During Thursday’s trading session, shares of a leading automotive components manufacturer moved up by nearly 17 percent on BSE, after securing a landmark Rs. 300 crores orders from Stellantis North America.

With a market capitalisation of Rs. 468 crores, at 10:31 a.m., the shares of Remsons Industries Limited were trading in the green at Rs. 134.15 on BSE, up by nearly 12 percent, as against its previous closing price of Rs. 119.65. The stock has delivered negative returns of around 32 percent in one year, but gained by over 8 percent in the last one month.

What’s the News

According to the latest regulatory filings on the stock exchanges, Remsons Industries Limited has secured multiple orders worth more than Rs. 300 crores ($35 million) from Stellantis North America. This deal stands to be the single largest business win to date for the company.

Through this collaboration, Remsons will supply critical components for vehicle platforms such as the Jeep Wrangler and RAM, strengthening its position as a global automotive leader. Additionally, the company will supply products for the Smart car and 3-Wheeler platforms to Stellantis Europe. The order is expected to be executed within 7 years.

This agreement marks a major milestone in Remsons’ international expansion and underscores its strong commitment to excellence, innovation, and customer satisfaction. It further solidifies the company’s global footprint and unlocks enhanced opportunities in North America and beyond.

Previous Updates

9th April: Remsons Industries announced the acquisition of Astro Motors Private Limited, a 3-wheeler EV manufacturing company. Astro Motors is engaged in the business of developing and manufacturing electric vehicles (EVs) for cargo, loaders, passengers and micro mobility.

Remsons Industries acquired a 51.01 percent stake in Astro Motors for Rs. 14.22 crores, in a mix of Rs. 4.22 crores equity issued on a preferential basis and Rs. 10 crores in cash.

Financial Performance

Remsons Industries reported a significant growth in its revenue from operations, showing a year-on-year rise of around 25 percent from Rs. 82.22 crores in Q3 FY24 to Rs. 102.6 crores in Q3 FY25. Similarly, its net profit increased during the same period from Rs. 3.4 crores to Rs. 4.7 crores, representing a growth of around 38 percent YoY.

About the Company

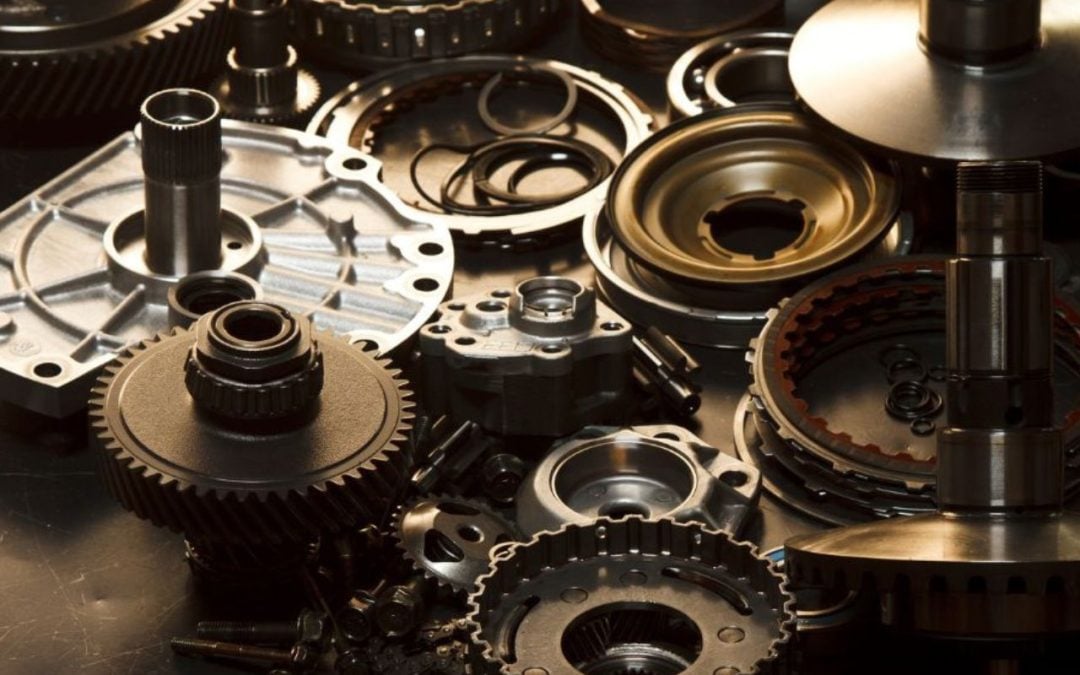

Remsons Industries Limited, an automotive OEM components manufacturer, specialises in producing automotive control cables, flexible shafts, push-pull cables and gear shifter assembly, supplying to two, three, and four-wheeler vehicles, commercial vehicles, and off-highway vehicles across India and automotive OEMs globally.

Remsons operates manufacturing facilities in Gurgaon, Pune, Pardi and Daman in India, and also Stourport & Redditch in England (UK). Its expertise spans a wide range of high-quality auto components, including Control Cables, Gear Shifters, Pedal Boxes, Winches, lighting, sensors, to many OEMS within and outside India.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.