The shares of the Micro-cap company, specializing in manufacturing auto components like auto control cables, Flexible shafts, Gear shift systems, push pull cables, and parking brake mechanism, jumped upto 6 percent after management provided guidance to increase revenue by 3x over the next 3 years from Rs. 376.6 Crores to ~Rs. 1,000 Crores

With a market capitalization of Rs. 502.95 Crores on Wednesday, the shares of Remsons Industries Ltd rose by 6 percent after making a high of Rs. 149.10 compared to its previous closing price of Rs. 140.15.

Remsons Industries Ltd at a Glance

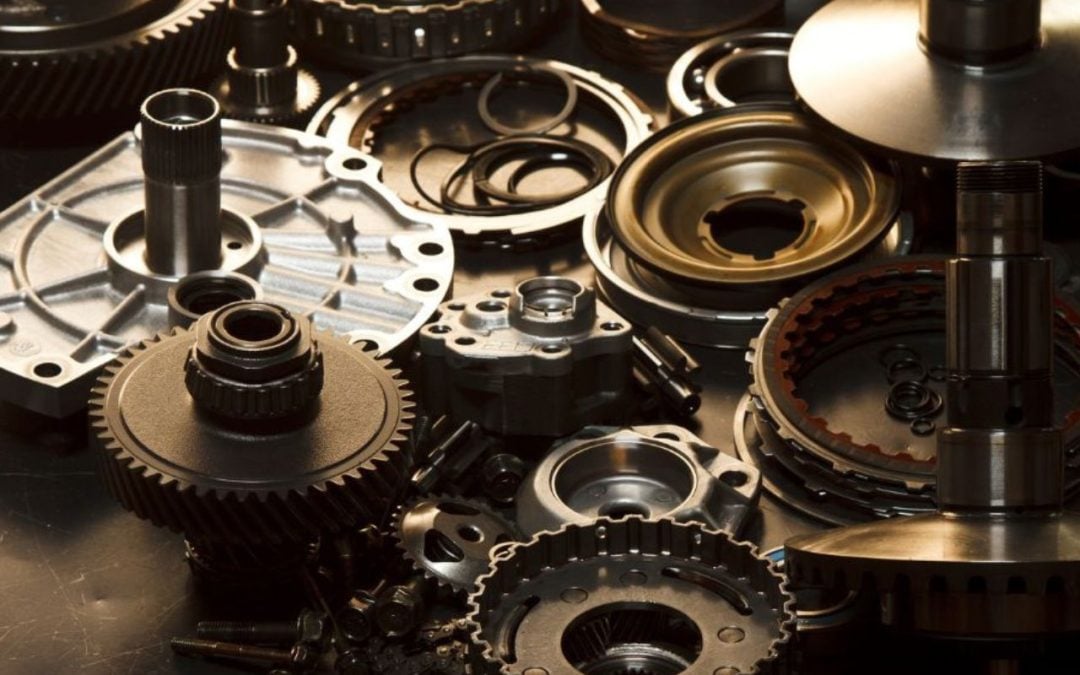

Remsons Industries Ltd, founded over 50 years ago by V. Harlalka, began as a cable manufacturer and has since diversified into advanced, fuel-agnostic automotive components for electric and conventional vehicles.

The company supplies a wide range of products, including control cables, gear shifters, lighting systems, sensors, and engineering components, to OEMs for two, three, and four-wheelers, as well as commercial and off-highway vehicles, exporting to over 20 countries.

With six manufacturing plants, four technology centers in India, and two in the UK, Remsons is recognized for its innovation, global reach, and commitment to quality. Its products are widely used across mobility, rail, and defense sectors, making Remsons a trusted name in the automotive industry

Guidance of Remsons Industries Ltd

According to the company’s recent conference call update, Remsons Industries has set a target to achieve a 3x revenue increase over the next three years, aiming to grow from Rs. 376.6 crores to approximately Rs. 900–1,000 crores. The company is targeting a revenue CAGR of around 20 percent by FY29.

The company’s strategy includes expanding its next-generation product offerings, undertaking complete organizational restructuring with a focus on people and change management, and moving up the value chain with high-margin, high-value products

Financials & Others

The company’s revenue rose by 31 percent from Rs. 81.0 crore to Rs. 106 crore in Q4FY24-25. Meanwhile, the Net profit declined from Rs. 5.15 crore to Rs. 4.55 crore during the same period.

Remsons Industries’ revenue is primarily driven by the passenger car segment, which accounts for 39 percent, followed by two-wheelers at 34 percent and light commercial vehicles at 14 percent. The remaining revenue comes from three-wheelers (3%), farm equipment (3%), heavy commercial vehicles (2%), others (4%), and railways (1%).

It offers a comprehensive product portfolio spanning mechanical, electronic, and lighting solutions for the automotive sector. In mechanical components, it manufactures control cables, gear shifters, pedal boxes, and more. In electronics, Remsons provides sensors, infotainment systems, digital cluster, and more. Its lighting solutions include headlamps and interior lighting, Signal lamps, and more.

They have established strong partnerships across key automotive segments. In passenger cars, it supplies components to major brands like Stellantis, Maruti, Jeep, Fiat, Ford, and Aston Martin. For commercial vehicles, partners include Ashok Leyland, Tata, and Navistar. In the two- and three-wheeler segment, Remsons works with Hero, TVS, and Harley-Davidson. In agriculture and off-highway vehicles, it collaborates with Mahindra, Kirloskar, and Honda.

Written by Sridhar J

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.