Synopsis:

A MACD bullish crossover signals potential upward momentum as the MACD line crosses above the signal line. Stocks like Fortis Healthcare, BSE Ltd, and Aditya Birla Lifestyle Brands may attract buying interest.

The MACD bullish crossover suggests a possible trend reversal or strengthening upward movement. Investors may view Fortis Healthcare, BSE Ltd, and Aditya Birla Lifestyle Brands as potential buying opportunities, subject to broader market and sector conditions.

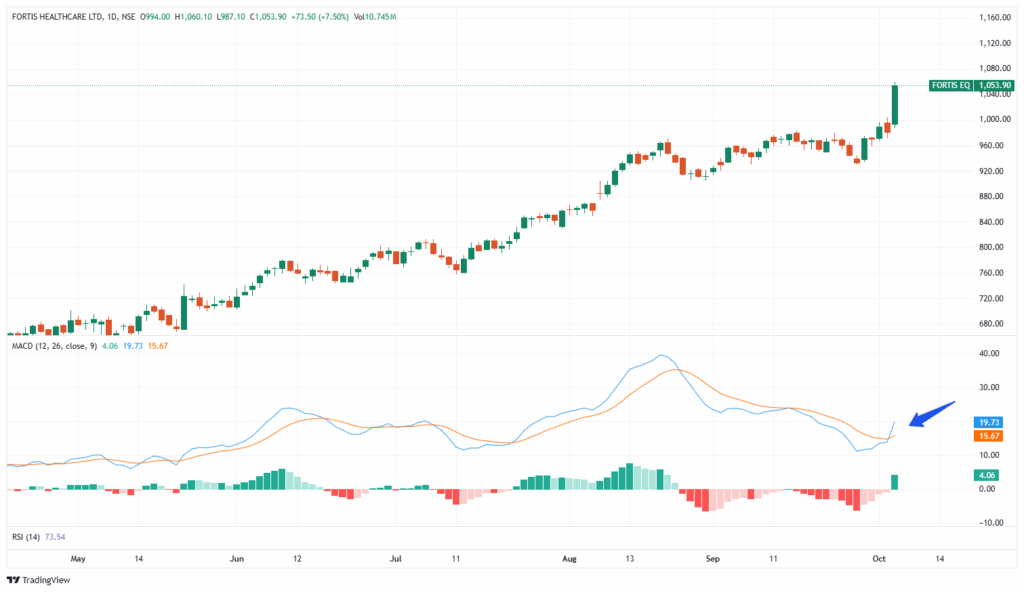

1. Fortis Healthcare Ltd

Fortis Healthcare Ltd is a leading private healthcare provider in India, operating a network of multi-specialty hospitals, diagnostic centers, and day-care facilities. Known for its quality medical services and advanced healthcare infrastructure, it serves both domestic and international patients, focusing on patient-centric care and expanding its presence across key Indian cities.

With market capitalization of Rs. 79,565 cr, the shares of Fortis Healthcare Ltd are closed at Rs. 1,053.90 per share, from its previous closing of Rs. 980.40 per share. A MACD bullish crossover appears on the stock, indicating upward movement and possible near-term price appreciation.

