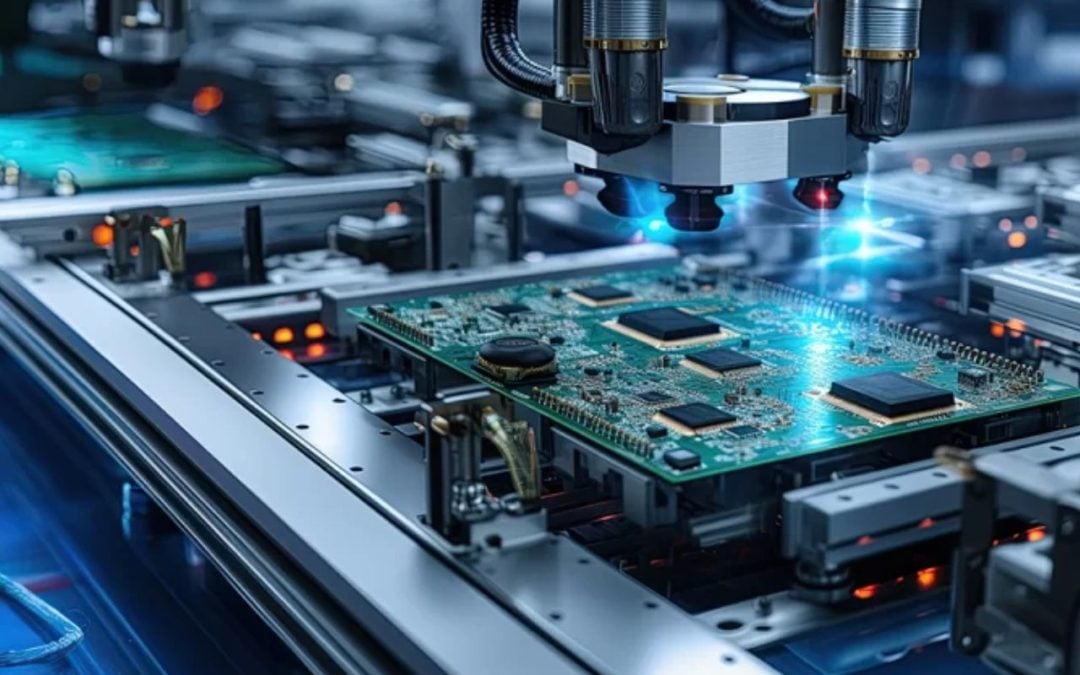

India’s electronics exports recorded a strong growth of over 47 percent year-on-year in Q1 FY26, reaching $12.4 billion, according to Union Commerce and Industry Minister Piyush Goyal in a post on X.

Highlighting the government’s efforts to boost domestic manufacturing, the Minister noted that India has progressed from just two mobile manufacturing units in 2014 to more than 300 facilities today. This growth, he said, reflects the success of initiatives aimed at making India self-reliant in electronics production.

The sector has also become a significant job creator. Alongside mobile phones, products such as solar modules, networking equipment, charger adapters, and electronic components are now key drivers of India’s export momentum. Goyal emphasised that one of the most remarkable transformations has been India’s journey from being a net importer of mobile phones to emerging as the world’s second-largest handset manufacturer.

Data shared by the Minister showed that electronics exports have grown nearly eight times in the last decade, rising from Rs. 38,000 crore in FY15 to Rs. 3.27 lakh crore in FY25.

In FY15, only 26 percent of mobile phones sold in India were manufactured domestically, with the majority imported. Today, that trend has completely reversed, with 99.2 percent of phones sold in India produced locally.

The value of domestic mobile production has also surged sharply, from Rs. 18,900 crore in FY14 to about Rs. 4,22,000 crore in FY24, underscoring India’s rapid rise as a global electronics hub.

Here are three EMS stocks worth exploring, each actively engaged in diverse electronics exports:

Syrma SGS Technology Limited

With a market cap of Rs. 13,898.8 crores, the stock is trading in the green at Rs. 722.15 on Tuesday, as compared to the previous closing price of Rs. 715.05 on BSE. Syrma SGS Technology Limited is engaged in the business of manufacturing various electronic sub-assemblies, assemblies, and box builds, disk drives, memory modules, power supplies/adapters, fibre optic assemblies, magnetic induction coils and RFID products and other electronic products.

In Q1 FY26, the company’s export revenue accounted for around 25 percent of total revenue from operations, amounting to around Rs. 233 crore. The Original Design Manufacturing (ODM) business contributed about 12 percent during the quarter. Geographically, exports to the U.S. comprised 5.5-6 percent, while the remaining share was largely directed toward Western Europe and other regions.

The management reiterated its guidance of maintaining exports in the range of 24-27 percent, with Q1 FY26 exports standing at 24.5 percent of total operating revenue.

Avalon Technologies Limited

With a market cap of Rs. 5,785.5 crores, the stock is trading in the green at Rs. 868.35 on Tuesday, as compared to the previous closing price of Rs. 856.15 on BSE. Avalon Technologies Limited, a leading fully integrated Electronics Manufacturing Services (EMS) company, offers end-to-end product offerings with vertically integrated solutions.

The company provides a full-stack product and solution suite, including Printed Circuit Board (PCB) design, analysis and assembly, cable and wire harness, sheet metal fabrication and machining, injection moulded plastics, magnetics, and complete Box-Build solutions. Avalon caters to global Original Equipment Manufacturers (OEMs) located in the United States, India, Europe, and Japan.

On the infrastructure front, the company’s export-oriented plant in Chennai has commenced production and is currently ramping up operations. To meet rising domestic demand, Avalon Tech is planning to complete Phase 2 of its brownfield expansion in Chennai by the end of Q3 FY26. At present, around 30-35 percent of production from this facility is directed toward exports.

In Q1 FY26, the company reported a 62.1 percent YoY revenue growth, supported by broad-based demand across industry verticals and geographies. Both the Indian and U.S. businesses delivered a 62 percent YoY growth, reflecting consistent performance across regions. Revenue share from the company’s U.S. manufacturing plant now accounts for 20 percent of total revenue in Q1 FY26.

Avalon’s dual presence in both the U.S. and India continues to provide a strategic advantage. The U.S. facility allows customers to localise production and mitigate tariff risks, while the India operations serve as a scalable and cost-efficient manufacturing hub. This geographic flexibility positions Avalon strongly to support evolving customer needs and navigate shifting global trade dynamics effectively.

Exicom Tele-Systems Limited

With a market cap of Rs. 1,990 crores, the stock is trading in the green at Rs. 143 on Tuesday, as compared to the previous closing price of Rs. 139.3 on BSE. Exicom Tele-Systems Limited provides efficient and reliable power electronics solutions for global telecom, IT, and other related industries and manufactures EV chargers and lithium-ion batteries for EVs.

In Q1 FY26, revenues from Africa and Southeast Asia stood at Rs. 29.3 crore, accounting for around 29-30 percent of the quarter’s total revenue. The company also strengthened its position in these regions by adding new customers while simultaneously expanding wallet share with existing customers.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.