Synopsis: This article compares the best 5 low-forex-fee cards offered by leading banks in India, including both forex cards and credit cards. It highlights their charges, benefits, and suitability for international travelers and online foreign transactions.

A Forex Card is also known as a prepaid travel card which provides a convenient and secure way for Indian residents to carry foreign currency for international travel. It is a debit card abroad that allows ATM withdrawals, online purchase and in store payment in local currencies.

Comparing Forex Cards with Low Forex fee Credit Cards

1. HDFC Credit Card

A. Multicurrency Platinum Forex Plus Chip Card

- It is a prepaid travel card that allows you to load up to 22 currencies on a single card acting like a digital wallet for international travel including shopping, education, medical treatment and business.

- Issuance fees: Rs. 500 + GST, Reload fees: Rs. 75 + GST

- ATM withdrawal fees: fixed fee charged based on the currency.

- Cross Currency Markup: 2% , Exchange Rate: 2.4%

- Insurance covers counterfeiting, skimming, road/ rail/ air accidents, baggage lost, loss of personal documents and cash.

- Limit of load : Maximum USD 250,000 in a financial year.

B. Regalia Forex Plus Card

- Single currency forex card.

- Available in US Dollars

- Zero cross currency Mark-up charges

- Accepted at all VISA/MasterCard affiliated merchants/establishments around the world as well as for online shopping.

2. SBI Card

A. SBI Multi-Currency Foreign Travel Card

- It is a prepaid based card for international travel, where you can load 9 different currencies.

- Initial purchase: Rs. 100 + GST

- Reload fees: Rs. 50 + GST

- Cross currency mark up fee is 3% + GST

- ATM withdrawal charges: $1.75 USD per transaction.

- Refund / Cash out fee: Rs. 100 + GST

- Inactive fees: $1.50 USD charged monthly if not used for a year.

B. SBI Card Elite

- Joining and Annual fees: Rs. 4999 + GST

- Foreign mark up : 1.99%

- Withdrawal charges: 2.5% for minimum Rs.500

- Finance charges : 3.75% per month

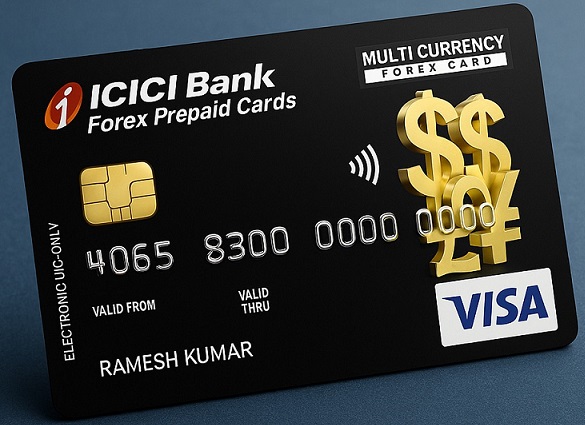

3. ICICI Credit Card

A. ICICI Multi-Currency Forex Card

- It is a prepaid card that allows you to load up to 15 different currencies for international travel.

- Joining fees: Standard multicurrency forex card has no joining or annual fees but some variants may have joining fees.

- Cross currency fee: 3.5% + taxes

- Reload fees: Rs. 100 per reload

- Wallet to wallet transfer fee: Rs. 2.5% for fund transfer between different countries.

- ATM withdrawal varies based on the currencies.

- $5 may be charged as inactive fees for every 180 days.

B. ICICI Times Black Credit Card

- Joining and Annual fees: Rs. 20000 + GST

- Foreign mark up : 1.45%

- Withdrawal charges: 2.5% for minimum Rs.300.

- Unlimited international and domestic lounge access.

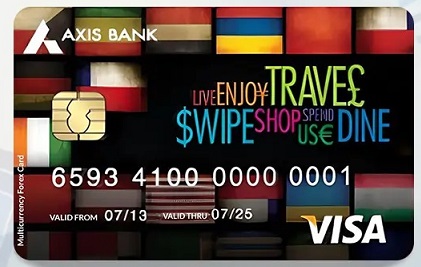

4. Axis Credit Card

A. Axis Multi-Currency Forex Card

- This is a prepaid card which can be loaded with 16 different foreign currencies.

- Initial issue fee: Rs. 300 + taxes

- Reload fee: Rs. 100 + taxes

- Encashment charges: Rs. 100 + taxes

- Cross currency conversion fee: 3.5%

- ATM withdrawal fee: $2.25

- Digital reload through online banking limit is approx $10,000

B. Axis Burgundy Credit Card

- Joining and Annual fees: Rs. 50,000 + GST

- Foreign mark up : Nil

- Withdrawal charges: Nil

- Flexibility to increase credit limit during foreign travel.

5. IDFC FIRST Credit Card

A. IDFC FIRST Multi Currency Forex Card

- It is a prepaid travel card designed for international trips allowing to load and manage up to 14 different currencies.

- Issuance fee: NiL

- Reload fee: NiL

- Cross currency markup : 3.5% + taxes

- ATM withdrawal fees: 1.5% per transaction

- Encashment fees: NIL

- Replacement fees: Rs. 200 + taxes

B. IDFC FIRST Wealth Credit Card

- Joining and Annual fees: Life time free

- Foreign mark up : 1.5%

- Cost effective for overseas spending.

- Lounge access and reward point benefits.

Conclusion

The top private sector banks like HDFC, SBI, ICICI, Axis and IDFC provide multi currency forex cards which can be used to load different currencies from netbanking or branch visits. Unlike credit cards, forex cards do not provide lounge access benefits and some of them have low forex mark up fees.

Written by Soumya M