Synopsis: RIR Power Electronics jumped 5% after reporting strong Q2 results, with profits surging 200% YoY. Revenue and income rose sharply, while the company posted robust QoQ growth despite the stock’s significant yearly decline.

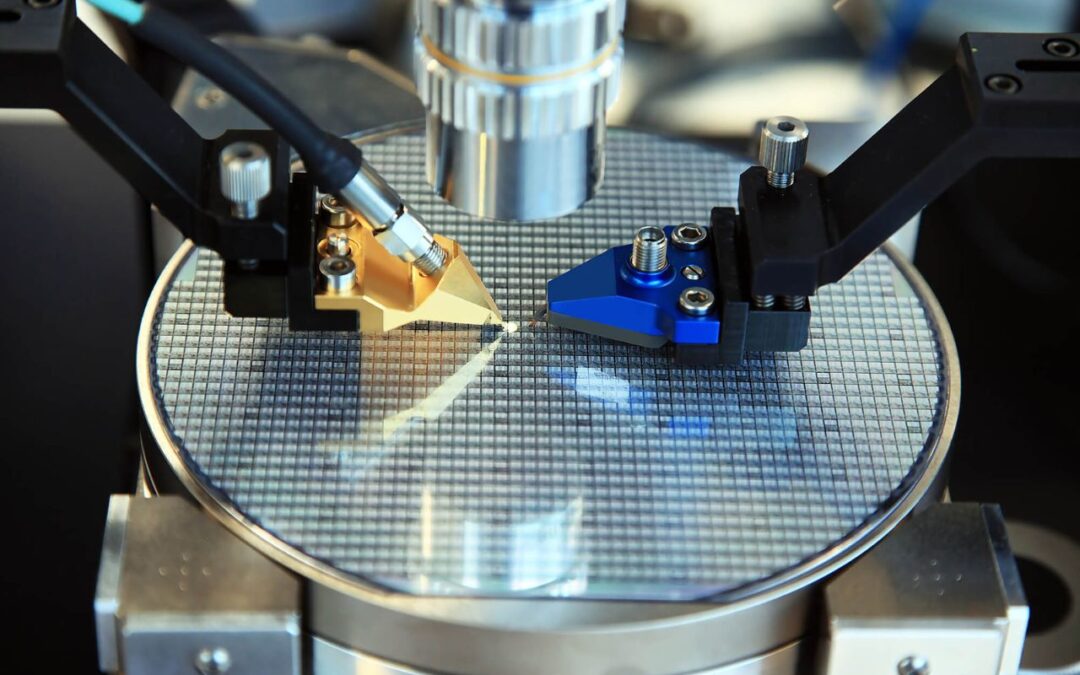

This company is engaged in the manufacturing of traditional semiconductor devices such as bridges, power modules, diodes, rectifiers,and thyristors, is now in the focus after its board reported Q2 results with 200% profit growth YoY.

With market capitalization of Rs. 2,132 cr, the shares of RIR Power Electronics Ltd are currently trading at Rs. 268 per share, hit 5% upper circuit in today’s market session making a high of Rs. 269.20, from its previous close of Rs. 256.40 per share. The stock has recorded a 61% decline over the past year, dropped 31% in the last six months, and is down 15% over the past month.

QoQ performance

Revenue from operation increased by 24% from Rs. 21 cr in Q1FY26 to Rs. 26 cr in Q2FY26. Total income rose to Rs. 26 cr from Rs. 21 cr. Total expenses raised 16% from Rs. 19 cr to Rs. 22 cr. Net profit significantly increased 134% from Rs. 1.8 cr to Rs. 4.2 cr over the same period.

YoY performance

On a YoY basis, Revenue from operation increased by 37% from Rs. 19 cr in Q2FY25 to Rs. 26 cr in Q2FY26. Total income rose to Rs. 26 cr from Rs. 19 cr. Total expenses raised 29% from Rs. 17 cr to Rs. 22 cr. Net profit significantly increased by 200% from Rs. 1.4 cr to Rs. 4.2 cr over the same period.

The company reports a ROCE of 12.0% and a ROE of 9.13%, with a low debt-to-equity ratio of 0.13. It has achieved strong 5-year profit growth of 42.3% CAGR and maintained a healthy dividend payout of 17.2%.

About the company

RIR Power Electronics Ltd is a specialized power semiconductor manufacturer offering high-power diodes, thyristors, rectifiers, and power modules used across railways, EVs, renewable energy, and industrial applications. With decades of expertise and expanding capabilities in advanced technologies like Silicon Carbide devices, the company is strengthening its presence in high-efficiency power electronics solutions.

Promoters have reduced their stake from 61.50% in Q1FY26 to 59.29% in Q2FY26. FII’s holding rose to 9.52% from 8.62%. DII’s holding stands at 0.01% from 0.02%. The public increased their holding from 29.86% to 31.17% over the same period.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.