Synopsis:

These stocks with RSI below 30 indicate weak short-term momentum, often reflecting recent price declines or market pessimism. For patient investors, such stocks might present a buying opportunity.

Stocks trading with an RSI (Relative Strength Index) below 30 are generally considered to be in oversold territory, indicating that they may have experienced significant recent selling pressure. This can sometimes signal a potential buying opportunity, as the stock might be undervalued or due for a short-term rebound.

Several stocks across the infrastructure, FMCG, footwear, and cement sectors are trading with RSI below 30, indicating oversold conditions potentially signaling rebound opportunities.

Reliance Infrastructure Ltd

Reliance Infrastructure Ltd is a major Indian infrastructure and utilities company, active across the full power value chain generation, transmission, and distribution as well as roads, metro rail, and urban infrastructure projects. With operations in key metros such as Mumbai and Delhi, of road projects and runs metro rail services under build‑own‑operate models.

With market capitalization of Rs. 7,520 cr, the shares of Reliance Infrastructure Ltd are closed at Rs. 184.05 per share, from its previous close of Rs. 193.70 per share. With an RSI of 22.68, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

Gillette India Ltd

Gillette India, incorporated in 1984 and headquartered in Mumbai, manufactures and sells grooming and oral‑care products in India under brands such as Mach3, Venus, and Fusion5. It markets through extensive distribution channels including mass merchandisers and drug stores, and is part of the global Procter & Gamble group.

With market capitalization of Rs. 28,350 cr, the shares of Gillette India Ltd are closed at Rs. 8,700.50 per share, from its previous close of Rs. 8,704.40 per share. With an RSI of 23.23, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

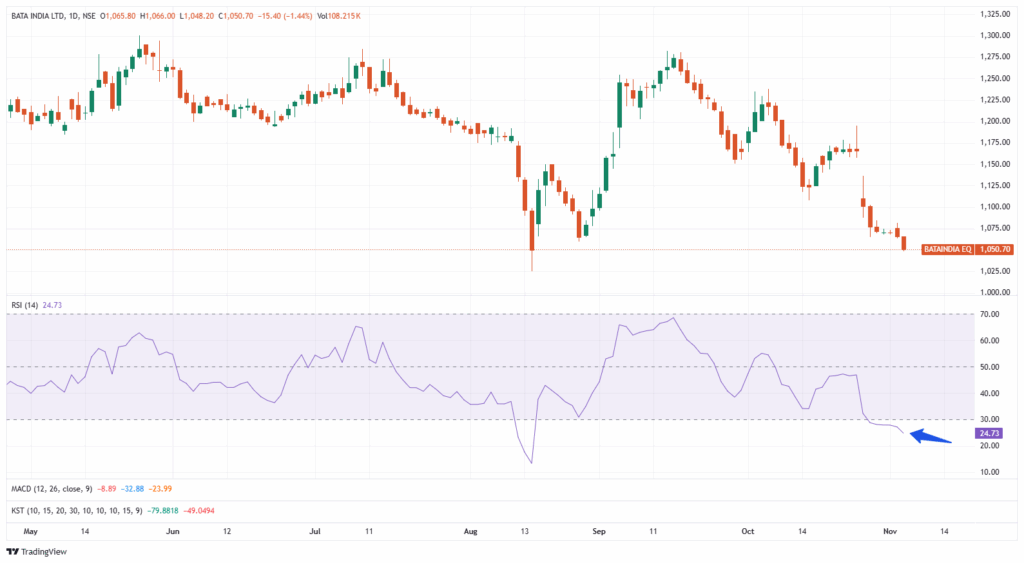

Bata India Ltd

Bata India, established in 1931 and headquartered in Kolkata, is the largest footwear retailer and a major manufacturer in India, with a strong pan‑India network of over 1,900 outlets and production units across multiple states. Its product range covers men’s, women’s, and kids’ footwear and accessories under several brands including Bata, Hush Puppies, North Star, and Power.

With market capitalization of Rs. 13,517 cr, the shares of Bata India Ltd are closed at Rs. 1,051.75 per share, from its previous close of Rs. 1,067.25 per share. With an RSI of 24.76, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

Shree Cement Ltd

Shree Cement, founded in 1979 and headquartered in Kolkata, is among India’s top three cement producers by capacity. It manufactures OPC, PPC, slag, and composite cements and has also forayed into ready‑mix concrete, while emphasizing sustainability and integrated operations, including power generation for captive use.

With market capitalization of Rs. 98,959 cr, the shares of Shree Cement Ltd are closed at Rs. 27,427.15 per share, from its previous close of Rs. 27,608.15 per share. With an RSI of 29.05, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

JK Cement Ltd

JK Cement, part of the JK Organisation, is a prominent cement company in India active in both grey and white cement segments. With an installed grey‑cement capacity of over 25 million tons per annum and white‑cement capacity exceeding 1 million tons, JK Cement supplies domestic markets and exports to over 36 countries.

With market capitalization of Rs. 44,048 cr, the shares of JK Cement Ltd are closed at Rs. 5,702 per share, from its previous close of Rs. 5,776.65 per share. With an RSI of 24.92, the stock is currently in oversold territory and could draw investor interest for a potential rebound if buying momentum picks up.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.