Synopsis: These stocks with RSI below 30 indicate weak short-term momentum, often reflecting recent price declines or market pessimism. For patient investors, such stocks might present a buying opportunity.

The Relative Strength Index (RSI) is a popular technical indicator used by traders to measure a stock’s momentum. It helps identify whether a stock is overbought or oversold. An RSI value below 30 typically suggests that the stock has been sold heavily and may be oversold, meaning it could be undervalued or nearing a potential rebound if market conditions improve.

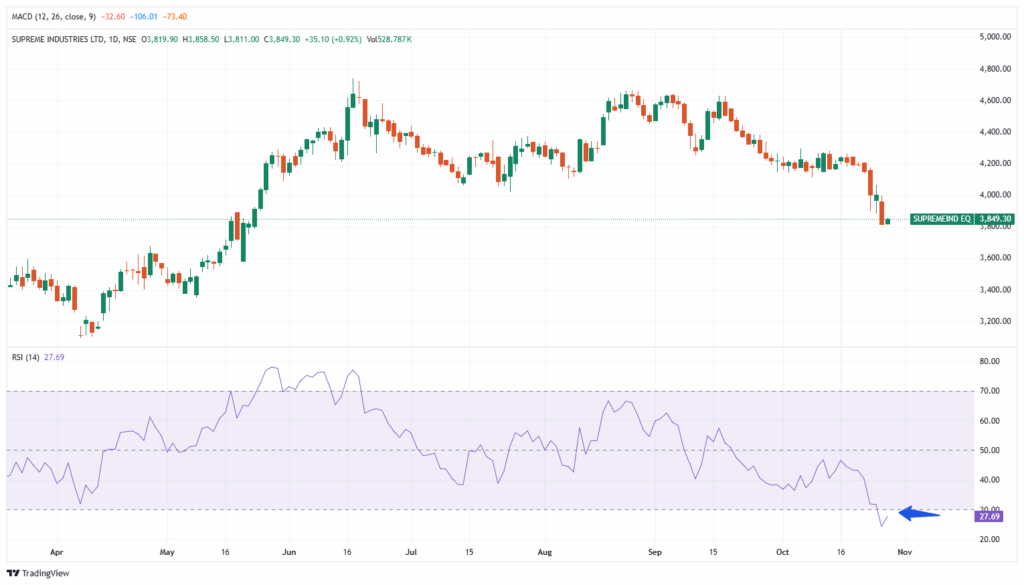

Supreme Industries Ltd

Supreme Industries Ltd is one of India’s largest plastic processing companies, manufacturing a wide range of plastic products including pipes, packaging, consumer goods, and industrial components. With strong brand recognition and a pan-India distribution network, the company serves construction, agriculture, and industrial sectors. Its consistent innovation, diversified product portfolio, and focus on value-added products have helped it maintain leadership in the domestic plastic industry.

With market capitalization of Rs. 48,818 cr, the shares of Supreme Industries Ltd are closed at Rs. 3,849.30 per share, from its previous close of Rs. 3,814.20 per share. With an RSI of 27.69, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

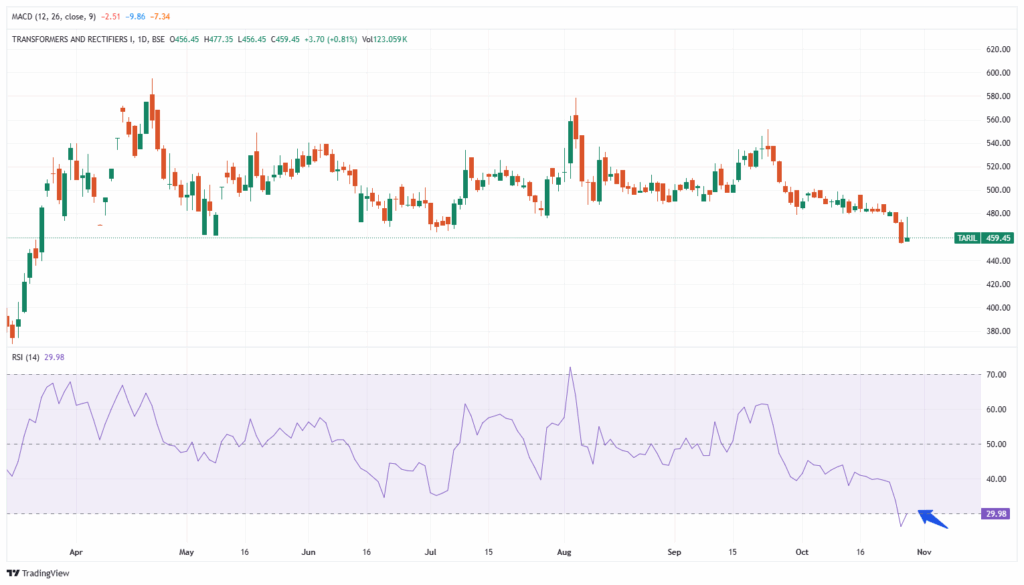

Transformers and Rectifiers (India) Ltd

Transformers and Rectifiers (India) Ltd is a key player in the power equipment industry, specializing in the design, manufacture, and supply of transformers for utilities, industrial, and infrastructure applications. The company produces a wide range of transformers including power, distribution, furnace, and rectifier types. With growing demand from renewable energy and transmission projects, it continues to benefit from India’s increasing power sector investments.

