Synopsis: According to the Inductus Global Capability Center report, India’s leading GCCs are driving significant revenue growth across key sectors including IT-ITeS, BFSI, Healthcare, and Engineering & Manufacturing.

India has more than 53% of the World’s GCC, With over 1,700+ GCCs operating in India and contributing significantly to global operations, the country has become a magnet for enterprise transformation. Bengaluru is the heart of India’s GCC landscape with 487 GCC accounting for 29% of the national total. The second position is Hyderabad holding 273 centres(16%), the fastest growing GCC in the country. Delhi NCR stands nearest with 272 centres, also at 16%, Mumbai has 207 centres, Pune 178 and Chennai 162. Six of these cities hold 94% of all GCCs in India.

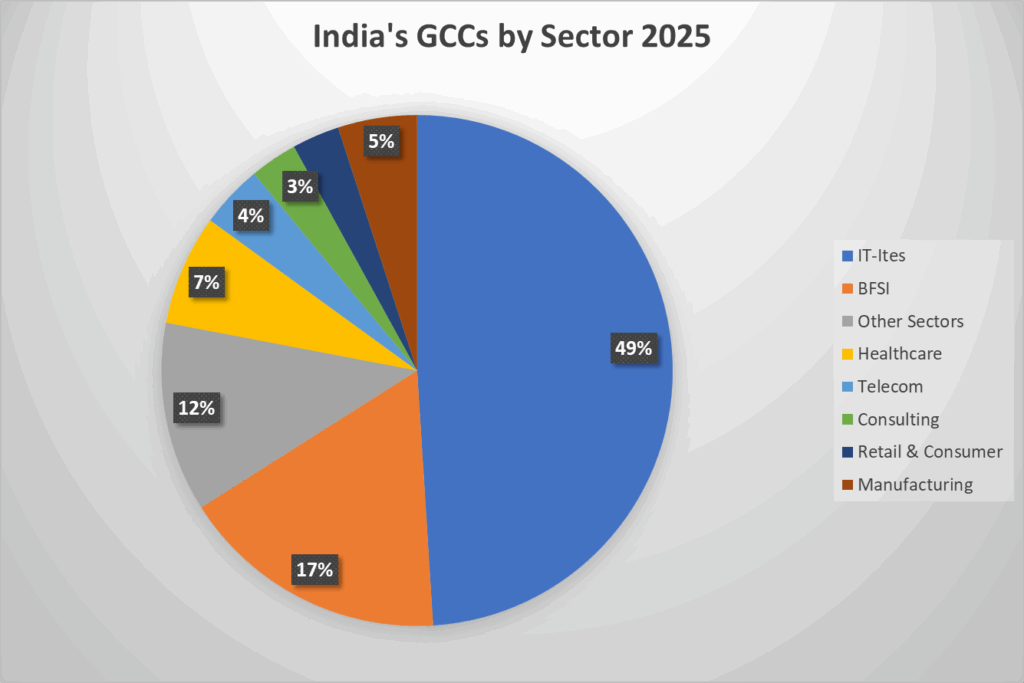

Ranking the Industry by its Sectors

1. BSFI & Fintech

JP Morgan stands as the largest GCC employer, with over 55,000 employees in India, making it a veritable digital headquarters for global financial services. Wells Fargo Stands closely with approximately 37,000 professionals while Citicorp operates around 32,000 employees. Bank of America maintains 28,000+ professionals, and Goldman Sachs commands a significant presence with 7,000+ employees across multiple Indian cities.

| Rank | Company | FY 25 Revenue |

| 1 | JP Morgan, Wells Fargo, Citicorp, Bank of America, Goldman Sachs | Multi Hundred Crore |

2. Tech & ER&D

India Leads as a global hub for tech and R&D GCC’s, especially in cities like Bengaluru and Hyderabad. These centres are focused on AI, machine learning(ML) data analytics, software development, and digital transformation. Increasingly, GCC functions as global innovation engines rather than just cost centres, with strong links to startups, academic and innovation clusters.

| Rank | Company | FY 25 Revenue |

| 2 | Microsoft | Large Multi Crore company |

| 3 | Large Multi Crore company | |

| 4 | Amazon | Large Multi Crore company |

| 5 | Oracle Financial Services | ₹6,373 Cr(US$750) |

| 6 | AMD India | Estimated ₹2,500-3000 Cr |

| 7 | Samsung R&D India – Bangalore | ₹5,000 Cr |

| 8 | Carl Zeiss(BLR) | ₹2,200 Cr |

| 9-13 | Silicon Labs, Celonis, Walmart, Tech, Cisco, VMware | Each ₹500-2,000 Cr range |

3. Pharma & Healthcare

India has become a major life sciences GCC hub, hosting nearly half of the top 50 global pharma and healthcare companies. These GCCs now extend from back-office roles into strategic areas such as drug discovery, clinical trial management, regulatory affairs, pharmacovigilance, supply chain analytics, and digital therapeutics. Advanced AI and real-world evidence analytics are accelerating innovation pipelines.

| Rank | Company | FY 25 Revenue |

| 14 | Sanofi (Hyderabad) | ₹3,500 Cr |

| 15 | Eli Lilly | Estimated ₹1,500 Cr+ |

| 16-20 | Roche, Novartis, Pfizer, AstraZenca, GE Healthcare | Each ₹800-2,000 Cr range |

Also read: From Dholera to GIFT City: Top 8 Mega Projects Transforming Gujarat in 2025

4. Manufacturing & Engineering

Manufacturing and engineering-focused GCCs are clustered in cities like Pune and Chennai, industrial engineering hub, automotive technology, product design, and supply chain optimization. These GCCs support global manufacturing operations with engineering research, technology-driven process improvements, and sustainable innovation initiatives. Engineering GCCs integrate digital technologies and IoT to enhance productivity and operational excellence.

| Rank | Company | FY 25 Revenue |

| 21 | Airbus Engineering India | ₹1,000-₹1,500 Cr+ |

| 22 | Collins Aerospace | ₹800-₹1,200 Cr+ |

| 23 | Pratt and Whitney India | ₹800-₹1,200 Cr+ |

| 24 | Marelli India R&D | ₹500- ₹800 Cr |

| 25 | Boeing India Tech | ₹500- ₹1,000Cr |

| 26 | Ford Business Solutions | ₹400- ₹800 Cr |

| 27 | Ebs-papst India (Chennai) | ₹300- ₹600Cr |

5. Retail, Consumer & Other Sectors

GCCs serving retail, consumer packaged goods (CPG), consulting, and other industries leverage India’s cost advantage and talent depth to drive functions such as supply chain analytics, customer insights, digital marketing, finance, and shared services. Major centers in Mumbai and Gurugram focus extensively on finance, legal, and consulting services supporting global enterprises.

| Rank | Company | FY 25 Revenue |

| 28 | LuLu Group GCC(Kochi) | ₹400-700 Cr |

| 29 | Yum Brands Tech (BLR) | ₹300 – 500 Cr |

| 30 | Reltio Data Hub | ₹200 – 400 Cr |

| 31 | BharatPe Tech & Ops | ₹150 – 300 Cr |

| 32 | Licious Innovation Lab | ₹100 – 200 Cr |

| 33 | PepsiCo Global Services (Hyd) | ₹300 – 500 Cr |

Conclusion

India’s GCC’s leaders are dominated by financial services giants commanding tens of thousands of employees and billions in revenue represent far more than operational efficiency plays. The future GCCs growth has forecast 2,100 GCCs by 2028 with market size touching $90 billion, with multinational enterprises India is growing in innovation, digital transformation and strategic value creation.

Written by Yatheendra N