Synopsis: The top 5 mutual funds bought and sold stock in the month of October by categorised by large, mid, and small cap companies. Major bought stocks are Tata Motors demerged, and more.

The total cash and cash equivalents transaction held by mutual funds increased from ₹2.39 lakh crore in September to ₹2.44 crore in October according to a report released by Nuvama International Equities. This article outlines the top mutual funds in India bought and sold in October, 2025.

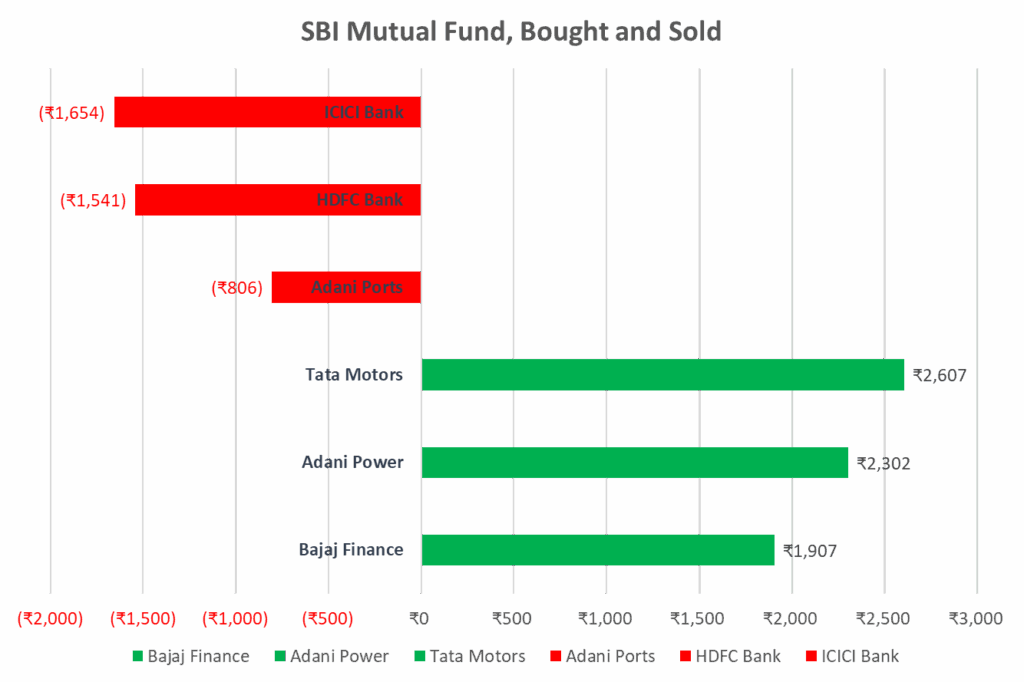

1. SBI Mutual fund

The biggest mutual fund in India increased its holdings in Tata Motors’ demerged entity (₹2,607 crore), Adani Power (₹2,302 crore) and Bajaj Finance (₹1,907 crore) the most. ICICI Bank (₹1,654 crore), HDFC Bank (₹1,541 crore) and Adani Ports (₹806 crore) were the stocks from which it cut its stake most. New investments in Canara Bank, Adani Energy Solutions and Dabur were amongst others, and the fund manager also completely withdrew from NTPC and Tata Elxsi positions.