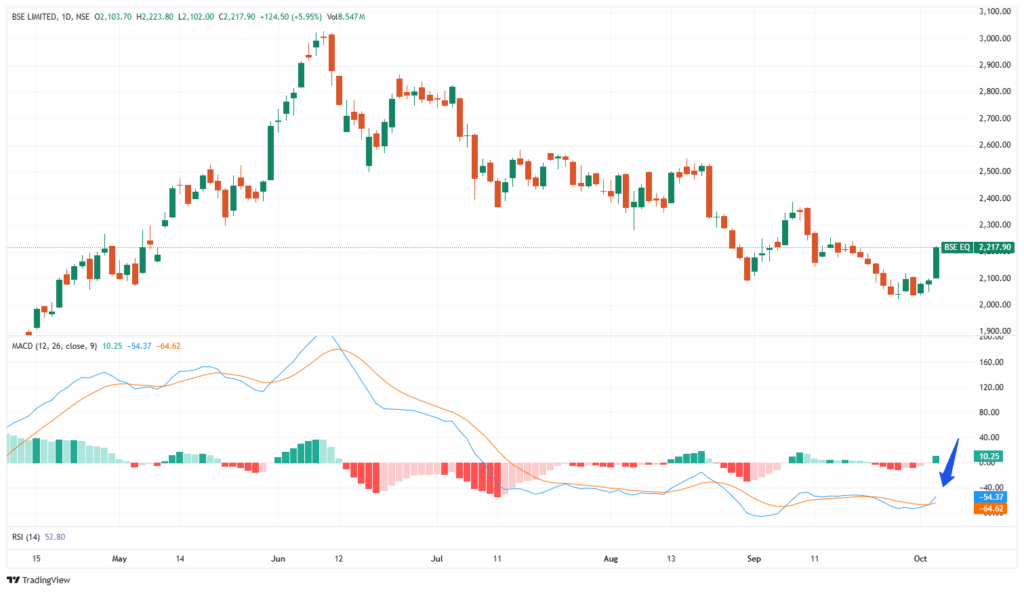

2. BSE Ltd

BSE Ltd (formerly Bombay Stock Exchange) is one of India’s oldest and largest stock exchanges, providing a platform for trading equities, derivatives, and debt instruments. It plays a crucial role in India’s financial markets by ensuring transparency, liquidity, and efficient price discovery for investors and listed companies.

With market capitalization of Rs. 90,205 cr, the shares of BSE Ltd are closed at Rs. 2,217.90 per share, from its previous close of Rs. 2,093.40 per share. The stock shows a bullish MACD crossover, signaling upward momentum, potential near-term price increase, and a possible buying opportunity.

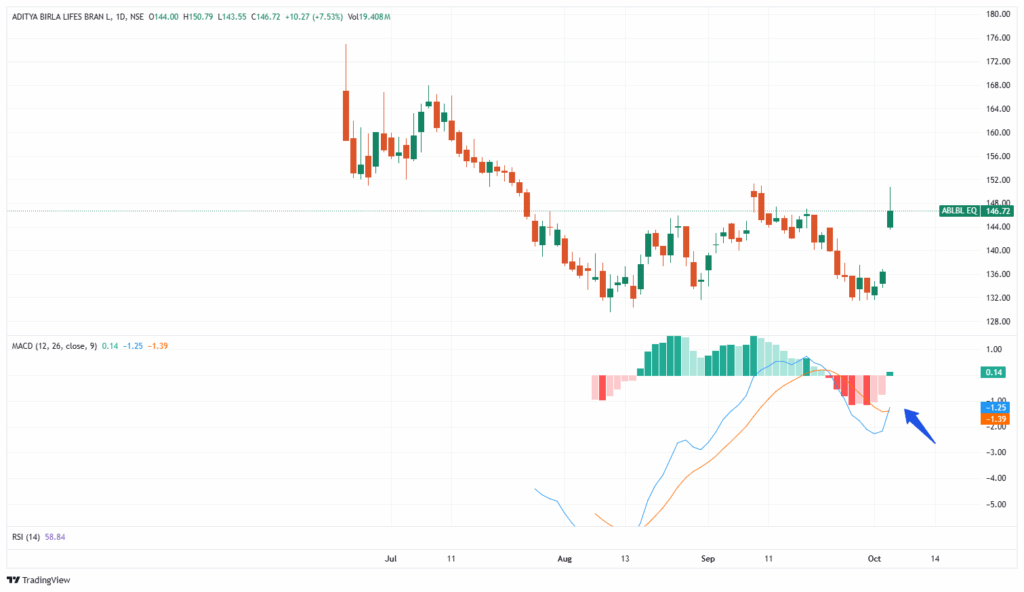

3. Aditya Birla Lifestyle Brands Ltd

Aditya Birla Lifestyle Brands Ltd is a leading Indian company in the premium and lifestyle apparel segment, operating brands like Van Heusen, Allen Solly, and Peter England. It focuses on fashion retail, brand management, and expanding its presence across India through both offline and online channels.

With market capitalization of Rs. 17,816 cr, the shares of Aditya Birla Lifestyle Brands Ltd are closed at Rs. 146.72 per share, from its previous close of Rs. 136.45 per share. Technical analysis shows a bullish MACD signal, pointing to increasing momentum and a potential entry point for traders.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.