Synopsis:

Several key stocks across the real estate, renewable energy, and pharmaceutical sectors are currently showing bearish signals on the MACD, indicating weakening momentum and potential short-term downtrends.

MACD (Moving Average Convergence Divergence) is a widely used technical indicator that tracks momentum and trend direction in the stock market. A bearish MACD signal, occurring when the MACD line crosses below the signal line, indicates weakening price momentum and potential downward movement in sectors like real estate, renewable energy, and pharmaceuticals.

Brigade Enterprises Ltd

Brigade Enterprises is a prominent Indian real estate developer headquartered in Bengaluru, with over three decades of experience. The company develops residential, commercial, retail, and hospitality projects, focusing on innovative and sustainable urban spaces.

With market capitalization of Rs. 23,974 cr, the shares of Brigade Enterprises Ltd are closed at Rs. 978.80 per share, from its previous close of Rs. 978.25 per share.

NTPC Green Energy Ltd

A wholly-owned subsidiary of NTPC Limited, NTPC Green Energy Ltd focuses on renewable energy development, including solar, wind, and hybrid projects. The company plays a key role in India’s green energy transition and aims to achieve large-scale renewable power capacity. It also collaborates with international partners to implement sustainable energy solutions.

With market capitalization of Rs. 82,578 cr, the shares of NTPC Green Energy Ltd are closed at Rs. 98 per share, from its previous close of Rs. 99 per share.

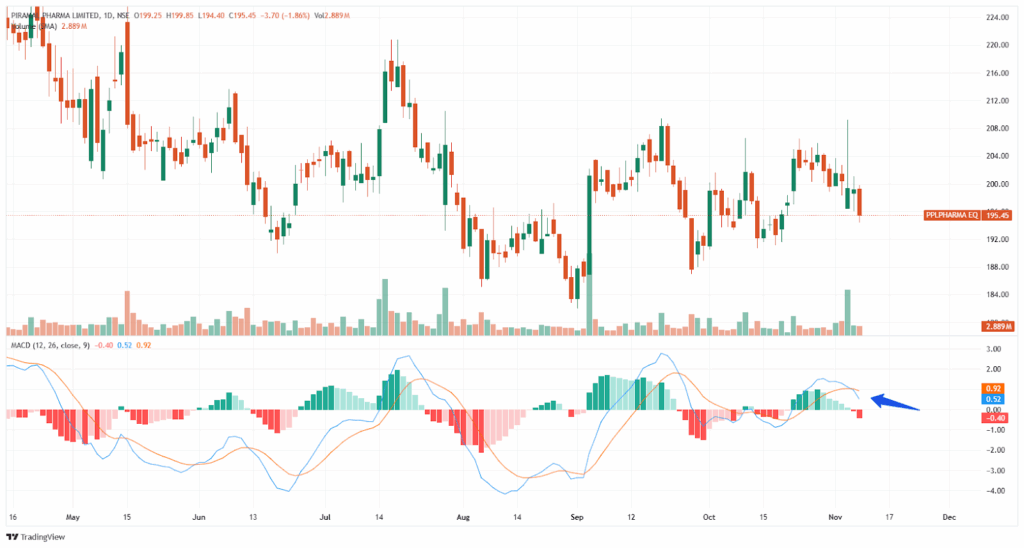

Piramal Pharma Ltd

Piramal Pharma Ltd, part of the Piramal Group, is a global pharmaceutical company engaged in drug discovery, contract development, and manufacturing services. It operates in multiple therapeutic areas and serves both domestic and international markets. The company is recognized for advanced research capabilities, innovative drug delivery systems, and strong regulatory compliance.

With market capitalization of Rs. 25,974 cr, the shares of Piramal Pharma Ltd are closed at Rs. 195.40 per share, from its previous close of Rs. 199 per share.

Inox Wind Ltd

Inox Wind Ltd is a leading Indian wind energy company that manufactures wind turbine generators and provides turnkey solutions for wind power projects. It is part of the diversified Inox Group and contributes significantly to India’s renewable energy capacity. Inox Wind also focuses on technology innovation, sustainability, and reducing the cost of clean energy.

With market capitalization of Rs. 26,209 cr, the shares of Inox Wind Ltd closed at Rs. 151.65 per share, from its previous close of Rs. 149.60 per share.

Adani Green Energy Ltd

Adani Green Energy Ltd is one of India’s largest renewable energy companies, developing and operating large-scale solar and wind power projects across the country. It aims to support India’s net-zero and clean energy goals, with ambitious capacity expansion plans. The company integrates advanced technology, sustainability practices, and strategic partnerships to strengthen its renewable energy portfolio.

With market capitalization of Rs. 1,68,515 cr, the shares of Adani Green Energy Ltd are closed at Rs. 1,038.55 per share, from its previous close of Rs. 1,060.15 per share.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.