Synopsis:

Stocks exhibiting a MACD bearish signal are showing weakening momentum, with the MACD line crossing below the signal line. This trend suggests a potential price decline, signaling caution for investors and traders.

MACD (Moving Average Convergence Divergence) is a popular technical indicator used in stock trading to identify momentum and trend direction. When a stock shows a MACD bearish signal, it indicates potential downward momentum, suggesting that selling pressure may be increasing and the stock price could decline in the near term. Traders often use this signal to time exits or short positions.

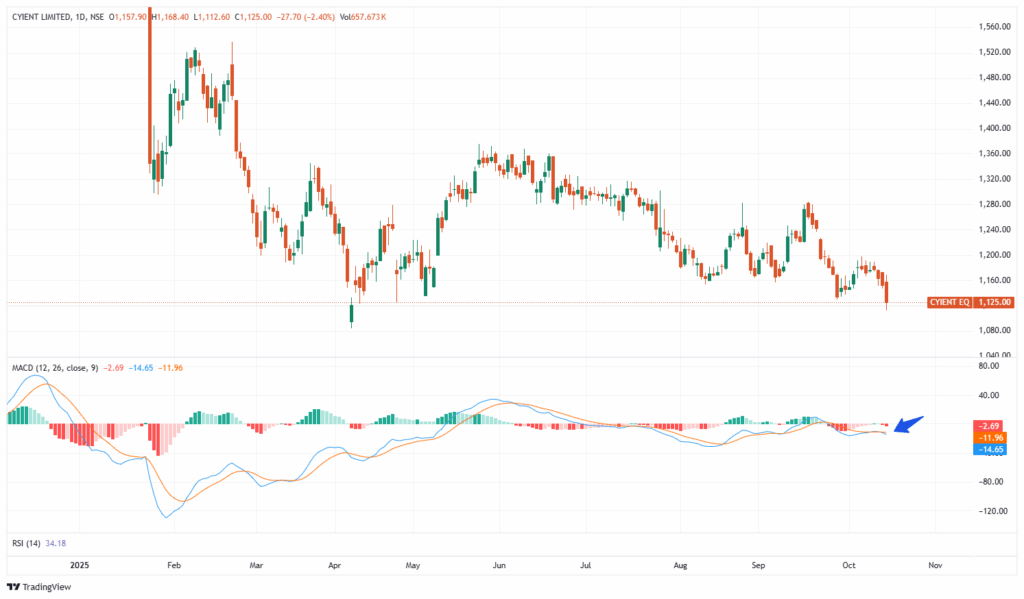

Cyient Ltd

Cyient Ltd is an Indian global engineering and technology solutions company that provides services in areas like aerospace, defense, transportation, telecommunications, and industrial sectors. The company specializes in engineering design, digital solutions, data analytics, and geospatial services, helping clients optimize processes and enhance operational efficiency.

With market capitalization of Rs. 12,507 cr, the shares of Cyient Ltd are closed at Rs. 1,125 per share, from its previous close of Rs. 1,152.70 per share.

The MACD line has crossed below the signal line, indicating a potential bearish momentum in the stock.

Coromandel International Ltd

Coromandel International Ltd is a leading Indian company in the agriculture sector, specializing in fertilizers, crop protection products, and specialty nutrients. It provides farmers with integrated solutions to enhance crop productivity and soil health.

With market capitalization of Rs. 64,676 cr, the shares of Coromandel International Ltd are closed at Rs. 2,198.20 per share, from its previous close of Rs. 2,117.10 per share.

The MACD line has crossed below the signal line, indicating a potential bearish momentum in the stock.

Zensar Technologies Ltd

Zensar Technologies Ltd is an Indian IT services and digital solutions company that provides software development, enterprise solutions, cloud services, and digital transformation offerings. It serves clients across industries such as manufacturing, retail, banking, and healthcare, helping them modernize operations and enhance customer experiences.

With market capitalization of Rs. 17,185 cr, the shares of Zensar Technologies Ltd are closed at Rs. 756.30 per share, from its previous close of Rs. 755.80 per share.

The MACD line has crossed below the signal line, indicating a potential bearish momentum in the stock.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.