The Indian automobile sector has attracted significant investments from both domestic and international players. Between April 2000 and December 2024, foreign direct investment (FDI) into the sector reached nearly Rs. 2.45 lakh crore, accounting for 5 percent of India’s total FDI inflows during this period.

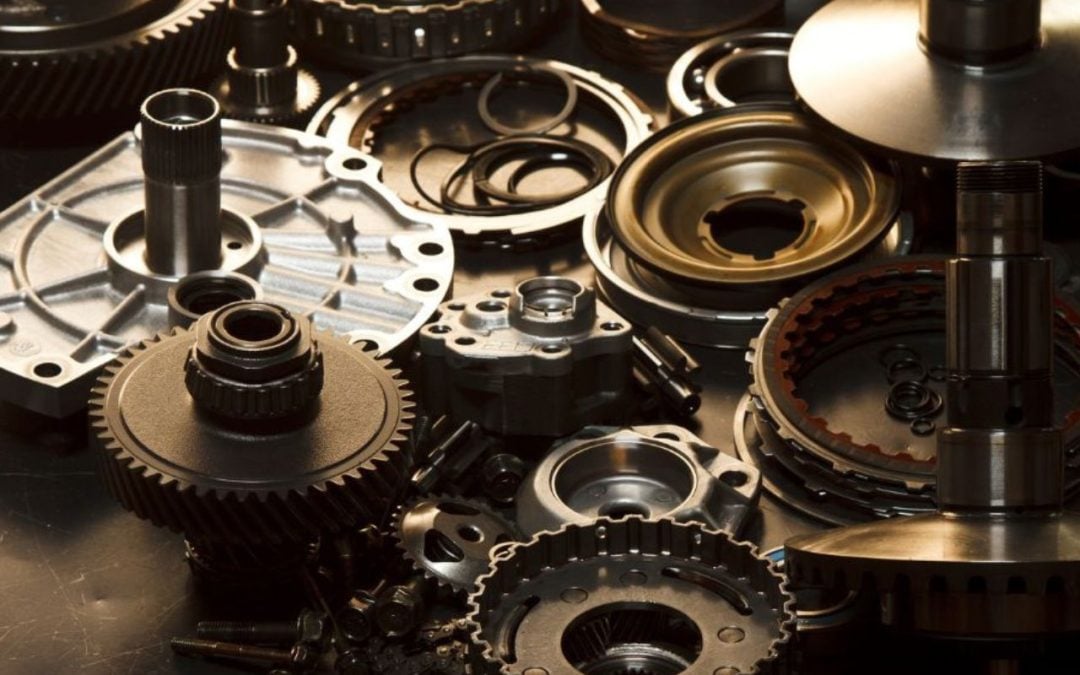

The auto component industry is poised for substantial growth, with projected investments of Rs. 25,000-30,000 crore in FY26 aimed at capacity expansion and localisation of EV parts, following an estimated Rs. 15,000-20,000 crore investment in FY25.

As the automotive industry undergoes rapid transformation, the auto components sector will be pivotal in driving the future of mobility. Strategic partnerships with OEMs, increased focus on research and development, and compliance with evolving regulations will be critical to staying competitive in this dynamic landscape.

According to ICRA, the domestic passenger vehicle market is expected to grow by 6-9 percent in the current fiscal year compared to the previous year. Furthermore, the Indian government’s exemption on customs duty for capital goods and machinery essential for lithium-ion cell production is set to boost EV manufacturing.

Alongside shifting global supply chains, these factors are expected to help expand India’s automotive component exports by 4-5 percent annually, reaching $80 billion by 2026. Notably, India’s auto component industry ranks as the third largest in the world.

Here are a few auto ancillary stocks to watch as the industry prepares for investments of up to Rs. 30,000 crore by FY26:

Craftsman Automation Limited

With a market cap of Rs. 15,947.8 crores, the stock is currently trading in the green at Rs. 6,685.15 on Tuesday, as against its previous closing price of Rs. 6,589.3 on BSE.

Craftsman Automation Limited, a prominent producer of automotive and industrial components, is engaged in the business of manufacturing engineering components, sub-assemblies, products and rendering of contract manufacturing services to various industries.

Bharat Forge Limited

With a market cap of Rs. 59,998 crores, the stock is currently trading in the green at Rs. 1,254.95 on Tuesday, as against its previous closing price of Rs. 1,237.6 on BSE.

Bharat Forge Limited is a global leader in high‑performance, safety-critical components and solutions across a wide spectrum of industries, including automotive, aerospace, defence, railways, marine, oil & gas, construction, and industrial equipment.

As India’s largest auto component exporter and one of the world’s foremost manufacturers of powertrain and chassis systems, the company combines advanced design capabilities, dual-shore manufacturing, and end-to-end supply solutions. Bharat Forge leverages deep expertise in steel and aluminium across forgings and castings to deliver reliable, precision-engineered products to global markets.

In Q1 FY26, the company secured new orders worth Rs. 847 crore, including Rs. 269 crore from the defence sector. The defence order book stood at Rs. 9,463 crore over the same period.

Gabriel India Limited

With a market cap of Rs. 19,014 crores, the stock is currently trading in the green at Rs. 1,323.7 on Tuesday, as against its previous closing price of Rs. 1,301.9 on BSE.

Gabriel India Limited, the flagship company of the ANAND Group, offers a wide range of ride control products, including shock absorbers, struts, front forks and sunroofs. The company serves a diverse customer base across two- and three-wheelers, passenger vehicles, commercial vehicles, railways, and the aftermarket, with a strong focus on innovation and technology-driven solutions.

As of Q1 FY26, Gabriel India holds an 88 percent market share in commercial vehicles (including aftermarket and railways), a 32 percent market share in the 2W/ 3W segment (including aftermarket), and a 25 percent market share in passenger vehicles (including aftermarket).

In FY25, the company expanded its manufacturing base and suspension products portfolio by acquiring assets from Marelli Motherson Auto Suspension Parts Private Limited (MMAS), a joint venture between the Motherson Group and Marelli Suspension Systems, Italy.

This strategic move not only marked Gabriel India’s foray into the gas spring segment but also enabled access to advanced suspension technologies through a Technical Assistance Agreement with Marelli, significantly enhancing the company’s product capabilities and competitiveness.

Sona BLW Precision Forgings Limited

With a market cap of Rs. 27,076 crores, the stock is currently trading in the green at Rs. 435.5 on Tuesday, as against its previous closing price of Rs. 433.75 on BSE. Sona BLW Precision Forgings Limited is engaged in the manufacturing of precision forged bevel gears and differential case assemblies, conventional and micro-hybrid starter motors, EV traction motors, etc., for automotive and other applications.

The company’s global market share for Differential Bevel Gears grew to 8.8 percent from 8.2 percent recorded last year, while its share for starter motors rose to 4.4 percent from 4.2 percent.

Entering the E2W/E3W segment four years ago with a range of traction motors and inverters, this segment contributed 8 percent to total revenue in FY25. During the year, Sona BLW secured 32 new programmes and onboarded seven new customers, expanding its order book position to Rs. 24,200 crore, 77 percent of which comprises EV-related programmes.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.