SYNOPSIS:

This article explores select Indian GPU manufacturers, including Netweb Technologies, detailing their innovations, strategic initiatives, and contributions toward advancing India’s indigenous GPU and AI ecosystem.

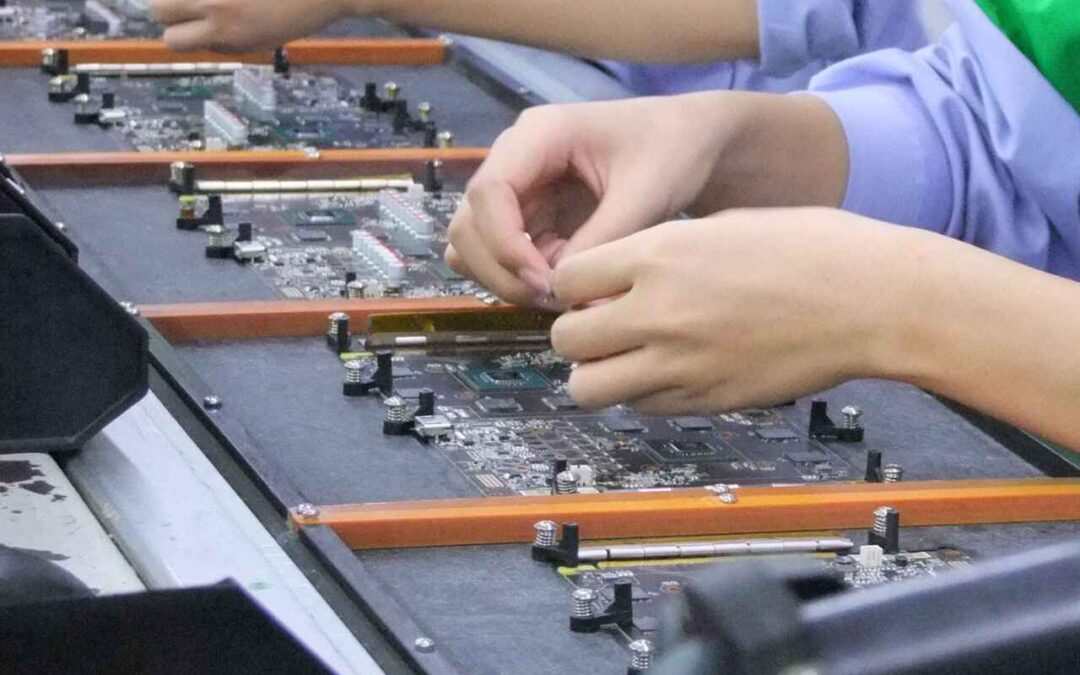

A Graphics Processing Unit (GPU) is a specialised electronic circuit designed to accelerate graphics rendering and image processing across a range of devices, including video cards, motherboards, mobile phones, and personal computers.

Under the National Supercomputing Mission (NSM), India is advancing its indigenous computing infrastructure to fuel AI model development. The country’s focus on homegrown chip design and the creation of open GPU marketplaces is reducing barriers to entry and fostering innovation in the AI ecosystem.

India’s national compute capacity has now surpassed 34,000 GPUs. Union Minister Shri Ashwini Vaishnaw encouraged the newly selected teams under the IndiaAI Mission to strive for a top-five global position in their respective domains.

The Minister highlighted that 367 datasets have already been uploaded to AI Kosh, India’s AI knowledge repository. He also underscored the IndiaAI Mission’s pivotal role in fostering reverse brain drain and building a holistic AI ecosystem encompassing foundational models, compute capacity, safety standards, and talent development. These efforts, he stressed, aim to create a complete and inclusive AI ecosystem in India.

Following are a few listed companies related to Graphics Processing Units (GPUs) in India:

Netweb Technologies Limited

With a market cap of Rs. 22,044 crores, the stock is currently trading in the red at Rs. 3,891 on BSE, down by around 1 percent during Thursday’s morning trading session.

