The shares of this Infra company with an orderbook of Rs. 36,869 Crores engaged in the business of construction and development across various sectors was in focus after receiving new work order from Reliance Industries.

With a market capitalization of Rs. 15,706 Crores, shares of Afcons Infrastructure Limited opened at Rs. 433.65 per equity share, from its previous day’s closing price of Rs. 433.50.

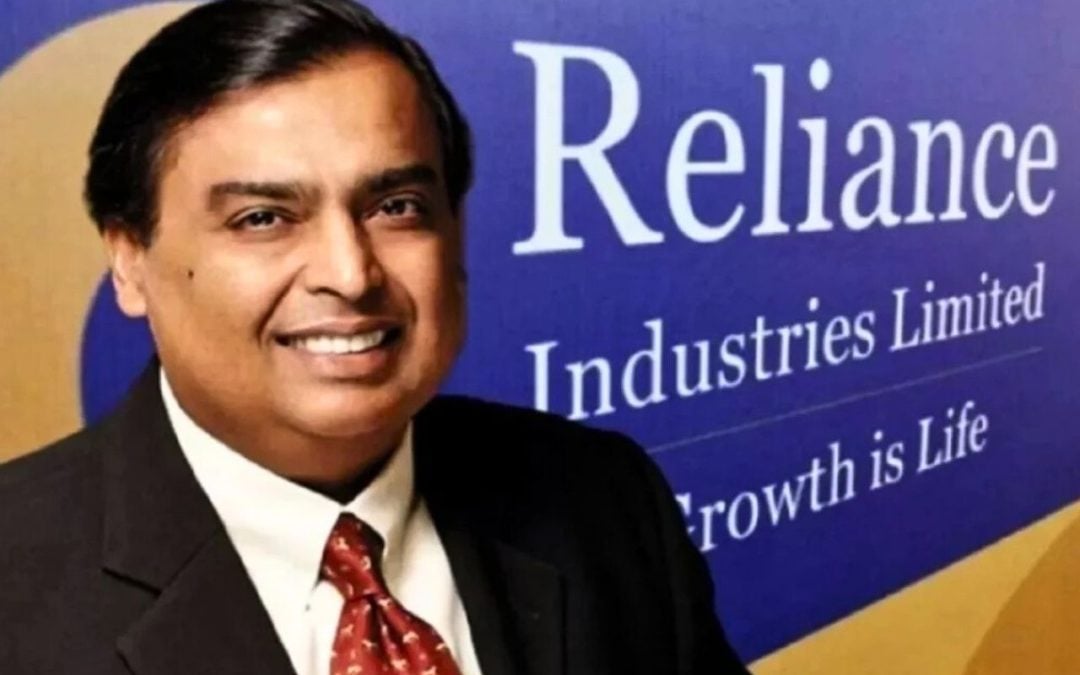

Afcons Infrastructure Limited has secured a significant Rs.175 crore order from Reliance Industries Limited (RIL) for civil and structural erection work at RIL’s facility in Jamnagar, Gujarat. This Letter of Commitment highlights Afcons’ strong reputation in handling large-scale, technically intensive infrastructure projects.

The scope of the work involves critical civil and structural components, and while the final completion timeline is yet to be decided, payments will be made based on actual execution as per the contract’s Bill of Quantities (BOQ).

This contract reinforces Afcons’ leadership in the engineering and construction sector, particularly in the industrial infrastructure segment. Being part of one of the world’s largest oil refining hubs not only boosts the company’s order book but also enhances its visibility and credibility in the industry.

As infrastructure development continues to be a national priority, such high-value projects strengthen Afcons’ growth outlook and reflect its ability to deliver on complex projects for India’s top corporations.

One of India’s leading engineering and construction firms, Afcons is known for handling complex infrastructure projects. It operates in diverse sectors including transportation, marine, oil & gas, and urban development. Established in 1959, it functions under the Shapoorji Pallonji Group.

The company has reported a historic high in its order book, reaching Rs. 36,869 Crore as of 31 March 2025 making a strong financial year. Coming to the breakup it derived 33 percent of its order from Urban Infra-Underground and Elevated Metro Projects, 24 percent from Hydro and Underground projects, 22 percent from Urban Infra- Bridges and Elevated Corridor, 12 percent from Marine and Industrial projects, and the remaining 9 percent from Surface Transport,oil and gas projects.

Afcons Infrastructure Limited has a Return on capital Employed (ROCE) 19.5 percent, indicating strong capital efficiency. The Return on Equity (ROE) stands at 11 percent Reflecting consistent Profitability.

The Company’s Price to earnings ratio is 32.3 times the industry average is 24.4 showing a moderate market valuation. The operating Profit margin (OPM) is Healthy at around 10.8 percent, which highlights efficient operations.

Written by Sudeep Kumbar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.