With market capitalization of Rs. 13,791 cr, the shares of Transformers and Rectifiers (India) Ltd are closed at Rs. 459.45 per share, from its previous close of Rs. 455.75 per share. With an RSI of 29.98, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

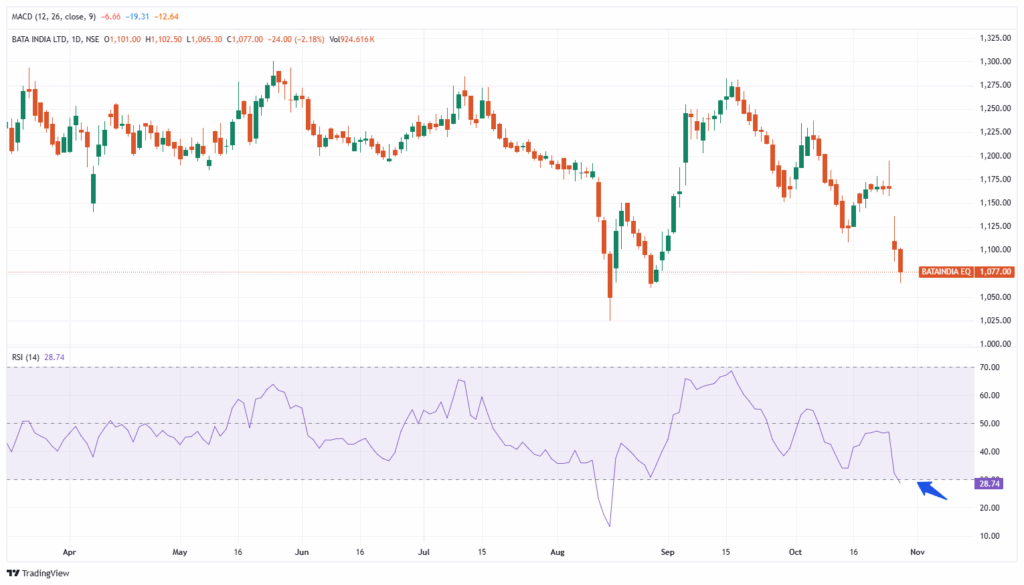

Bata India Ltd

Bata India Ltd is one of the country’s leading footwear manufacturers and retailers, known for its wide range of stylish and affordable shoes across formal, casual, and sports categories. With a vast retail presence and strong brand legacy, Bata caters to both urban and semi-urban markets. The company has been focusing on premiumization, digital sales channels, and youth-oriented product lines to drive growth amid rising competition in the footwear segment.

With market capitalization of Rs. 13,847 cr, the shares of Bata India Ltd are closed at Rs. 1,077 per share, from its previous close of Rs. 1,101 per share. With an RSI of 28.74, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

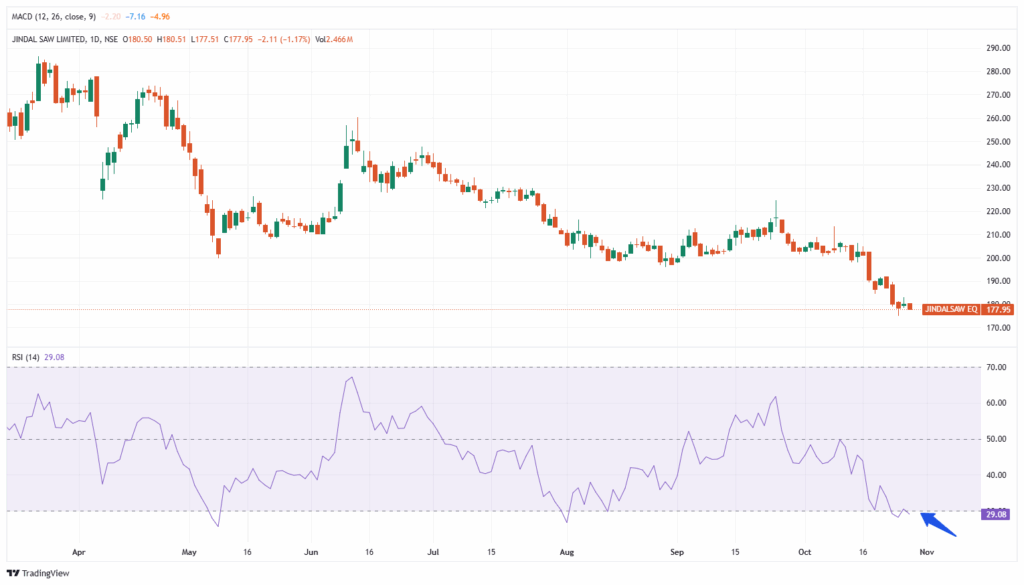

Jindal Saw Ltd

Jindal Saw Ltd is a leading manufacturer of steel pipes and tubes, supplying products used in the energy, water, and infrastructure sectors. The company produces a diverse range, including large diameter submerged arc welded (SAW) pipes, ductile iron pipes, and seamless tubes. With a strong export presence and participation in major pipeline and water distribution projects, Jindal Saw plays a vital role in India’s infrastructure and industrial development.

With market capitalization of Rs. 11,383 cr, the shares of Jindal Saw Ltd are closed at Rs. 178 per share, from its previous close of Rs. 179.90 per share. With an RSI of 29.34, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.