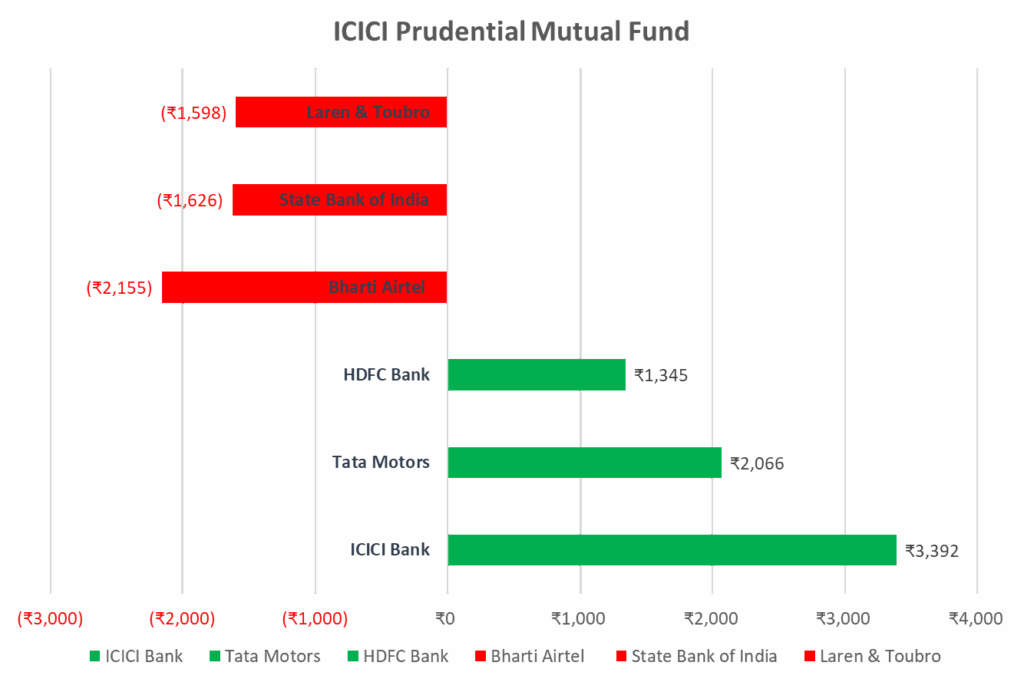

2. ICICI Prudential Mutual fund

The asset management company made significant investments in ICICI Bank (₹3,392 crore), the split-up unit of Tata Motors (₹2,066 crore), and HDFC Bank (₹1,345 crore). The company’s total withdrawal in Bharti Airtel (₹2,155 crore), State Bank of India (₹1,626 crore), and Larsen & Toubro (₹1,598 crore) was well-timed. Aditya Birla Sun Life AMC, Can Fin Homes, Thyrocare, JSW Energy, and Astra Microwave were among the new players, while a complete divestment was made from Chennai Petro, TD Power, and ICICI Lombard.

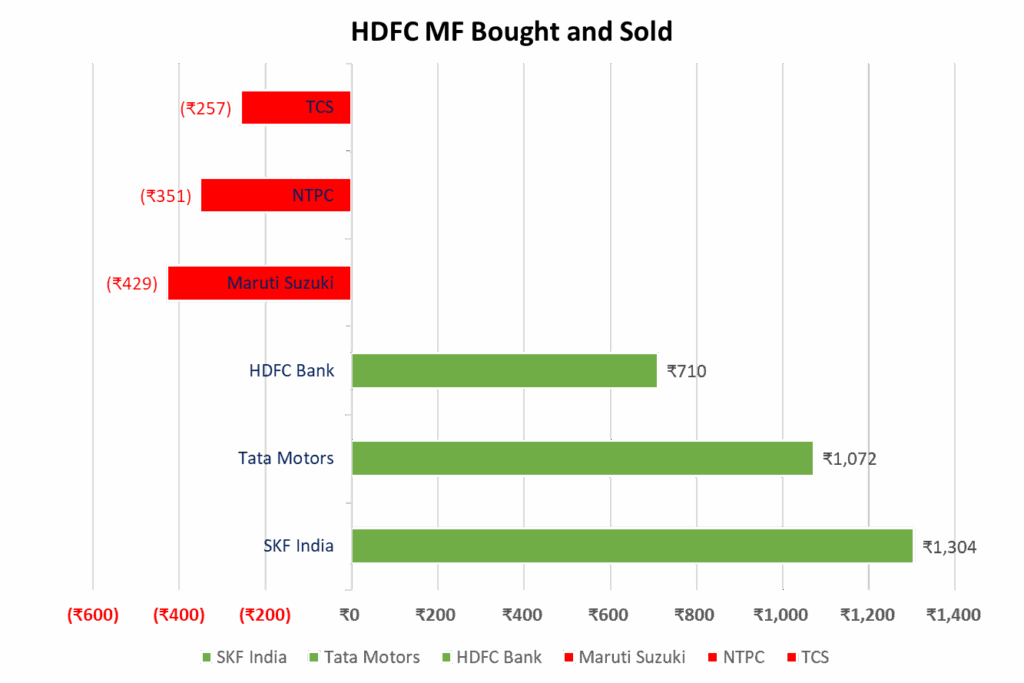

3. HDFC MF

The asset management firm positioned itself significantly in SKF India (₹1,304 crore) and the separated unit of Tata Motors (₹1,072 crore), besides HDFC Bank (₹710 crore). Positions were lessened in Maruti Suzuki (₹429 crore), NTPC (₹351 crore) and TCS (₹257 crore). The firm took new positions in ABB, Canara HSBC Life and Lenskart, while completely exited from HCC, Coal India, IREDA, Advanced Enzyme and Go Fashion.

