Synopsis: Property prices in several major Indian cities have now surpassed those in the US, reflecting India’s booming real estate market. This article highlights which Indian cities are now pricier than top US markets.

India is the fastest growing economic in the world. The real estate market in India is at its peak, powered by fast urbanization, rising demand in Tier 2 cities, and foreign investments. There is increased demand in the residential sector, particularly where the emphasis is on premium houses and the integration of smart technology.

In contrast the US real estate market has gone through its cycle and is diversified, with residential, commercial, and industrial segments firmly established. It is subject to the same factors affecting the economy, such as interest rates and demographic trends; thus, it can be considered a relatively secure investment area with the participation of major institutions.

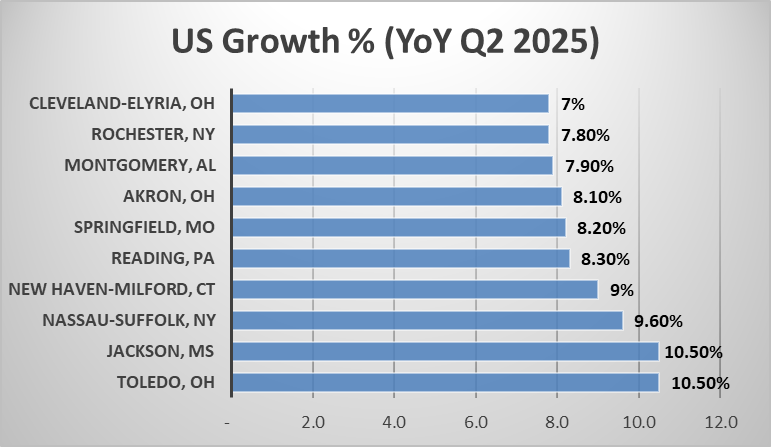

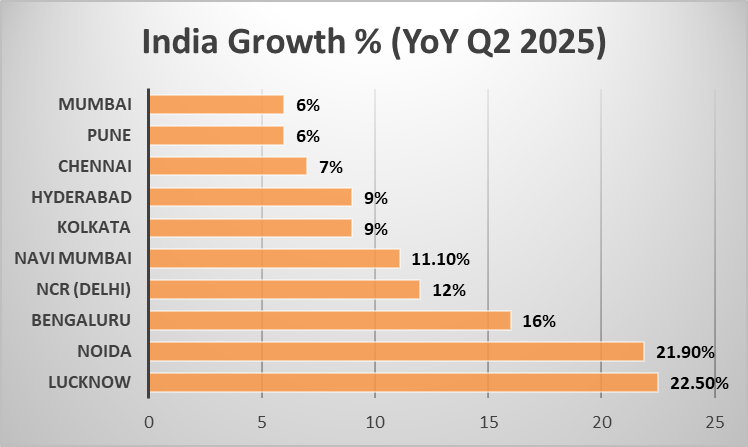

- India’s real estate market significantly outpaces the US, with average YoY growth of 12.05% compared to the US average of 8.77%, a difference of 3.28 percentage points.

- This shows the leading tier-2 city phenomenon cities like Lucknow and Noida are experiencing explosive growth at 22.5% and 21.9% respectively which is more than double the top performing US metros. This reflects the rapid urbanization, Infrastructure development, and migration pattern toward the secondary market.

- While Indian tier-1 metros cities like Bengaluru which is growing 16% and NCR 12% still grow faster than US metros, they lag their tier 2 counterparts, suggesting market saturation in established metros. The US market shows consistent growth clustering between 7.8% and 10.5% indicating stability over volatility.

- Meanwhile Mumbai and Pune show the lowest growth in India at % comparable to the lowest US metros Cleveland-Elyria and Rochester at 7.8% suggesting that established, mature metros in both countries experience slower appreciation.

Also read: Top 10 Rapidly Expanding Sectors in India to Watch in 2025

Comparative Investment Framework

| Factor | Indian Cities | US Cities |

| Growth Potential | 15-25% annually | 4-8% annually |

| Affordability | ₹40-60L (2BHK) | $200-300k median |

| Market State | Early Urbanization | Mature equilibrium |

| Risk Profile | Higher volatility | Stable, predictable |

| Rental Yield | 2-5% | 3-5% |

| Government | Strong incentives | Regulatory Stability |

Top 3 Leading US Cities

- Toledo, Ohio, has YoY growth of 10.5%, driven by manufacturing revival (Stellantis Jeep Factory expansion, First Solar manufacturing). Infrastructure transformation (I-75 expansion, Glass City Riverwalk), and downtown revitalization so it attracts tech companies.

- Median home prices of $135,000-140,000 are 67% below the national average, with significant inbound migration from major metros like New York, Chicago and Los Angeles.

- Jackson, Mississippi saw year on year growth of 10.5%, showing a dramatic September 2025 appreciation of 63.2% YoY, though long-term trends suggest normalized 2-3% annual growth. The market attracts affordability focused buyers with median prices around $120,000 to $139,0000. Which have a strong rental fundamentals make it appealing for cash flow investors seeking 5 plus cap rates.

- Nassau- Suffolk, New York has 9.6% year on year growth and commands premium pricing with Nassau at $810,000 and Suffolk at $687,500 median prices. The market reflects NYC spillover demand and remote work flexibility and this city shows a rising inventory of 14.6% year on year growth suggests transition from hot seller’s market toward balanced conditions, with prices moderating 1-3% annually.

Conclusion

Comparatively, the India’s Real Estate Market is growing fast because the U.S market is already a mature market. And YoY growth is more in India which has 12.05% whereas the U.S has 8.77% YoY growth. India tier 2 cities are also rapidly growing and investors are showing interest in these cities.

Written by Yatheendra N