Synopsis:

Alphabet Inc., Google’s parent company, leads the AI race with Gemini 3, boosting its stock 90% in 2025 by integrating AI across search, cloud, and ads, and leveraging proprietary hardware for efficiency and growth.

Google’s parent company, Alphabet, is swiftly pulling ahead in the artificial intelligence (AI) race, outperforming its technological rivals known as the Magnificent 7. Despite skepticism from many technologists who favored newer players like OpenAI and Microsoft, Alphabet’s stock has surged impressively, revealing that investors believe it leads the future of AI innovation. Its latest AI model, Gemini 3, unveiled in November 2025, has beaten competitors like ChatGPT in benchmark tests, demonstrating a leap in AI capability.

Alphabet’s Dominance

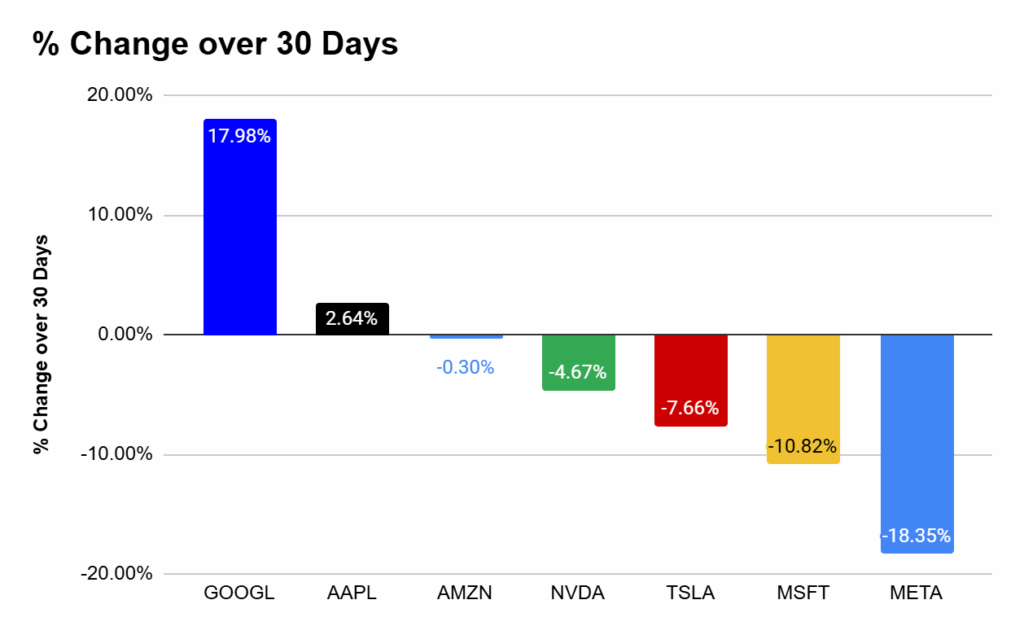

Alphabet’s stock has soared by about 90% over the past year, decisively outpacing the 34% gains seen by Nvidia (NASDAQ:NVDA) and performing better than all members of the Magnificent 7 group.

Since September 2025, the stock jump of 49% contrasts sharply with losses from other tech giants in recent months, highlighting investor confidence in Alphabet’s AI strategy. This powerful rally is remarkable given a challenging market environment for tech stocks, with many peers faltering or showing modest growth. Such performance shows Alphabet’s increasing market capitalization, nearing $4 trillion, making it one of the most valuable companies globally.

Gemini 3

Launched on November 18, 2025, Gemini 3 marks a milestone as Alphabet’s most advanced AI model. It integrates multimodal intelligence, excelling in tasks involving text, images, video, audio, and coding.

Independent tests reveal Gemini 3’s superior reasoning and problem-solving compared to rivals. Moreover, the AI model powers innovative tools like the Nano Banana Pro image generator, known for its speed and professional-quality outputs. This new AI infrastructure is built on proprietary hardware, increasing efficiency and reducing reliance on other chip manufacturers, adding to Alphabet’s competitive advantage.

Monetization and Market Reach

Unlike newer AI companies still figuring out their business models, Alphabet capitalizes on a massive user base and established revenue streams. Its AI products are integrated seamlessly into popular services like Google Search, YouTube, and Google Docs.

Google Cloud, powered by AI, reported 34% year-over-year revenue growth in Q3 2025, reaching $15 billion. Additionally, Alphabet’s AI chips and cloud services attract major enterprise clients, demonstrating the company’s growing influence beyond consumer apps. These factors contribute to solid financial results, with earnings rising steadily alongside AI-driven innovation.

Investor Confidence and Market Outlook

Wall Street’s bullish sentiment is evident as major investors, including Berkshire Hathaway, have increased stakes in Alphabet, signaling faith in its long-term AI growth prospects. The company’s valuation remains attractive, trading at a forward price-to-earnings ratio lower than peers like Nvidia. Analysts have raised Alphabet’s price targets, expecting continued stock appreciation.

Risks remain, such as regulatory scrutiny and market volatility, but Alphabet’s integrated AI ecosystem positions it to maintain leadership. For retail investors using tools like stock screeners show that Alphabet emerges as a standout among the Magnificent 7 for its AI prowess and financial strength.

Source: Google Finance

Alphabet’s rise in the AI space reminds us that the race is not always won by the newest entrants but often by those who combine innovation with execution and monetization.

Google’s AI journey, fueled by Gemini 3, clearly shows the power of leveraging existing strengths while pushing technological boundaries further. For investors and tech watchers alike, Alphabet’s story is a compelling example of how effective strategy beats hype in the critical race towards AI dominance.

Written By Fazal Ul Vahab C H

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.