The Adani Group headed by Gautam Adani has been in a lot of market news recently because of different Adani Group airport deals. In their past deals, they managed to get the right over six major Indian airports – Ahmedabad, Lucknow, Jaipur, Guwahati, Thiruvananthapuram, and Mangaluru – for 50 years. Moreover, last month, Adani Group also signed a deal to acquire Mumbai airport and to take over Navi Mumbai airport.

In today’s article of Market Forensics by Trade Brains, we’ll be discussing different Adani Group Airport Deals and why is Adani Group Interested in Indian Airports. Let’s get started.

Table of Contents

What is the Adani Group?

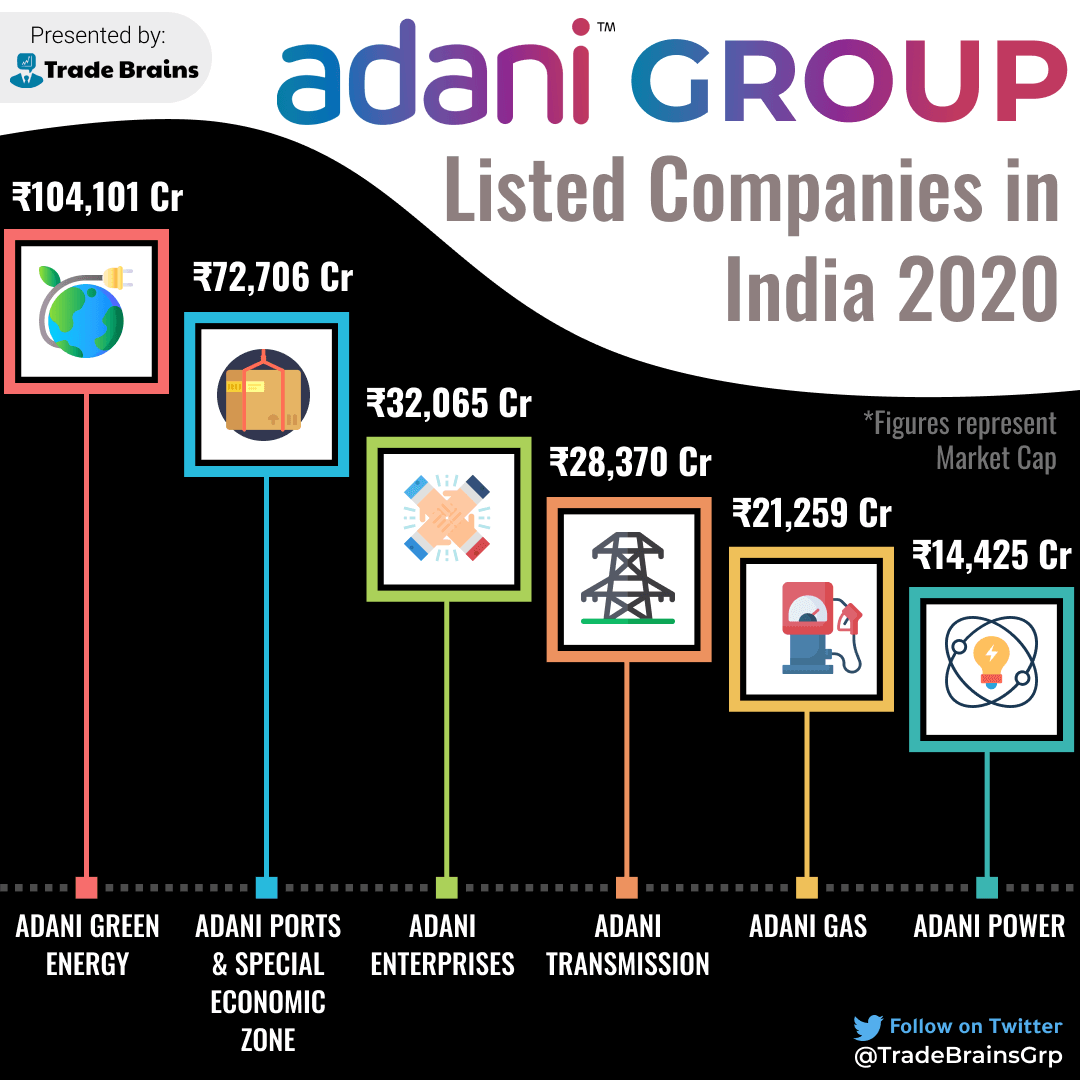

The Adani Group is an Indian multinational conglomerate company with combined revenue of $13 Bn and a market cap of $22 Bn (as of 27th May 2020). It was founded by Gautam Adani (current the second richest man in India) in 1988 as a commodity trading business headquartered in Ahmedabad, in the state of Gujarat, India.

Today, the group has grown to venture into energy, resources, logistics, agribusiness, real estate, financial services, defense, and aerospace. The Adani group is India’s largest private port company and special economic zone in India. It also is the largest private power producer and the largest solar power producer in the country.