Aligned with its strategic focus on AI, Netweb launched Skylus.ai in FY25, a unified platform designed to accelerate the deployment of GPU-based AI infrastructure. Skylus.ai enables organisations to optimise GPU resource management and streamline AI workload deployment, thereby reducing time-to-value and enhancing operational efficiency.

The launch of Skylus.ai marks a significant milestone, offering a composable GPU appliance purpose-built for dynamic GPU resource management across multi-vendor environments. Netweb’s Data Centre Server offerings include 1U Server, 2U Server, All-Flash NVMe, 4U 8-Node Server, GPU Server, and Storage Server.

Backed by a dedicated R&D facility, the company has expanded its portfolio to eight product lines: Tyrone Cluster Manager, KUBYTS, VERTA, ParallelStor, Collectivo, Skylus, Tyrone Camarero AI Systems, and GPU Systems.

Netweb Technologies offers a full stack of products and a solution suite, providing end-to-end capabilities in designing, developing, implementing and integrating high-performance computing solutions. It collaborates with leading global technology partners, including Intel Americas, Inc., AMD, Samsung India Electronics Private Ltd, NVIDIA, and Seagate India Private Ltd.

E2E Networks Limited

With a market cap of Rs. 6,343 crores, the stock is currently trading in the red at Rs. 3,155 on BSE, down by around 1.4 percent during Thursday’s morning trading session.

As India’s leading hyperscaler focused on advanced Cloud GPU infrastructure, E2E Networks offers accelerated cloud computing solutions that include cutting-edge GPUs such as NVIDIA A100, H100, and the newly available H200 GPUs on the cloud. These capabilities cement its position as the nation’s premier Infrastructure-as-a-Service (IaaS) provider for advanced Cloud GPU solutions.

Through early investments in GPU cloud infrastructure and an agile proof-of-concept-to-production model, E2E Networks is well-positioned to capture a significant share of the growing demand for GPU-enabled cloud services.

The company is committed to deepening its expertise in high-performance cloud GPU clusters for AI, ML, and Generative AI workloads, aiming to deliver industry-leading performance while maintaining cost competitiveness.

Looking ahead, E2E Networks plans to expand its GPU capacity by ramping up investments in accelerated computing hardware, networking, and scale-out storage to meet the demands of large-scale AI, ML, and deep learning workloads.

Tata Communications Limited

With a market cap of Rs. 56,453 crores, the stock is currently trading in the green at Rs. 1,980.8 on BSE, up by around 1.3 percent during Thursday’s morning trading session.

Tata Communications Vayu AI Cloud unlocks the power of AI through a unified platform that offers advanced capabilities, including large-scale GPU computing, LLM operations, and serverless functions. It empowers enterprises to efficiently build, train, and deploy AI models at scale with unmatched performance and flexibility.

The company provides Kubernetes-as-a-Service, enabling enterprises to run secure and scalable workloads – from native backups to GPU scaling – with complete flexibility and zero vendor lock-in. It ensures robust application protection through fully managed, Kubernetes-native backups and effortless cross-cluster restores. The company also empowers organisations to accelerate their AI workloads with auto-scaling GPU nodes and seamless integration with Tata Communications Vayu Cloud AI Studio.

Kaynes Technology India Limited

With a market cap of Rs. 47,168 crores, the stock is trading in the green at Rs. 7,036.4 on BSE, up by around 1.1 percent during Thursday’s morning trading session.

Through its wholly-owned subsidiary, Kaynes Semicon, the company is pursuing ambitious plans to establish a fab facility, compound fab, design lab, and indigenous GPU development capabilities, as per sources.

As part of its aggressive expansion strategy, Raghu Panicker, CEO of Kaynes Semicon, stated that the company will invest nearly $20 million in research and development (R&D) in FY26, to achieve a revenue target of Rs. 100 crore within the fiscal year.

Kaynes Technology India Limited is a leading end-to-end and IoT solutions provider enabling electronics manufacturing players, with capabilities across the entire spectrum of Electronics System and Design Manufacturing (ESDM) companies.

The company provides conceptual design, process engineering, integrated manufacturing, and life-cycle support for major players in the automotive, industrial, aerospace and defence, nuclear, medical, railways, IoT, IT and other segments.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.