Also read: Top 10 Best Performing Mutual Funds Gen Z Investors Should Consider in 2025

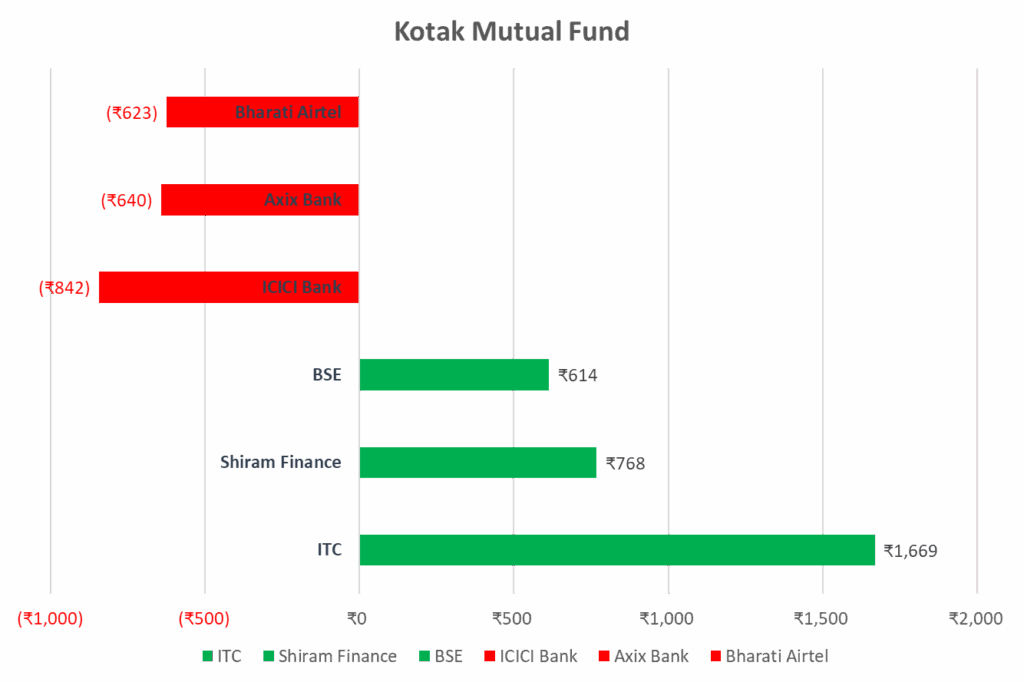

4. Kotak Mutual Fund

The Kotak Mutual fund has increased its holdings in ITC (₹1,669 crore), Shriram Finance (₹768 crore), and BSE (₹614 crore). They reduced in ICICI Bank (₹842 crore), Axis Bank (₹640 crore), and Bharti Airtel (₹623 crore). Lenskart, LG Electronics India, and Rubicon Research made their debut in October, whereas MTAR Tech, Travel Food Services, and Vikram Solar were total exits.

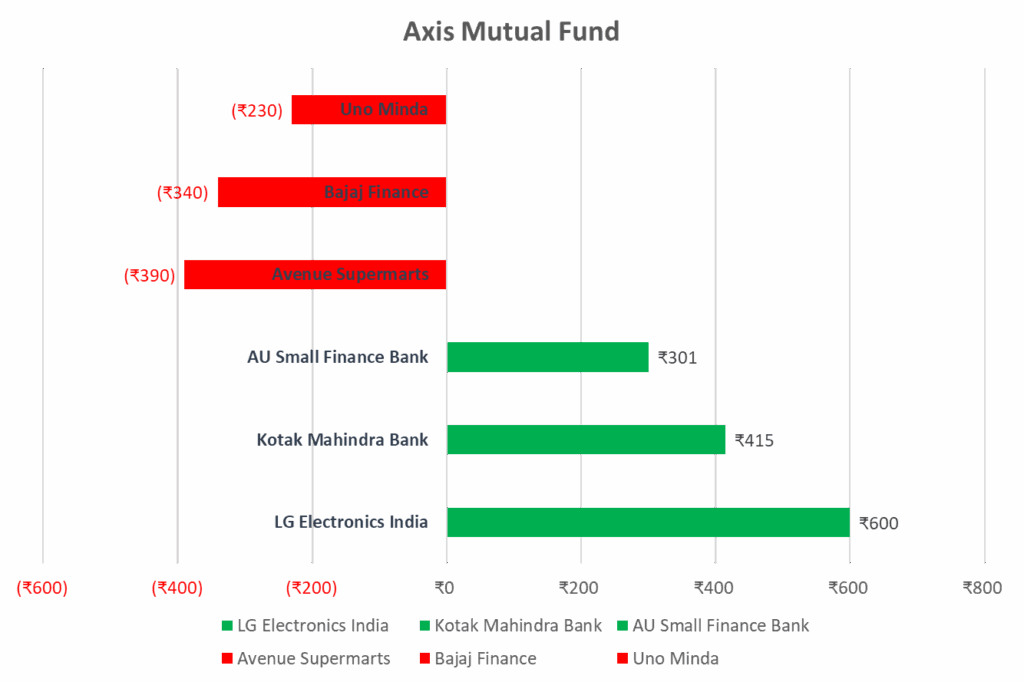

5. Axis Mutual Fund

The Axis mutual funds made investments in LG Electronics India (₹600 crore), Kotak Mahindra Bank (₹415 crore), and AU Small Finance Bank (₹301 crore) among the top picks. It cut stake in Avenue Supermarts (₹390 crore), Bajaj Finance (₹340 crore), and Uno Minda (₹230 crore). AU Small Finance Bank, Ujjivan Small Finance Bank, and CESC were added as new investments, whereas the firm entirely dropped its holdings in Sumitomo Chemicals and VA Tech Wabag.