(Fig: The Adani Group Verticals as of October 2020)

Why is Government Privatising the Airports?

Now that we have covered the Adani Group, let’s move to the main topic of this article – Why is Government Privatising the Airports and Why Adani Group is interested in it.

Till now, the Government of India has Privatised Six Airports (Lucknow, Ahmedabad, Jaipur, Mangaluru, Thiruvananthapuram, and Guwahati) and plans to privatize 25-30 more in the second phase of disinvestment. One of the major reason behind this privatization is that there are a total of 123 airports in India and out of which 109 are running under losses. A few strategic reasons as to why the government is keen on Privatising the Airports in India as as follows:

- The Financial reason: With the Privatisation of reports, the government will be able to generate revenue that could further be used in infrastructure development and also is helpful in meeting the budgetary deficit of the government.

- The Efficiency factor: Anything which goes in the hand of private ownership is always well managed and the operations are run smoothly. Further, even the movement of goods becomes quicker and smoother with privatization.

Why Adani Group is Interested in buying Airports?

Adani Group is interested in acquiring airports as buying them gives a lot of strategic advantage to Adani Group. Here are two of the biggest reasons behind Adani Group Airport Deals and why Adani Group is interested in buying Indian Airports:

- As the Adani group is one of the major players in the Ports segment, so the airport like Trivandrum gives them a strategic edge because of its proximity to the sea. And moreover, the Adani group has already picked up a port near Trivandrum. Even having Airports like Mumbai and Mangaluru (both have ports), gives it a tremendous advantage in terms of having a powerful grip on the airport sector.

- Having airports under their purview gives them the advantage of being major players in both ports and the airport sector. This directly makes them a major player in the infrastructure sector.

How will the Adani group make money from Airports?

As already discussed in this article, Adani Group is interested in acquiring airports because of different strategic advantages. Here’s how Adani group may make money from these airports:

- Service providers: Adani group will make money from service providers on Airports. The bigger the airport, the higher the rent which will be charged from these service providers. To put things into perspective, the average number of footfalls in a big airport is more than the footfalls in the biggest mall in India. The service providers at the Airport include Restaurants, Parking, Lounges, Taxi services, etc.

- Airlines: The airports make money from airlines by providing “Aeronautical services”. These include – fuel supply, air traffic monitoring, Ground staff services, Baggage handling, aircraft parking, etc.

Adani Group Airport Deals: How Adani managed it?

The connection of Gautam Adani, with our current Prime Minister Shri Narendra Modi, is no hidden secret. Even though there has been a lot of opposition from the Chief Minister of Kerala and the labor unions of the AAI, regarding the Privatisation of airport in Thiruvananthapuram, the Adani group will soon be controlling the operations in eight airports in India.

And what also benefitted the Adani group, is that in times of COVID-19, the infrastructure sector has been badly hit, especially the Aviation sector. Even the process of Privatisation was sped up and the PMO instructed the respective departments of Economic Affairs and the NITI aayog to prepare a mechanism to remove six airports from the control of AAI (Airport Authority of India) and to hand them over to the private players. And to top it off, the lease period for the Privatisation was increased by 20 years, from 30 years to 50 years.

On December 14, 2018, the government invited bids for the Privatisation of these Airports. And the tenders for the Privatisation were processed at breakneck speed. And in Feb 2019, the government announced that the ADANI group, which had no prior experience in airport operations and development, have won the bids for all the six airports. Interestingly, all these six airports are some of the only few airports which were running under profits.

Having secured the right of private ownership of six airports in India, the Adani group has now set its eyes, on controlling the right on other major airports in India which would be privatized. And the ultimate aim is to be able to have a firm grip on the Port sector (already the biggest player) and the airports sector.

But, the path to securing these airports was never easy. They had to fight legal disputes with entities in different corners of the world, like South Africa, Mauritius, Abu Dhabi, and Canada. After a series of search and seizure raids were conducted on the GVK group (Operating second largest Airport in India i.e., Mumbai), the Hyderabad group capitulated and agreed to hand over the controlling stake in companies operating two Airports of Mumbai and the one coming up in Navi Mumbai to Adani Group.

Closing Thoughts

The initial hurdle towards being a major player the infrastructure player has been crossed by the Adani group. It remains to be seen whether they will be able to cope up with the expectation of maintaining the smooth operations of the airport functioning. This becomes more crucial especially knowing that they have no prior experience in airport operations and management sectors.

That’s all for today’s Market Forensics. We’ll be back tomorrow with another interesting market news and analysis. Till then, Take care and Happy investing!!

Hitesh Singhi is an active derivative trader with over +10 years of experience of trading in Futures and Options in Indian Equity market and International energy products like Brent Crude, WTI Crude, RBOB, Gasoline etc. He has traded on BSE, NSE, ICE Exchange & NYMEX Exchange. By qualification, Hitesh has a graduate degree in Business Management and an MBA in Finance. Connect with Hitesh over Twitter here!