The Relative Strength Index (RSI) is a technical indicator used to determine whether a stock is overbought or oversold. It ranges from 0 to 100 and reflects the momentum of recent price movements, helping traders assess if a potential price reversal or correction may occur.

When the RSI rises above 70, it signals that a stock may be overbought and could experience a pullback. Conversely, when the RSI falls below 30, it suggests the stock may be oversold and might bounce back. Traders use these RSI levels to identify potential entry and exit points, allowing them to make more informed decisions based on short-term price momentum.

Here are a few Nifty 500 stocks that are trading below the Relative Strength Index (RSI) Level 30

NCC Limited

NCC Limited was founded in 1978 and is a leading construction company in India. It undertakes building, transportation, water, electrical, irrigation, and railway infrastructure projects, delivering high-quality turnkey EPC solutions across the country with a strong pan-India presence.

With a market capitalization of Rs. 11,031.26 crores on Friday, the stock closed at Rs. 175.70, with an RSI of 20.14, indicating that it is in the oversold zone, offering the potential for an upside bounce.

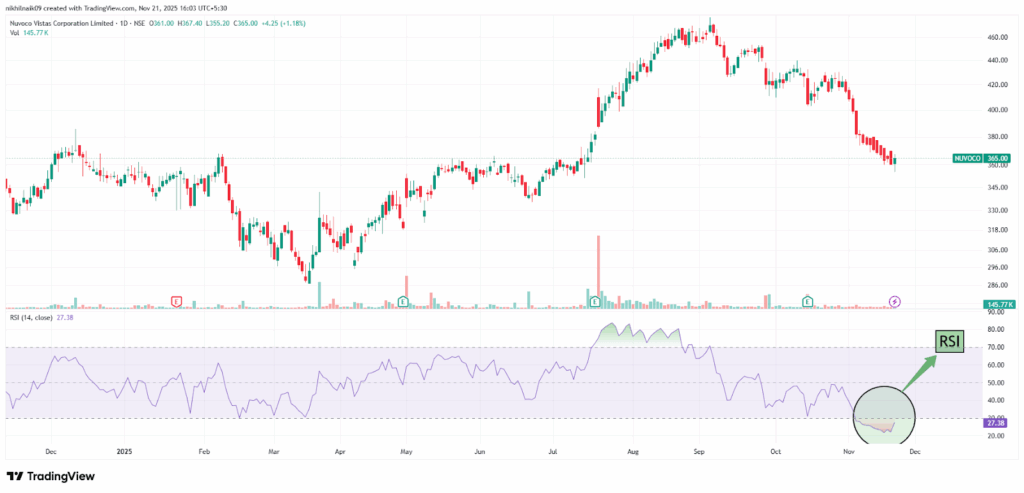

Nuvoco Vistas Corporation Limited

Nuvoco Vistas Corporation Limited was established in 1999 and is a leading Indian building materials company. It produces cement, ready-mix concrete, and modern building materials, focusing on sustainable solutions for infrastructure and construction with a strong market presence in India.

With a market capitalization of Rs. 13,036.20 crores on Friday, the stock closed at Rs. 365, with an RSI of 27.38, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Saregama India Limited

Saregama India Limited was founded in 1901 and is India’s oldest music label and entertainment company. It operates in music, artist management, video content, and live events, owning a vast catalog of songs and producing multi-language digital content across India.

With a market capitalization of Rs. 7,261.21 crores on Friday, the stock closed at Rs. 376.60, with an RSI of 18.83, indicating that it is in the oversold zone, offering the potential for an upside bounce.

KSB Limited

KSB Limited was founded in 1871 and is a global player in pumps, valves, and related systems. The company supplies products for water, energy, industry, and building services sectors with manufacturing and service presence worldwide.

With a market capitalization of Rs. 12,435.97 crores on Friday, the stock closed at Rs. 714.55, with an RSI of 21.80, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Bata India Limited

Bata India Limited was established in 1931 and is a leading footwear manufacturer and retailer in India. It offers a wide range of shoes for men, women, and children through its expansive retail network across the country.

With a market capitalization of Rs. 12,839.90 crores on Friday, the stock closed at Rs. 999, with an RSI of 22.02, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.