In stock market technical analysis, a “Death Crossover” is seen as a bearish signal that may indicate potential price declines. This pattern occurs when a short-term moving average, typically the 50-day, crosses below a longer-term moving average like the 200-day. It suggests that recent price momentum is weakening compared to the longer-term trend.

For traders and investors, the Death Crossover serves as a warning sign and may suggest the beginning of a downward trend in the stock’s price. While it doesn’t guarantee a decline, it reflects increased selling pressure and reduced buying interest. Many investors consider this signal alongside other technical indicators to evaluate market conditions and make more informed decisions.

Here are a few 5 Nifty 500 stocks with a Death Crossover:

1. Page Industries Limited

Page Industries Limited was established in 1994 and is headquartered in Bangalore. The company is the exclusive licensee of JOCKEY International for manufacturing, marketing, and distributing innerwear, loungewear, and socks across India and neighboring countries. It also holds the Speedo swimwear license for India and Sri Lanka.

The death crossover took place on the 25th of September 2025, at the price of Rs. 45,311.10 with a decent volume of 20.19 K. The stock closed at Rs. 40,685 in Tuesday’s session, reflecting a 0.97 percent decrease in the intraday trade.

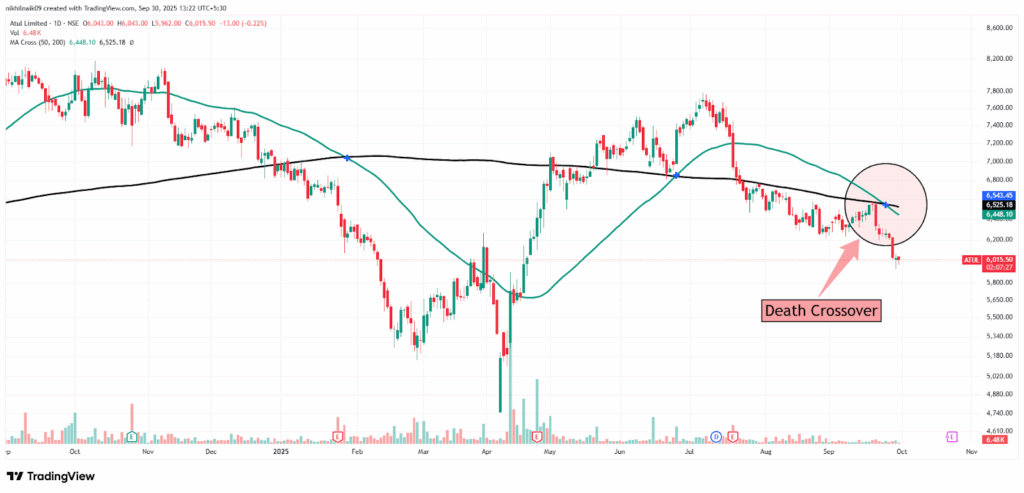

2. Atul Limited

Atul Limited was established in 1947 by Kasturbhai Lalbhai and is engaged in manufacturing chemicals, agrochemicals, pharmaceuticals, and specialty products. It serves around 4,000 customers globally across 30 industries, with subsidiaries in the USA, UK, China, Brazil, and the UAE.

The death crossover took place on the 24th of September 2025, at the price of Rs. 6,543.45 with a decent volume of 20.5 K. The stock closed at Rs. 6,059 in Tuesday’s session, reflecting a 0.51 percent increase in the intraday trade.

3. Shriram Finance Limited

Shriram Finance Limited was established in 1979 and is a leading non-banking financial company (NBFC) in India. It is engaged in providing commercial vehicle finance, personal loans, home loans, and business loans. It operates over 3,225 branches with a strong focus on financial inclusion and technology-driven services.

The death crossover took place on the 23rd of September 2025, at the price of Rs. 622.24 with a decent volume of 3.59 million. The stock closed at Rs. 616.10 in Tuesday’s session, reflecting a 0.70 percent increase in the intraday trade.

4. LIC Housing Finance Limited

LIC Housing Finance Limited was established in 1989 as a subsidiary of Life Insurance Corporation of India (LIC) and is engaged in providing long-term housing finance for purchasing, constructing, repairing, and renovating residential properties across India.

The death crossover took place on the 22nd of September 2025, at the price of Rs. 582.18 with a decent volume of 146.24 K. The stock closed at Rs. 565.05 in Tuesday’s session, reflecting a 0.39 percent decrease in the intraday trade.

5. Sundaram Finance Limited

Sundaram Finance Limited was established in 1954 and is a leading financial services company in India. It is engaged in vehicle finance, asset management, insurance, and housing finance. The company has over 640 branches, a strong customer base, and focuses on innovation and technology-driven financial solutions.

The death crossover took place on the 22nd of September 2025, at the price of Rs. 4,744.08 with a decent volume of 45.44 K. The stock closed at Rs. 4,411.50 in Tuesday’s session, reflecting a 3.42 percent increase in the intraday trade.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.