Synopsis: HEG Ltd’s promoter boosted their stake by 6.74 lakh shares (0.35% of equity) on November 25, signaling strong confidence in the company’s growth prospects and reinforcing positive market sentiment about its future performance.

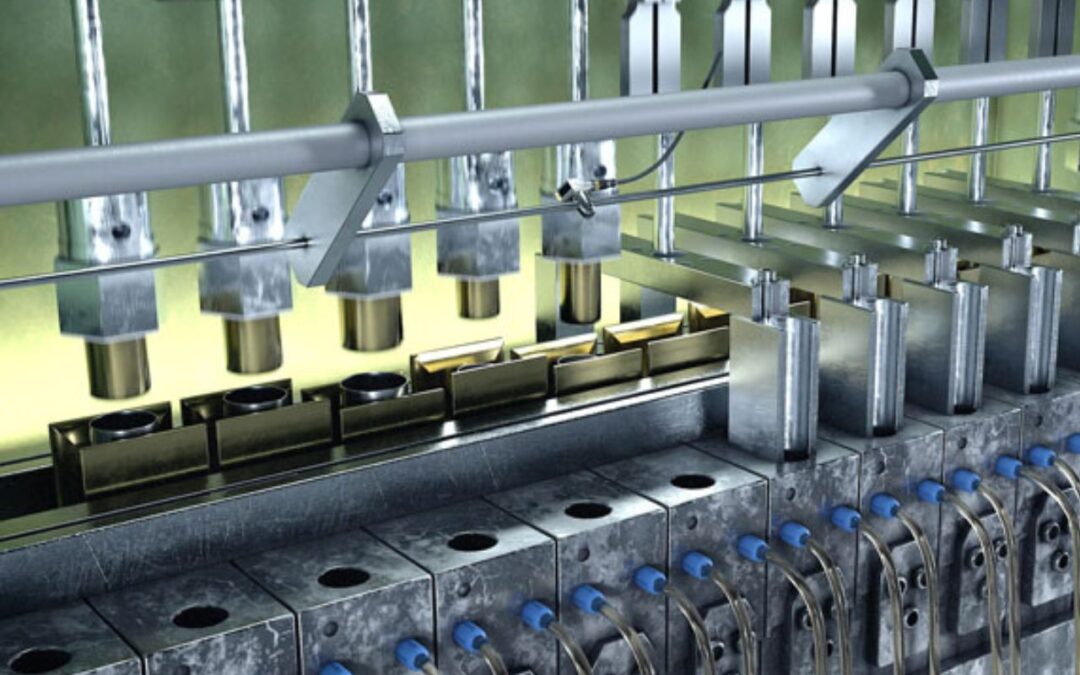

This company is a leading manufacturer and exporter of graphite electrodes in India. It operates the largest single-site integrated graphite electrodes plant in the world and is now in the focus after its promoter increased stake in the company.

With market capitalization of Rs. 10,309 cr, the shares of HEG Ltd are currently trading at Rs. 534 per share, increasing nearly 2% in today’s market session making a high of Rs. 535.50, from its previous close of Rs. 526 per share.

Over the past five years, the stock increased by 232%. In the past year, it grew by 30%, while the past six months saw a 9.5% rise. Most recently, over the past month, the growth was 2%.

News

Promoter of HEG Ltd have recently increased their stake in the company by acquiring 6.74 lakh equity shares, which represents 0.35% of the total equity. This transaction took place on November 25, reflecting the promoter group’s confidence in the company’s prospects. Such an increase in promoter holding is often viewed positively by the market, as it signals strong faith in the company’s future growth potential.

About the company

HEG Ltd is a leading Indian company specializing in the production of graphite electrodes, primarily used in electric-arc-furnace (EAF) steelmaking.Graphite products account for around 80 % of HEG’s revenue. The company exports a significant portion over 70 % of its electrodes to more than 30 countries, giving it a strong global presenceIn addition to graphite electrodes, HEG runs captive power-generation facilities (around 77 MW) to support its manufacturing operations.

The company reports a ROCE of 3.96% and an ROE of 2.59%. Its debt-to-equity ratio stands at 0.14. The stock is trading at a P/E of 39.9, close to the industry P/E of 40.0. Additionally, the company has consistently maintained a healthy dividend payout of 29.6%.

HEG’s latest quarterly performance shows strong year-on-year growth, with sales rising 23% to ₹699 crore and EBITDA also up 23% to ₹118 crore. Net profit surged 74% to ₹143 crore, while EPS similarly increased 74% to ₹7.43.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.