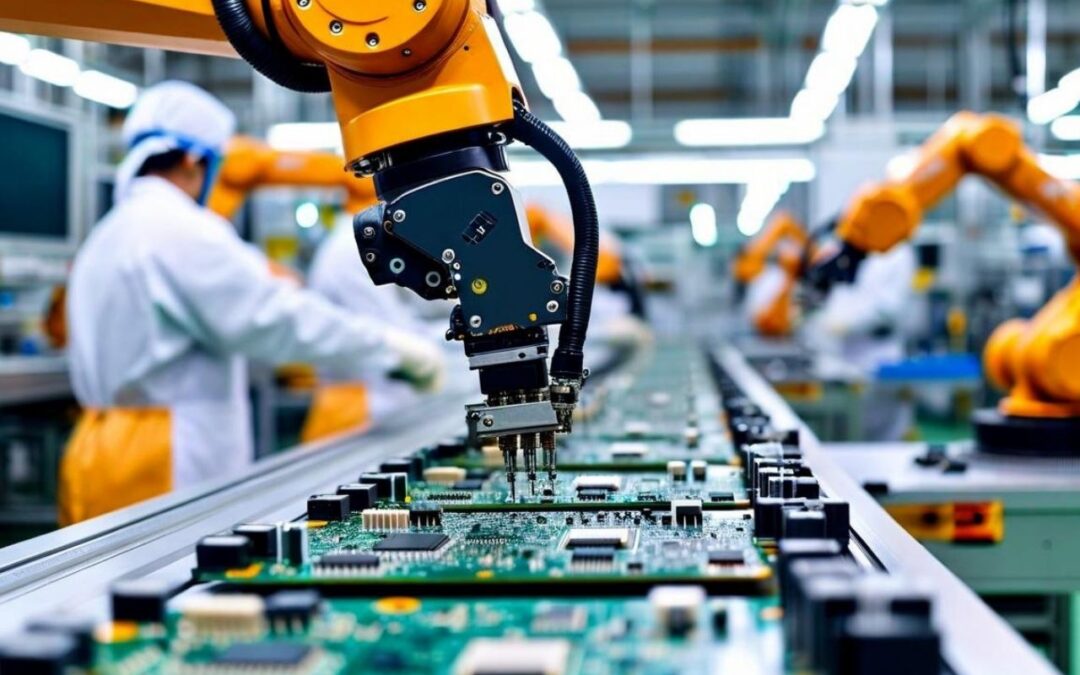

This Small-cap EMS stock, engaged in electronics system design, precision PCB assembly, electromechanical box build manufacturing, and delivering advanced electronic solutions across automotive, medical, industrial, aerospace, and consumer sectors globally, is in focus after management guiding Rs. 250-280 crore in revenue growth for FY26.

With a market capitalization of Rs. 2,027.09 crore, the shares of Aimtron Electronics Limited were currently trading at Rs. 993 per equity share, down nearly 1.94 percent from its previous day’s close price of Rs. 1,012.65.

Management Guidance

Aimtron Electronics Limited has given a strong outlook for FY26, guiding Rs. 250-280 crore in revenue, which represents about 76.10 percent growth over FY25 revenue of Rs. 159 crore. The company expects an EBITDA margin of around 20 percent and a PAT margin of nearly 15 percent, supported by strong demand and capacity expansion.

Key Growth Areas

Aimtron Electronics Limited plans to scale its ODM business, increase its box-build contribution to over 50 percent, and expand deeper into aerospace and defence, backed by its AS9100D certification. Global expansion is another key priority, with growing presence in the U.S. (Texas) and Europe (Germany).

The upcoming new 6-line greenfield plant will further boost production capability. Additionally, the company is actively evaluating 5-6 potential M&A opportunities to accelerate growth across new technologies and customer segments.

Order Book Analysis

Aimtron Electronics Ltd has reported a strong performance in H1 FY26 with a closing order book of Rs. 463.9 crore as of September 30, 2025. The company started the year with Rs. 189 crore, received Rs. 397.4 crore worth of new orders, and executed Rs. 122.6 crore during the first half, showing solid demand for its electronic manufacturing services.

Industry-wise, the order book is well diversified, led by telecom (33.5 percent), power (20.9 percent), and IoT (18.6 percent), followed by industrial, automotive, AI, green energy, and other sectors. Geography-wise, India contributes 77.9 percent, while the USA accounts for 20.7 percent and Spain for 1.5 percent, reflecting a healthy mix of domestic and international customers.

In the segment breakdown, Box Build dominates with 74.5 percent, PCBA contributes 24.5 percent, and ODM holds 1 percent, highlighting Aimtron’s strength in full-system integration and assembly.

Revenue Segment

Aimtron Electronics Limited’s H1 FY26 revenue shows a well-balanced and diversified business mix. Industry-wise, industrial electronics lead with 36.1 percent, followed by IoT & Robotics at 27.7 percent, and telecom & network security at 16.7 percent. The BMS & automotive segment contributes 8 percent, MedTech 7 percent, and others 4.6 percent, showing the company’s wide industry reach.

Geography-wise, India remains the largest market at 64.1 percent, while North America contributes 14.1 percent, the USA 12.9 percent, Spain 4.5 percent, Australia 2.7 percent, and others 1.7 percent, reflecting a healthy global footprint.

Segment-wise, PCBA accounts for 64.1 percent of revenue, making it the company’s core strength, while Box Build forms 34.7 percent, and End-to-End solutions contribute 1.2 percent, showing Aimtron’s growing capabilities in complete system manufacturing.

Global Presence

Aimtron Electronics Limited has a strong global supply chain and sourcing network that spans India, China, the USA, the UK, Hong Kong, Singapore, Taiwan, Ireland, and Thailand, enabling efficient component procurement and faster production turnaround.

Current Capacity & Expansion

Aimtron Electronics Limited is preparing for strong multi-year growth through a major capacity expansion. The company currently has a production capacity of around Rs. 450-500 crore, with each SMT line capable of delivering nearly Rs. 100 crore in annual revenue.

The upcoming 3-acre greenfield facility, which will house six SMT lines, is expected to boost total capacity to about Rs. 1,000 crore once fully scaled. The first SMT line is targeted to be operational by Q3 or early Q4 next year, with the initial two lines coming online first, followed by the remaining four in planned phases.

Company Overview

Aimtron Electronics Limited was incorporated in 2011 and specializes in electronics system design and manufacturing (ESDM), including high-precision printed circuit board assembly (PCBA) and electromechanical box builds.

The company offers end-to-end solutions from PCB design and assembly to complete electronic systems for diverse sectors such as automotive, medical technology, industrial automation, aerospace, defence, consumer electronics, and alternative energy.

Financial Highlights

Coming into financial highlights, Aimtron Electronics Limited’s revenue has increased from Rs. 58 crore in H1 FY25 to Rs. 123 crore in H1 FY26, which has grown by 112.07 percent. The net profit has also grown by 81.82 percent from Rs. 11 crore in H1 FY25 to Rs. 20 crore in H1 FY26.

In terms of return ratios, the company’s ROCE and ROE stand at 29.2 percent and 24.8 percent, respectively. Aimtron Electronics Limited has an earnings per share (EPS) of Rs. 17, and it’s a debt-free company.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.