Synopsis:

Three stocks of the IT, Chemical, and Electrical sectors are trading at RSI levels under 30, suggesting they are oversold. This technical indicator could attract short-term traders looking for rebound opportunities.

Several stocks are showing oversold signals with their Relative Strength Index (RSI) below 30, indicating potential buying opportunities. Notable names include Happiest Minds Technologies, Alkyl Amines Chemicals, and Crompton Greaves Consumer Electricals.

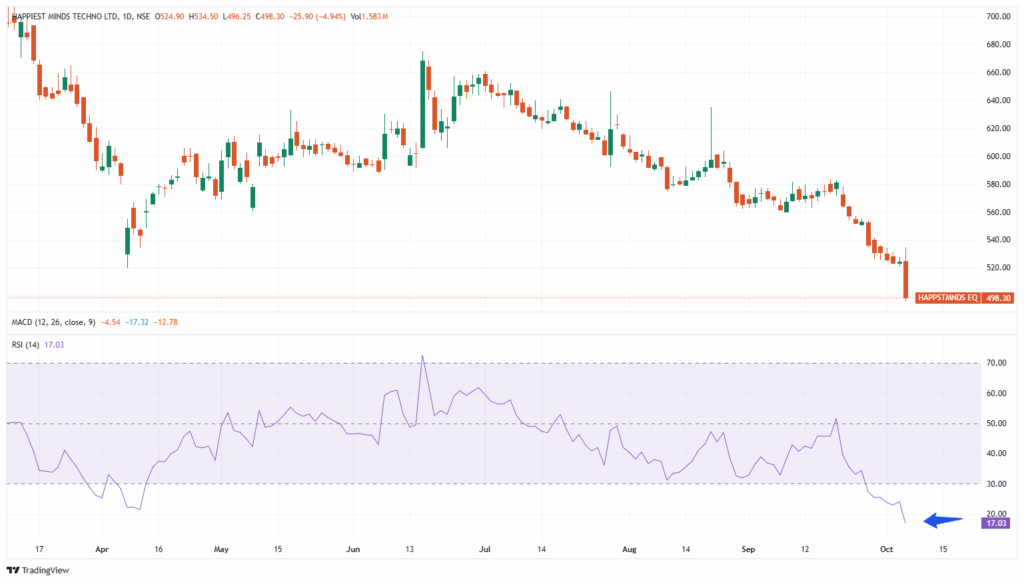

Happiest Minds Technologies Ltd

Happiest Minds Technologies Ltd is an Indian IT services company specializing in digital transformation, cloud computing, cybersecurity, data analytics, and artificial intelligence solutions. Known for its agile approach and innovative services, the company serves clients across sectors such as BFSI, retail, manufacturing, and technology, helping them modernize IT infrastructure, enhance customer experiences, and drive business growth.

With market capitalization of Rs. 7,603 cr, the shares of Happiest Minds Technologies Ltd are closed at 498.30 per share, decreasing 5% in today’s market session making a low of Rs. 496.25 per share, from its previous close of Rs. 542.20 per share. The current RSI of 17.03 suggests the stock is technically oversold and could be on investors radar for a potential rebound if buying momentum picks up.

