Synopsis:

CWD Limited, a technology firm making smart wireless devices, announced a bonus share plan to reward shareholders after strong revenue and profit growth in recent quarters.

The company, known for its operations in the technology and digital solutions space, has caught investor attention after its board proposed a bonus share issue for equity shareholders. The announcement has sparked optimism in the market, leading to a sharp 5 percent rise in the stock ahead of shareholder approval.

CWD Limited‘s stock, with a market capitalisation of Rs. 755.91 crores, rose to Rs. 1,731.45, hitting the intraday upper circuit, up 5 percent from its previous closing price of Rs. 1,649. Furthermore, the stock over the past year has given a return of 111 percent.

Bonus Announcement

The company plans to increase its authorised share capital from Rs. 10 crore to Rs. 35 crore by raising the number of equity shares from one crore to three crore fifty lakh, all at Rs. 10 each. This proposal comes with changes to the capital clause in the Memorandum of Association and will need shareholders approval.

Additionally, the company aims to recommend and approve a bonus issue for its equity shareholders, subject to necessary approvals. For example, in a 1:1 bonus issue, every shareholder receives one additional share for each share held if someone owns 100 shares, they then get 100 extra shares for free. This rewards long-term shareholders, increases the number of shares in the market, and can make shares more affordable without costing the shareholder anything extra.

H1 FY25 Financial Highlights

The company reported strong revenue growth in H2FY25, rising 71% year-on-year to Rs. 26.34 crore from Rs. 15.41 crore in H2FY24 and surging 278% compared to Rs. 6.97 crore in H1FY25. This indicates sharp recovery momentum amid improving demand and better operating performance. Over the past three years, sales have grown at a 30% CAGR, showcasing consistent top-line expansion.

Profit also improved significantly to Rs. 4.33 crore in H2FY25 from Rs. 3.66 crore in H2FY24, marking an 18% YoY rise, while turning around from a loss of Rs. 1.83 crore in H1FY25. Despite a 3-year profit CAGR of -7%, the company’s earnings rebound and 3-year ROE CAGR of 6% reflect improving profitability and strengthening financial efficiency.

About The Company

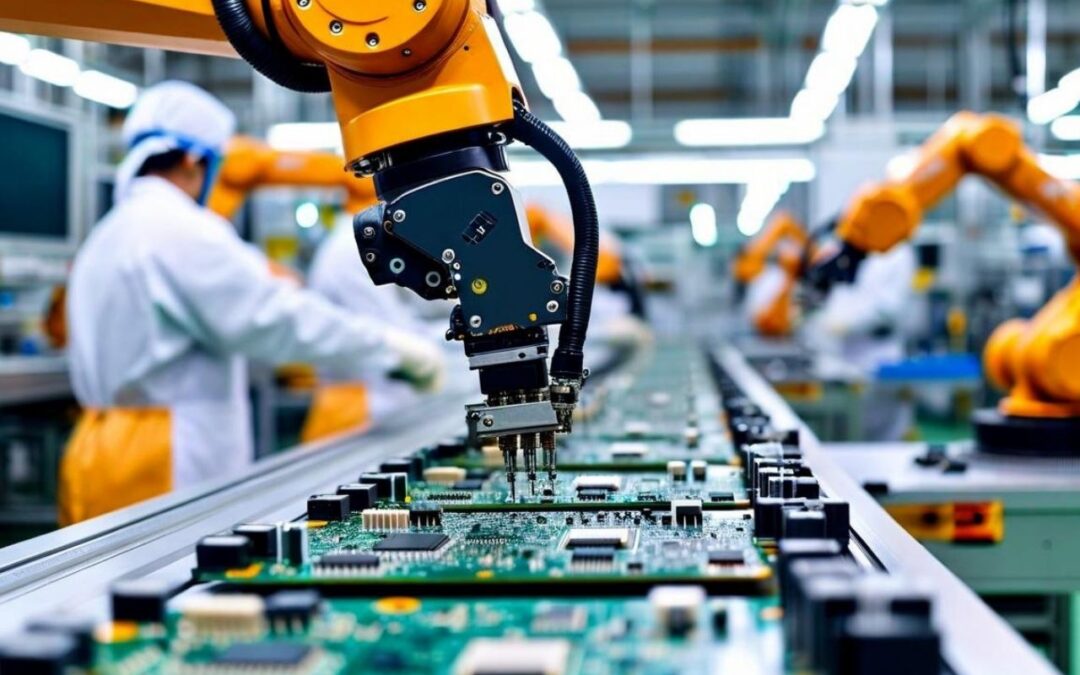

CWD makes wireless devices by designing, building, and selling smart electronics with software. It uses short-range tech like Bluetooth and WiFi, mid-range like LoRa, and long-range like 5G. The company serves consumers and businesses with products such as medical trackers, cattle monitors, smart meters, employee safety tools, and energy-saving lights.

Written By Fazal Ul Vahab C H

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.