Synopsis: The shares of this electrical equipment company were in the spotlight today as the company, in its exchange filing, announced that it has signed an agreement with a Canada-based firm for the development and manufacturing of aircraft engine components.

The shares of this company, which is a manufacturer of aerospace components and turbines and supplies its products to original equipment manufacturers (OEMs) in the aerospace, defence, energy, and oil and gas industries, were in focus today as the company announced its agreement with a Canada-based firm to develop and manufacture aircraft engine components.

With a market cap of around Rs 10,801 crore, the shares of Azad Engineering Ltd gained almost 5% and made a high of Rs 1,717 compared to its previous day closing price of Rs 1,638.05. The shares are trading at a PE of 95.4, whereas its median PE is at 101.7.

About the Agreement.

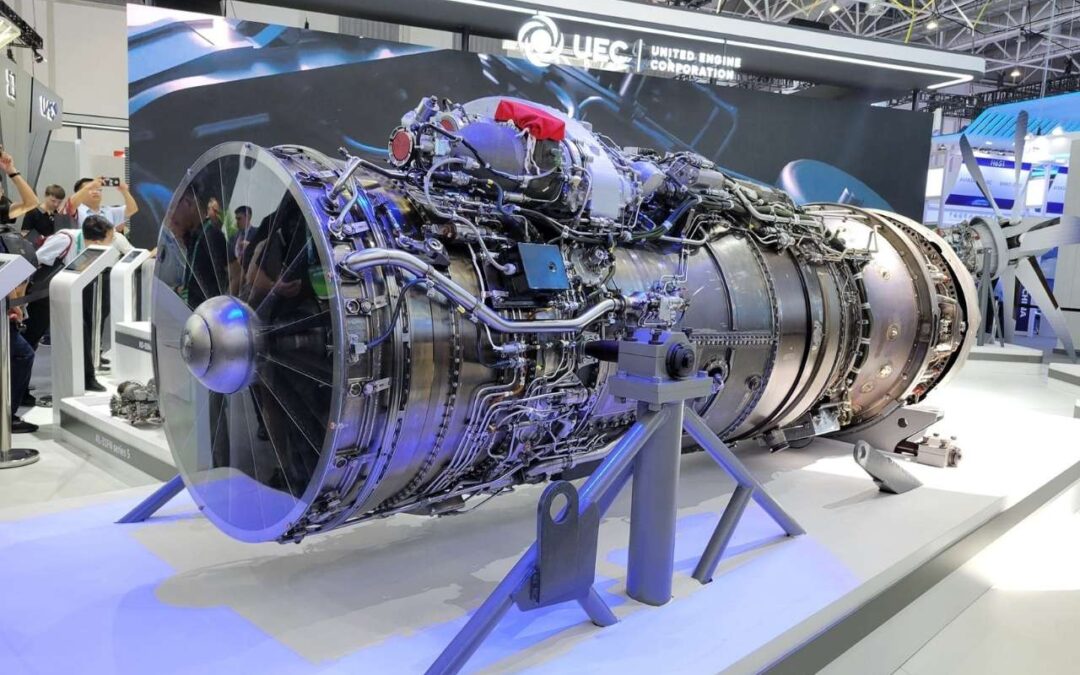

Azad Engineering Ltd has entered into a long-term master terms and purchase agreement with Pratt & Whitney Canada to develop and manufacture aircraft engine components. The partnership sets the stage for a deeper strategic collaboration, giving Azad a stronger foothold in the global aerospace supply chain.

The company sees this as an opportunity to scale its advanced manufacturing expertise and contribute to India’s broader aerospace ambitions, while securing steady business visibility for the years ahead. The size, terms and time period of the contract are not disclosed due to confidentiality reasons.

Also read: 100% Acquisition: Stock jumps 3% after acquiring entire stake worth in Ayoleeza Consultants

Financials and more

The revenue from operation for the company stood at Rs 111 crore in Q2 FY25, which grew to Rs 143 crore in Q2 FY26, increasing by about 29%. Similarly, the net profit also grew by 57% when we compare the Q2 FY25 net profit of Rs 21 crore to Rs 33 crore in Q2 FY26. The stock is trading at an ROCE and ROE of 12.2% and 8.58%, respectively.

Azad Engineering has secured a strong lineup of new and recent orders, deepening its partnerships across both global and domestic aerospace and energy players. In Q2FY26, it added major wins from Mitsubishi for advanced gas turbine components and from Safran through an MoU focused on indigenous aerospace manufacturing.

Over the past months, the company has also signed supply and strategic agreements with respected names such as Arabelle Solutions, BHEL, Baker Hughes, GE Vernova, GTRE, Honeywell Aerospace, Rolls-Royce Plc London, and Siemens Energy Global. These collaborations span highly engineered turbine parts, precision components, assemblies, and critical manufacturing work, reinforcing Azad’s position as a trusted partner for complex, high-value engineering programmes worldwide.

Azad Engineering builds some of the most critical and complex precision components used across aerospace, defence, energy, and oil & gas industries worldwide. Guided by a strong focus on precision and performance, the company has built a reputation for high-quality engineering and reliable delivery. Today, it supplies mission-essential parts to leading global OEMs operating in tightly regulated sectors, serving customers across several countries.

Written by Leon Mendonca.

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.