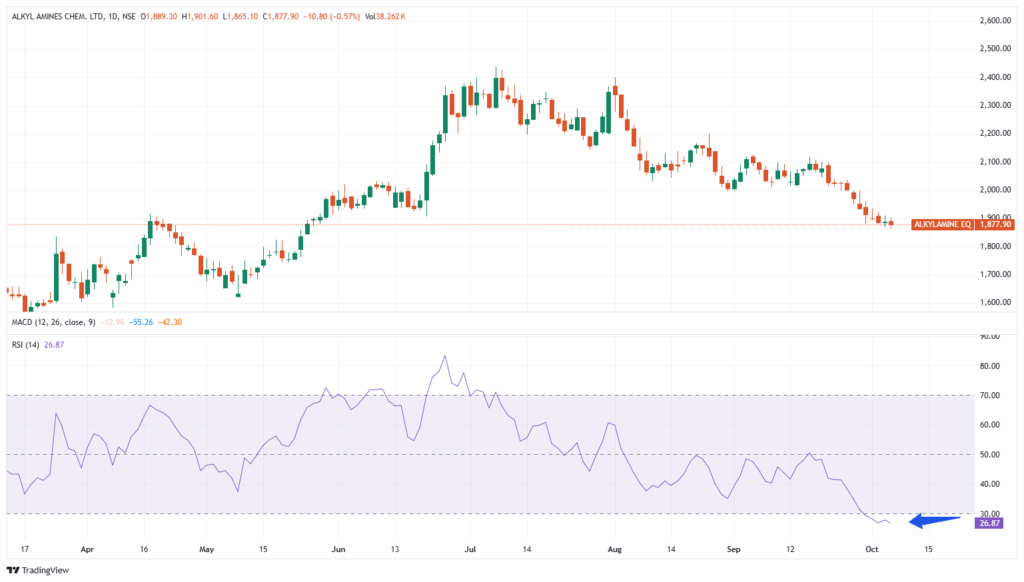

Alkyl Amines Chemicals Ltd

Alkyl Amines Chemicals Ltd is a leading Indian specialty chemicals company, primarily engaged in the manufacture of aliphatic amines, derivatives, and other specialty chemicals used in pharmaceuticals, agrochemicals, and water treatment industries. Known for its strong research and development capabilities, the company exports to multiple countries, maintaining a robust global presence and consistent growth in both domestic and international markets.

With market capitalization of Rs. 9,591 cr, the shares of Alkyl Amines Chemicals Ltd closed at 1,877.90 per share, from its previous close of Rs. 1,888.70 per share. The current RSI of 26.87 suggests the stock is technically oversold and could be on investors radar for a potential rebound if buying momentum picks up.

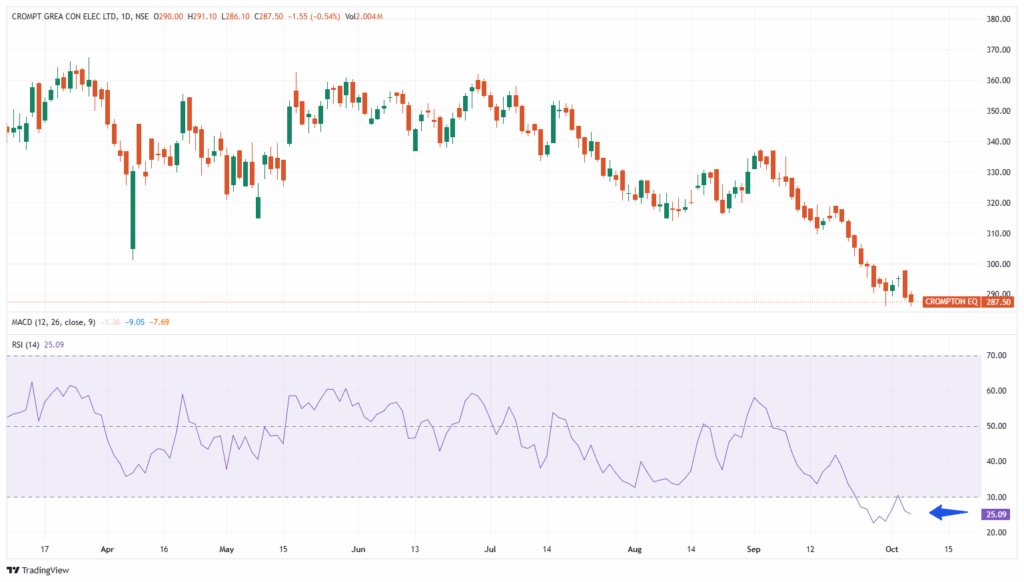

Crompton Greaves Consumer Electricals Ltd

Crompton Greaves Consumer Electricals Ltd is a prominent Indian company specializing in consumer electrical products such as fans, pumps, lighting solutions, and household appliances. With a strong distribution network and focus on innovation and energy-efficient products, the company caters to urban and rural markets, maintaining a reputation for quality, reliability, and sustainable growth in the consumer electrical segment.

With market capitalization of Rs. 18,506 cr, the shares of Crompton Greaves Consumer Electricals Ltd are closed at 287.50 per share, from its previous close of Rs. 289.05 per share. The current RSI of 25.09 suggests the stock is technically oversold and could be on investors radar for a potential rebound if buying momentum picks up.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.