Synopsis– India has become one of world’s top 10 markets for branded luxury residences and the Luxury Real Estate market segment is estimated to reach a growth rate of 200% by 2031. This is mainly due to the rapid increase in the number of HNWIs and Ultra-HNWIs in India’s top cities. Branded residencies in India is signalling a strong turning point for the country’s Luxury real estate segment.

The New Gold Standard: Why Branded Residences are Taking Over

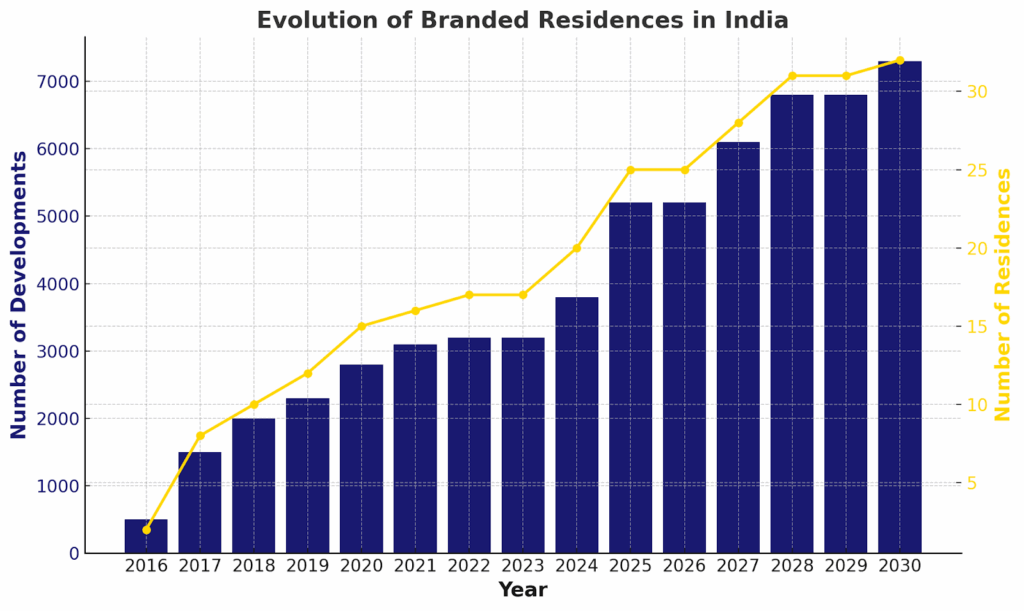

India has become one of world’s top 10 markets for branded luxury residences. The branded residencies market is set to hit $118 billion by 2030. It’s growing at this impressive rate of 21.81% a year, compound style. Branded residences have become a strong concept to bring an ₹86.1 billion (FY2027) market with a steady CAGR of 11–15% annually. A big part of that comes from HNWIs, and UHNWIs. Their numbers keep climbing fast.

HNWIs and UHNWIs are Driving the Demand

- India is currently home to approximately 3,50,000 HNWIs with an annual growth of roughly 12% over the past 5 years. Meanwhile the UHNWI population in India is expected to grow from 13000 in 2023 to 20000 in 2028 according to various reports.

- Investment wise, branded residences usually fetch a premium of 30 to 40% over non-branded luxury spots. They show strong capital appreciation over time.

Expansion of Global Brands in India

India’s Branded Residencies market is attracting Global market players like Marriot International, ITC Hotels, Wyndham Hotels and Radisson Hotel Group, pursuing branded residency opportunities in India.

Also read: Top Realty Developers Offering Branded Residences in India 2025

Factors Driving Growth

- H-1B Visa Fee Hike- Due to the new H1-B Visa Fee hike, NRIs are turning towards the Indian real estate market specially moving towards the luxury residential segment and commercial segment. They see the Indian residential market as stable investment opportunity.

- Rising Affluence: India’s GDP has been expanding at an average rate of more than 7% per annum fostering wealth creation in the real estate sector.

- Strategic Brand Collaborations: Hotels and other brands are teaming up with builders to make these fancy living spots. Non-hotel ones make up approximately 75% of the market. Hospitality brands like Marriot are partnering with developers to tap into the branded residencies segment.

- Urbanization and Infrastructure: Urbanization is pushing things along, with better connections in major cities like Mumbai, Delhi NCR, Bangalore, Pune, and Hyderabad as potential growth hubs. Even Tier-2 spots like Jaipur and Coimbatore are picking up steam, fueling the whole demand.

Market Trends

- Branded residences go for premium prices. They end up costing more than your average luxury properties, pretty much every time.

- Mumbai, Delhi NCR, and Bangalore, those are still the big players in the market. Pune and Hyderabad, they’re starting to show up as solid hubs too, you know.

- Smart home tech and all those sustainable design bits, they’re turning into standard stuff in luxury builds now. Kind of expected these days.

- Buyers want properties that mix in luxury amenities with some curated experiences and good security. That’s the main focus, really.

The Landscape in the Next Five Years (2025–2030)

- Mumbai, Delhi-NCR, Bengaluru, those are still the main spots. But places like Goa and Alibaug are getting in on it. They’re vacation areas, so branded villas and homestays make sense. Hospitality groups run them, perfect for second homes or extras for the rich.

- Other cities too, like Hyderabad, Pune, Chennai. Local HNWIs there want that world class feel without leaving. More brands, homegrown and foreign, will show up.

Product Diversification: Beyond Hospitality

The market will move beyond purely hotel-branded residences to include new categories:

| Category | Example | Target HNWI Segment |

| Hotel Branded | Four Seasons Private Residences, Ritz-Carlton Residence | Primary home, service-oriented, high security |

| Fashion/Design Branded | Residences by Versace Home, Armani/Casa | Aspirational, design-focused, status-driven |

| Automotive Branded | Residences by Aston Martin or Porsche (hypothetical future) | Collectors, status-conscious, ultra-luxury niche |

The push will be toward custom setups, unique ways to live. Developers are pouring money into green stuff, wellness features. Air cleaners, nature inspired designs, built in gyms and spas. The elite care about health now, so it’s a must.

Conclusion

Branded residences are on their way to becoming the new benchmark in India’s luxury real estate market. They are not just houses but lifestyle assets that come with exclusivity, security, wellness, and brand prestige. The market is about to experience the geographical and format-wise speedy growth as HNWIs and UHNWIs create demand, and developers work with global names to bring exclusive offerings. Consequently, the next five years will mark the arrival of this phenomenon, not only reimagining Indian urban luxury in the traditional metro strongholds but also moving into new cities and lifestyle destinations. Moreover, branded residences guarantee investors and buyers alike not only aspirational value but also handsome returns, thereby making them one of the most powerful factors in the country’s real estate revolution.

Written By Rachna Rajput