Synopsis: Leading banks have shown impressive QoQ credit growth, reflecting their strong financial performance. This growth highlights their expanding market presence and robust lending capabilities in a competitive banking landscape.

The quarterly reports tells us three signals that define banking this quarter, which includes Loan growth, Asset Quality and Margins and Net Interest Margin (NIMs). This article focuses on credit growth of 4 major banks HDFC, SBI, ICICI and Kotak Mahindra Bank.

Loan Growth

Four banks had significantly higher growth rates in the last quarter, Kotak grew 16%), SBI grew 12.7%, ICICI Bank grew 10.3% and HDFC bank grew 10%. If you see the corporate Loan growth segment. All banks are growth below 10% except Kotak bank were it grew 18%.

Reason behind 18% growth in Kotak Mahindra Bank

Big corporations have the ability to take loans from a variety of sources, and this results in a reduction of interest rates to such a level that a lot of banks choose not to participate in the market at all. Instance of chasing big, long dated project finance deals, Kotak prioritising short term working capital loans and trade finance, It’s not show big numbers in the balance sheet, but it’s great for profitability. This gives them a huge lead in terms of growth compared to its peers.

An interesting thing has been in SBI’s Concall, many large businesses are going for IPO and equity markets in recent quarters, companies are using that money to repay bank loans. This is very good for the debt ratios of these companies, but can we say it is good for bank loan growth? Not really. It benefits companies because the current equity markets are phenomenal. Even if companies are overvalued, people still apply for IPOs, so many large companies are choosing equity markets to raise funds and repay their loans. In some cases, they are also converting their loans into bonds, a couple of airports have done this.

Retail and SME lending

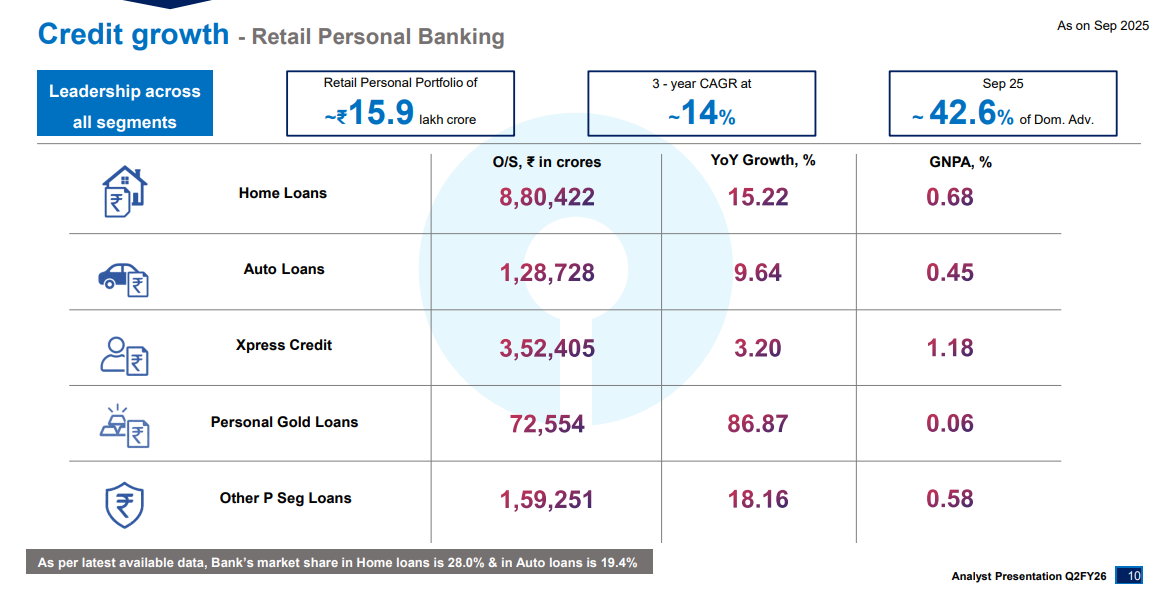

As for banks in general, retail lending made a significant increase, as mortgages, car loans, gold loans, and even credit cards enjoyed great support. A really interesting development has been taking place in the area of retail lending for the State Bank of India. For the past two quarters, the SBI bank has been saying that they will get back to double-digit growth for its ‘Xpress Credit’ (unsecured personal loan) portfolio, but now that is not the case.

Gold loans, in fact, ended up being the main reason for that decline in the bank’s unsecured personal loan portfolio being the main reason for that decline, gold loans grew at the expense of the Xpress credit line being declined.

This image tells you personal loans did not completely fail, the demand merely changed hands. People still require temporary credit; they just prefer the security of gold loaning rather than taking a purloined unsecured loan.

Also read: 6 Top Global Investors Increasing Stakes in Leading Indian Banks

Asset Quality

One interesting thing in banking is that loan books currently look very clean, with Non-Performing Assets(NPA’s) sitting at multi-year lows across the big banks. Take agriculture as an example. The retail loan portfolio of every bank looks good until the agri part is considered separately. HDFC Bank even explicitly stated that their NPAs go below 1% only when the agricultural portfolio is completely taken out.

Agriculture: The agriculture NPAs of SBI are also significantly higher than the remaining part of its retail book. Moreover, this situation is not a recent development. Lending to the agricultural sector has always been difficult. weather, commodity cycles, political write-offs, all these factors influence this segment. However, there is some evidence that the pressure in agricultural loans is also starting to ease.

Small and Medium Enterprises (SMEs): These loans are characterized by high growth, high yields, and unexpectedly good behavior of the borrowers. Nevertheless, there is stress even in this segment, only at non-crisis levels. Graze likes to lend to SMEs because of the high returns; however, they know that it is the first segment which will have difficulty when the economy is down. This tension is reflected in the figures: the NPAs of SMEs are always higher than retail lending but still not as high as in the past.

Margins and Net Interest Margin (NIM)

Over the past year, banks have felt the pressure as the fight for deposits intensified, squeezing their Net Interest Margins( NIMs)

Early Signs of Stabilization

- The latest quarter showed early signs that the bottoming out of margins is finally underway.

- SBI’s domestic NIM inched up from 3.02 to 3.09%

- Kotak and ICICI reported stable NIMs, and HDFC Bank also reported steady margins after its merger.

The Relief Came from Cheaper Funding

- According to Kotak, the RBI’s reduction in repo rates affected their returns entirely in the second quarter, leading to borrowers being charged lesser interest rates.

- As the funds prices went down for Kotak and HDFC, ICICI also had a decline in its cost of deposit. This indicates that the rates on deposits have at last reached their highest and the cost of finance has decreased quicker than the interest on loans has been lowered, thus giving the margins some “breathing space”.

Conclusion

The quarter told a story of banks growing through lending to households and small businesses, whereas large corporations kept themselves away from the credit cycle and purified their loan portfolios, and their profits with net interest margins (NIMs) became stable as the cost of funding reduced.

Written by Yatheendra N