The shares of this company remain in focus after reports suggest that Havells and Reliance Retail have entered the race to acquire a majority stake in the business. In this article, we will dive deep into the highlights of this.

With a market capitalization of Rs 16,785 crores, the shares of Whirlpool of India are currently trading at Rs 1,323 per share, down by 46 percent from its 52-week high of Rs 2,450 per share. Over the past five years, the stock has delivered a negative return of 34.22 percent.

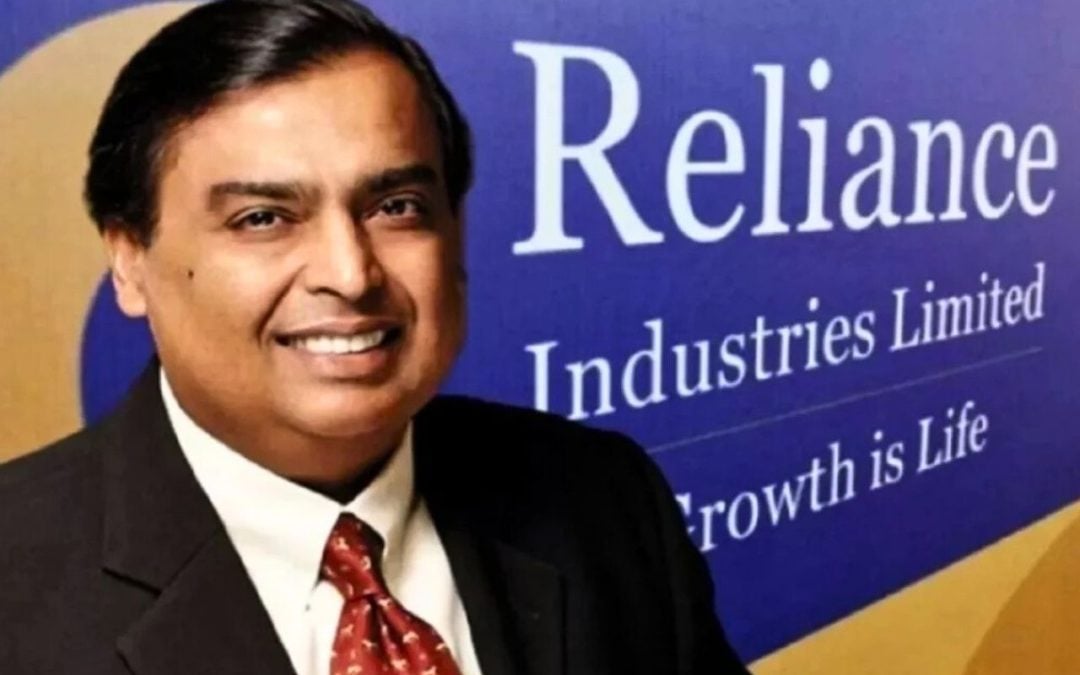

Sources indicate that Reliance Retail and Havells India are planning to buy a controlling stake in Whirlpool of India. These companies are potential in the race along with financial giants EQT and Bain Capital, who were also selected after the initial round of screening. Both companies are already in the FMEG segment and can grab the attention with their strong base, which will help them to derive better profitability.

Currently, Whirlpool Mauritius, the investment arm of Whirlpool Corp, owns 51 percent of Whirlpool of India. The parent company is now looking to divest 31 percent of its holdings while retaining 20 percent going forward. Whirlpool of India accounts for approximately 85 percent of Whirlpool’s Asia revenue.

Financial Highlights

Whirlpool of India reported a revenue of Rs 7,919 crores in FY25, up by 16 percent from its FY24 revenue of Rs 6,830 crores. Additionally, it reported a net profit growth of 62 percent to Rs 363 crore in FY25 from Rs 224 crore in FY24.

It has an ROE and ROCE of 9.27 percent and 13 percent, respectively, and is trading at a P/E of 47.33x as compared to its industry average of 51.02x.Whirlpool of India Limited, which was incorporated in 1960 and has its head office in Gurugram, India, produces and sells home appliances like refrigerators, washing machines, air conditioners, microwaves, dishwashers, and small kitchen appliances. It is a subsidiary of Whirlpool Corporation and operates in Indian and international markets.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.