Synopsis:

These stocks are showing a MACD bullish crossover indicating a potential upward trend, as the short-term moving average crosses above the long-term moving average, signaling growing positive momentum in the stock price.

This technical pattern often attracts investor attention, suggesting increasing buying interest and potential price appreciation. Traders and investors view such crossovers as a signal to consider entry points in technically strong stocks.

KFin Technologies Ltd

KFin Technologies Ltd is a leading provider of financial and investor services in India, offering solutions such as mutual fund transfer agency, registrar services, and fintech-enabled platforms. Known for its robust technology infrastructure and strong client base, the company supports seamless financial operations for asset managers, corporates, and investors, reflecting steady growth and operational efficiency.

With market capitalization of Rs. 19,708 cr, the shares of KFin Technologies Ltd are closed at Rs. 1,143.80 per share, from the previous close of Rs. 1,072.50 per share.

The stock has recorded a bullish MACD crossover, suggesting upward momentum, a potential short-term price rise, and a favorable buying opportunity.

Just Dial Ltd

Just Dial Ltd is a prominent Indian digital services company that provides local search, business listings, and online advertising solutions. Leveraging technology and a vast database, it connects consumers with service providers across sectors, demonstrating consistent revenue growth and strong market presence.

With market capitalization of Rs. 7,311 cr, the shares of Just Dial Ltd are closed at Rs. 861.50 per share, from its previous close of Rs. 832.45 per share.

The stock has recorded a bullish MACD crossover, suggesting upward momentum, a potential short-term price rise, and a favorable buying opportunity.

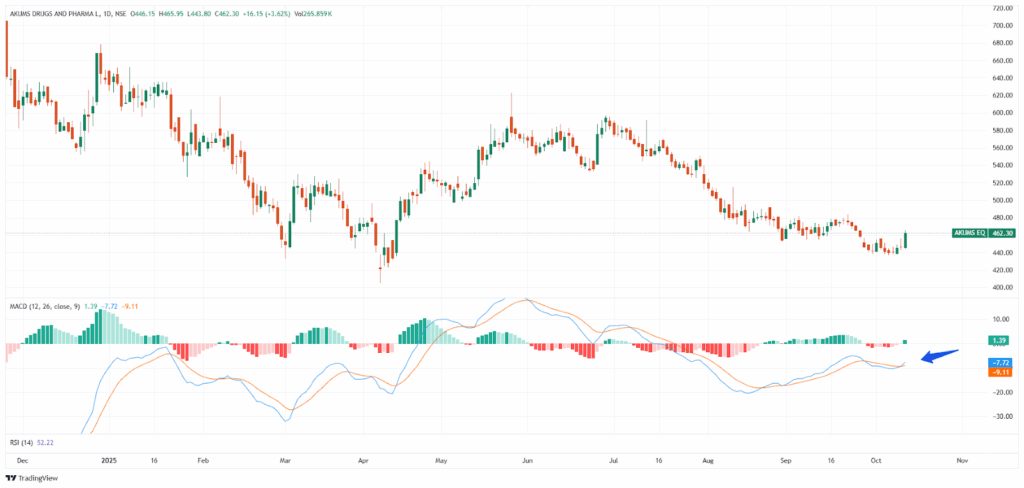

Akums Drugs & Pharmaceuticals Ltd

Akums Drugs & Pharmaceuticals Ltd is an Indian pharmaceutical company specializing in the manufacture of formulations, injectables, and contract manufacturing services. Known for its wide product portfolio and strong manufacturing capabilities, the company demonstrates consistent growth and operational efficiency in the domestic and export markets.

With market capitalization of Rs. 7,297 cr, the shares of Akums Drugs & Pharmaceuticals Ltd are closed at Rs. 462.30 per share, from its previous close of Rs. 446.15 per share.

The stock has recorded a bullish MACD crossover, suggesting upward momentum, a potential short-term price rise, and a favorable buying opportunity.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.