Synopsis:

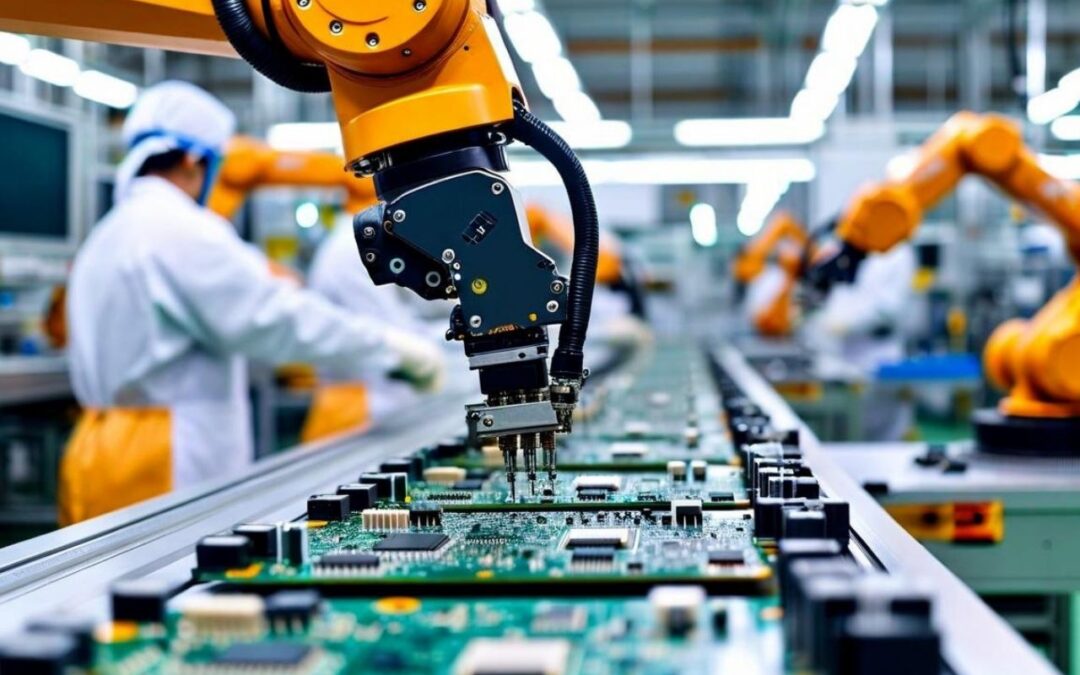

The EMS provider announced a Rs 1,000 crore investment for its first South India plant in Sri City, aiming to expand manufacturing and export capacity. Despite a 14% revenue rise, net profit fell 20%, while strong client relationships and future growth plans support long-term expansion.

The shares of the electronic manufacturing services provider gained up to 2.2 percent in today’s session after the company announced an investment plan of Rs 1,000 crore for capacity expansion in South India.

With a market capitalization of Rs 14,546.09 crore, the shares of PG Electroplast Ltd were trading at Rs 512.05 per share, decreasing around 0.48 percent as compared to the previous closing price of Rs 514.50 apiece.

Expansion Plan

The shares of PG Electroplast Ltd have seen positive movement after its Wholly Owned Subsidiary, PG Technoplast Private Limited, announced the acquisition of a 50-acre land parcel in Sri City, Andhra Pradesh. This is a landmark moment for the company, as it establishes its first facility in South India and represents its largest land acquisition to date.

Further, PGEL is set to invest Rs 1,000 crore over five years to build a modern integrated manufacturing campus near Chennai port, enhancing its national footprint and export potential. The first phase will produce 1.2 million refrigerators annually, starting in December 2026, with infrastructure designed for future expansion into air conditioners, washing machines, and other appliances.

Commenting on the development, Mr. Vikas Gupta, Managing Director – Operations, said: “This is an emotional and proud milestone for the PG Group. Sri City marks our very first step into South India and also our largest land acquisition so far. It reflects our deep commitment to building for the long term, not just for our customers but also for the communities we will engage with. The facility’s scale, its proximity to the port, and its potential for exports make this a transformative chapter in our journey.”

Also read: ₹6,000 Cr Orderbook: Defence stock jumps 4% after receiving ₹651 Cr contract for turbine engines

Financial & Guidance

The company reported a 14 percent increase in revenue, rising from Rs 1,321 crore to Rs 1,504 crore in Q1FY26, indicating strong top-line growth. However, net profit declined 20 percent to Rs 67 crore, suggesting rising costs or margin pressures despite higher sales, highlighting the need for efficiency improvements.

PG Electroplast has an impressive client portfolio featuring industry giants like Acer, Blue Star, Daikin, Flipkart, Foxconn, Godrej, Haier, Honeywell, Hyundai, LG, Midea, Whirlpool, and Voltas. This wide customer base across consumer durables, electronics, and home appliances highlights the company’s reputation, trust, and expertise in servicing top brands.

PGEL projects FY26 group revenues of Rs 6,550-6,650 crore, up 21-23 percent, driven by strong growth in products, electronics, and Goodworth Electronics. Net profit is guided at Rs 300-310 crore. The company is investing Rs 700-750 crore in new facilities for refrigerators, washing machines, plastics, and coolers, supporting continued expansion and margin improvement.

PG Electroplast is a top electronics manufacturing services provider in India, focusing on original design and contract manufacturing of consumer durables like washing machines and air conditioners. The company’s mission is to offer competitively priced, high-quality products and services that consistently exceed customer expectations, ensuring value for all stakeholders.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.