastructure, and build-up of green technology are key drivers of growth.

- India’s Advantage: Rapidly expanding local manufacturing base with PLI incentives, and competitive labor/industrial cost in comparison to other locations.

- Major Players: Players such as Samsung, Foxconn, Dixon Technologies, Bharat Electronics Ltd.

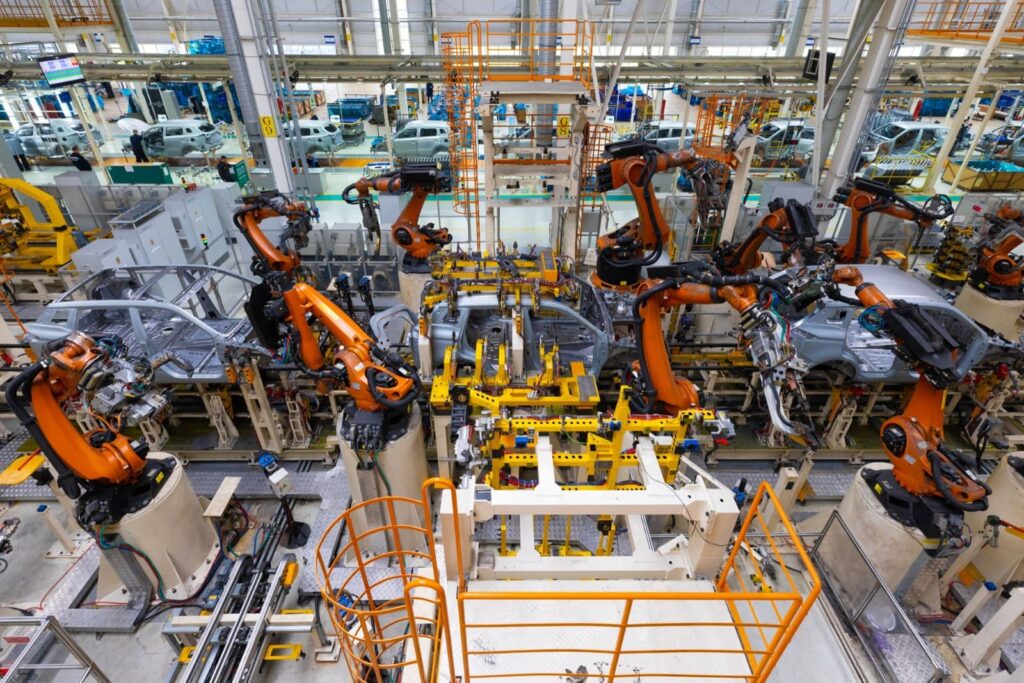

3. Engineering Goods

- Export Value & Growth: Export value was a key contributor growing significantly at 8-10% year-on-year. Key products include machinery, auto parts and industrial equipment.

- Global Demand Drivers: Global demand growth based on infrastructure expansion and more industrial automation.

- India’s Advantage: Growing diverse manufacturing base and improving quality standards.

- Major Players: L&T, Bharat Forge, Bosch India, Cummins India

4. Textiles and Apparel

- Export Value and Growth: This sector is rapidly growing at 6–7%, especially in organic and sustainable fabrics.

- Global Demand Drivers: There are increasing trends towards environmentally-conscientious consumers.

- India’s Advantage: India has a very large availability of basic raw materials and an extraordinary number of export processing zones.

- Major Players: Key companies include Arvind Mills, Welspun India, Raymond, and Vardhman Textiles.

Also read: 6 Top Global Investors Increasing Stakes in Leading Indian Banks

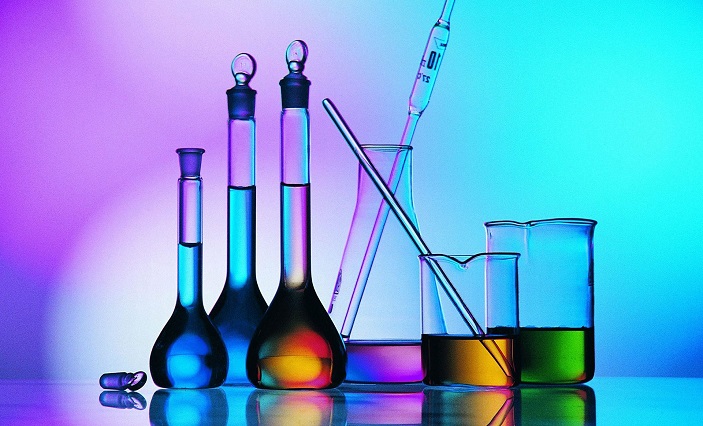

5. Chemical and Organic Chemicals

- Export Value and Growth: Fast growing sector 8–10% including specialty chemicals and advanced intermediates.

- Global Demand Drivers: There is continued demand from global pharmaceutical and agri-chemical industries.

- India’s Advantage: India supplies a workforce that competes on cost and is evolving its R&D capacity levels.

- Major Players: Leading companies include Aarti Industries, Tata Chemicals, and Deepak Nitrite.

6. Oil & Petroleum Products

- Value and Growth Rates: A significant export value of nearly 54 billion dollars; recent growth of refined fuels and petrochemical products has been appreciated.

- Drivers of Global Demand: Energy demand from developing economies.

- India’s Comparative Advantage: Large refining capacity and diversification.

- Industry Leaders: Reliance Industries, Indian Oil Corporation, Bharat Petroleum.

7. Agriculture & Food Products

- Value and Growth Rates: The export value is varied and increasing at around 5% to 7% (including cereals such as rice), spice and tea, but also organic foods.

- Drivers of Global Demand: Increasing global demand for specialty and organic products.

- India’s Comparative Advantage: Increase how diverse agriculture is and increased capability of processing.

- Industry Leaders: Adani Wilmar, Allana Group, Gujarat Agrochemicals.

Policy and Infrastructure Enablers

- PLI schemes in key sectors have the potential to encourage local manufacturing and exports.

- New free trade agreements with the European Union, UAE and Australia have the potential to reduce tariff barriers and increase markets.

- Modern port logistics and process digitization can enhance the export supply chains.

Conclusion

As India continues its ascent in global value chains, export-led growth offers the dual promise of generating wealth creation, employment, and ushering in a new wave of industrial prosperity.

Written By Rachna Rajput