Synopsis:

Azad Engineering signed a $73.47 million contract with Mitsubishi Heavy Industries to supply turbine parts. This five-year deal boosts its order book and strengthens its global energy sector position. The partnership builds on a previous agreement, marking steady growth and strong future prospects for the company

The company, known for manufacturing precision-engineered critical components for global energy and aerospace sectors, has secured a significant long-term contract. The agreement, valued at nearly Rs 651 crore is with Mitsubishi Heavy Industries. This marks a major development that brings the stock into focus.

Azad Engineering Limited’s stock, with a market capitalisation of Rs. 10,298 crores, rose to Rs. 1,626, hitting a high of up to 4.44 percent from its previous closing price of Rs. 1,556.80. Furthermore, the stock over the past year has given a return of 9.2 percent.

Order Details

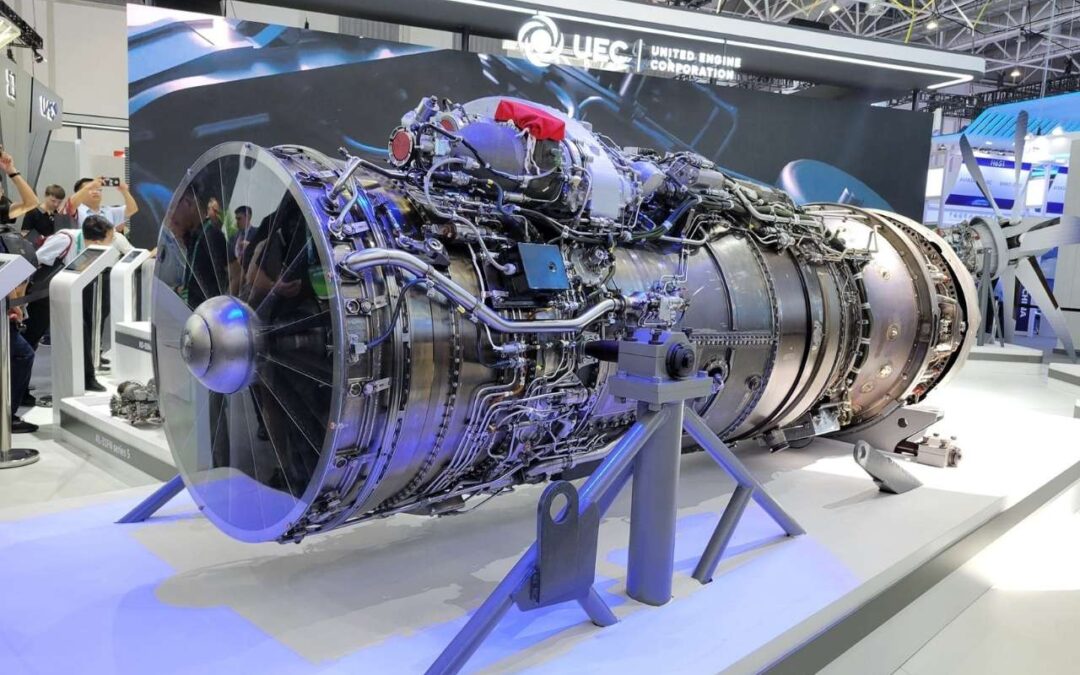

Azad Engineering Limited has signed a new long-term contract and price agreement with Mitsubishi Heavy Industries Limited, Japan (MHI) for the supply of highly engineered and complex airfoils used in gas and thermal power turbine engines.

The latest contract is valued at USD 73.47 million (about Rs. 651 crores), and it helps MHI meet its global demand in the power generation sector. This agreement is considered as Phase 2, following a previous contract signed on November 3, 2024, and is seen as a strong step towards building a lasting partnership between the two companies.

With this new agreement, the total value of Azad Engineering’s contracts with MHI now stands at USD 156.36 million (around Rs. 1,387 crores). The agreement will run for five years and is international in nature, with no related party transactions or shareholding links between the two companies. No shares are being issued, and the contract is strictly for the supply of turbine engine parts to MHI, supporting their needs in the global energy market.

Also read: Infra stock jumps after receiving ₹32.63 Cr order from Abu Dhabi-based company

Q1 Financial Highlight

The company reported strong Q1FY26 performance with revenue at Rs. 137 crore, up 39.8% YoY from Rs. 98 crore in Q1FY25 and 7.9% QoQ from Rs. 127 crore in Q4FY25. Profit stood at Rs. 29 crore, a robust 70.5% YoY increase over Rs. 17 crore and 16.0% higher sequentially from Rs. 25 crore, indicating sustained operational momentum.

Over the last three years, the company delivered 33% revenue CAGR and 44% profit CAGR, highlighting consistent growth. With ROE CAGR at 9% during the same period, profitability and returns remain on an improving trajectory, pointing to strengthening fundamentals.

Written By Fazal Ul Vahab C H

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.