Synopsis: The best handpicked Gen Z-friendly credit cards in India that offer cashback, reward points, and exclusive perks. This article compares their benefits and fees to help you find the perfect card that matches the Gen Z lifestyle.

Hey there! Having your best life in 2025 requires being smart with your money, and if you are someone who is always online, placing orders, or thinking about your next destination. But what credit card gets your job done? Forget confusing jargon. Plain, not to be followed, direct to the point. We can suggest a card that will reward your lifestyle.

To begin with, what type of spender are you?

- The Savvy Online Shopper

- The Food & Bills Pro

- The Globetrotter

- The First-Timer

For the Savvy Online Shopper

When they own the fan club, you get back your money with these cards when you do what you love to do.

1. Cashback SBI Card

- Best perk: Flat 5% online cashback (Capped at ₹5,000/month)

- Additional Benefit: Annual fee is eliminated in case of spending more than ₹2 lakh in one year.

2. Amazon Pay ICICI Credit Card

- Greatest Advantage: It is life-long free! No joining or annual fees. Ever.

- Added Bonus: Up to 5% on Amazon (Unlimited, Lifetime Free)

3. HDFC Millennia Credit Card

- Best Perk: 5% CashBack Points on popular apps

- Additional Benefit: Airport lounges in India are free. (Lounge access is conditional on spending ₹1 Lakh/quarter)

Also read: HDFC Regalia Gold Tops the List of Best Travel Credit Cards; Check Out Its Competitors

For the Food & Bills Pro

You are the king/queen of handling bills every month and know where to get what to order. Get rewarded for it.

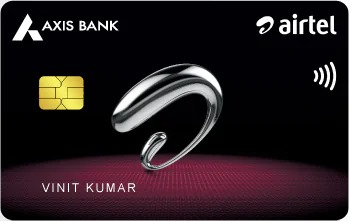

1. Airtel Axis Bank Credit Card

- Granted Benefit: 25% cashback on Airtel bills (10% on Swiggy, Zomato, BigBasket only)

- Additional Benefit: (10% on Swiggy, Zomato, BigBasket only)

2. Axis Bank ACE Credit Card

- Best Eligibility: 5% on Google Pay bills

- Additional Benefit: Get 4% money back when applied to Swiggy, Zomato and Ola.

For the Globetrotter

When you have a full camera roll of travel photos and you are always scheming on what to do next, these cards are your fellow travelers.

1. MakeMyTrip ICICI Bank Platinum Credit Card

- Best Perk: Welcome vouchers & lounge access (Lounge access is conditional on spending [?]35K/quarter)

- Additional Benefit: Have access to a free domestic airport and railway lounge every quarter.((Lounge access is conditional on spending [?]35K/quarter)

2. Club Vistara SBI Card

- Best Perk: One yearly free Vistara flight ticket.

- Bangin Bonus: Receive up to 4 additional free flights depending on your annual spending.

Also read: HDFC Infinia or Diners Club Black: Which Premium Credit Card Offers the Best Value?

For the First-Timer

You are only beginning your credit life? These cards are ideal to be able to build your score without any strain.

1. IDFC FIRST Millennia Credit Card

- Best Value: It has zero joining or annual fees and you make a risk-free decision.

- Additional Benefit: No problem converting purchases in excess of ₹2,500 into small EMIs.

2. Flipkart Axis Bank Credit Card

- Best Perk: 5% on Flipkart (Capped quarterly)

- Extra Perk: Welcome Vouchers/Gift Cards (e.g., a Flipkart gift card, often worth ₹250, upon first transaction/activation)

| Credit Card | Best For | Key Benefit | Annual Fee |

| Cashback SBI Card | All-Round Online Spends | Flat 5% online cashback | ₹999 |

| Amazon Pay ICICI | Amazon Lovers | Up to 5% on Amazon | ₹0 |

| HDFC Millenia | Online Shopping | 5% cashback on popular apps | ₹1,000 |

| Airtel Axis Bank | Airtel users and bill payments | 25% cashback on Airtel bills | ₹500 |

| Axis Bank ACE | Utility Bills & Food Orders | 5% on bills, 4% on food apps | ₹499 |

| MakeMyTrip ICICI Platinum | Budget Travel Perks | Welcome vouchers & lounge access | ₹500 |

| Club Vistara SBI | Vistara Flyers | Free Vistara flight ticket | ₹1,499 |

| IDFC FIRST Millennia | Beginners | Great rewards | ₹0 |

| Flipkart Axis Bank | Flipkart Shoppers | 5% cashback on Flipkart/Myntra | ₹500 |

Your Perfect Card is Waiting!

The decision to pick a credit card is rather uncomplicated: a card that corresponds to your largest expenses. Is it online shopping that you are good at or are you a frequent flier, there is a card that can reward you. Ready to start earning?

Written By Jayanth R Pai