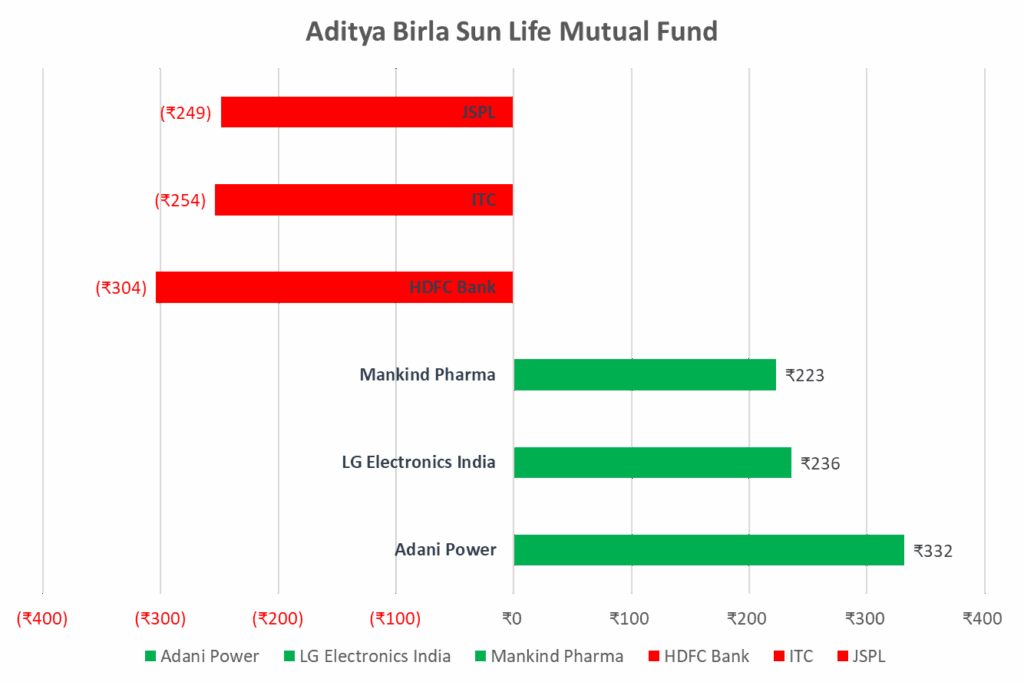

6. Aditya Birla Sun Life Mutual Fund

Aditya Birla Sun Life Mutual fund took up new shares in Adani Power (₹332 crore), LG Electronics India (₹236 crore), and Mankind Pharma (₹223 crore). And cut down its investments in HDFC Bank (₹304 crore), ITC (₹254 crore), and JSPL (₹249 crore). While Tata Capital was a new entry, Utkarsh Small Finance Bank was a total exit.

Mid cap segment addition includes Canara HSBC life(₹1,800 crore), Rubicon Research(₹700 crore), and Delivery(₹600 crore). Meanwhile reduction were RBL bank(₹200 core), and ACC (₹200 crore).

Key buying and Selling

| Category | Top Buys | Top Sells |

| Large cap | Kotak Mahindra Bank, Reliance Industries, ITC, HDFC Bank, Titan Company | Reliance Industries, Axis Bank, Bharti Airtel, ICICI Bank, SBI |

| Mid cap | IDFC First Bank, PB Fintech, Federal Bank, Relaxo Footwear, Dalmia Bharat | RBL Bank, Exide Industries, ACC, Vodafone Idea, Voltas |

| Small cap | Bluestone Jewellery, Medi Assist Health, Thirumalai Chem | Aditya Birla Fashion, JK Tyre & Industries, Senco Gold |

Conclusion

You can see the major transactions across the mutual fund industry include Tata Motors (demerged entity), LG Electronics(₹5,200), ITC(₹3,500), and ICICI Bank (₹2400). Major reductions can be seen in Bharti Airtel(₹2,800 crore), Axis Bank (₹2,600), and Coal India (₹1,500 crore).

Written by Yatheendra N