Synopsis: Several Nifty 500 stocks have exhibited bullish MACD crossovers, indicating potential upward momentum. This technical signal suggests strengthening trends, possible price gains, and favorable opportunities for traders to consider.

The Moving Average Convergence Divergence (MACD) is a widely used stock market indicator that helps track trend direction and momentum. It is calculated by subtracting a longer-term moving average from a shorter-term moving average to produce the MACD line, while the signal line, being the moving average of the MACD line, is used to generate trading signals.

A bullish signal arises when the MACD line crosses above the signal line, indicating potential price gains, whereas a bearish signal occurs when it crosses below, suggesting possible declines.

MACD is useful for traders and investors as it provides insights into whether a stock’s momentum is strengthening or weakening. It can identify potential entry and exit points, indicate the trend direction, and even highlight possible reversals. In essence, a bullish MACD signals rising momentum and may point to a favorable buying opportunity, making it a key tool in technical analysis. Here are four stocks to keep on your radar.

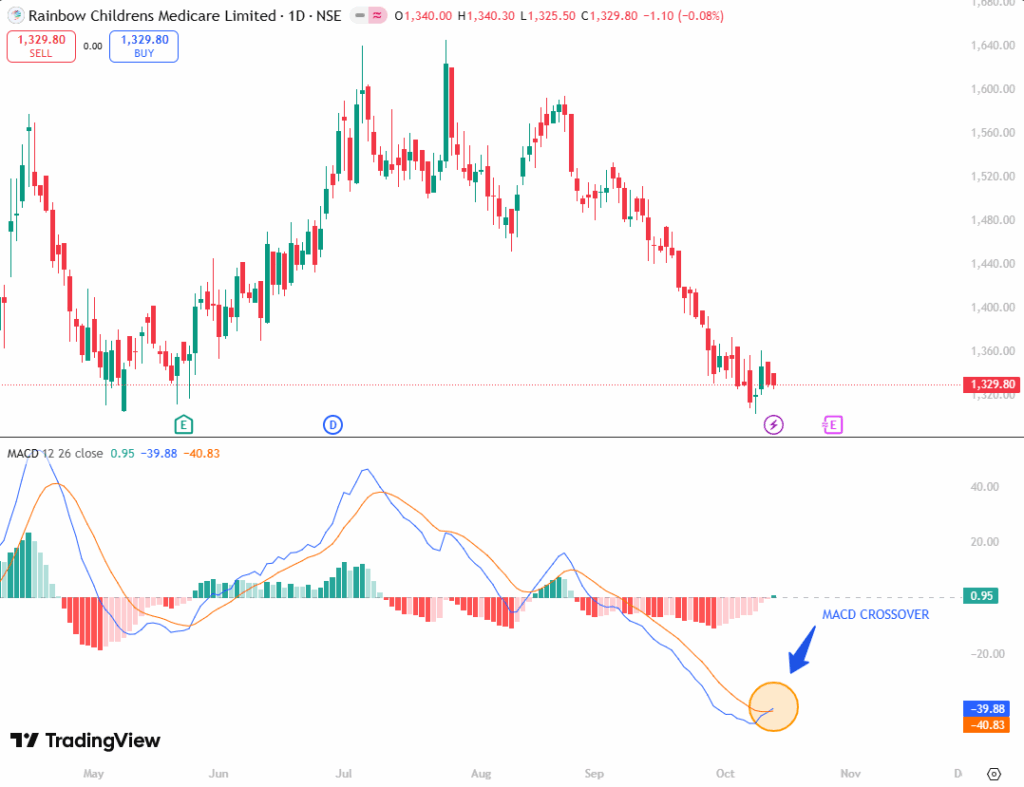

1. Rainbow Children’s Medicare Ltd

Incorporated in 1998, Rainbow Children’s Medicare Ltd specializes in providing comprehensive medical and healthcare services. Its pediatric offerings include neonatal and pediatric intensive care, multi-specialty treatment, and advanced quaternary care such as multi-organ transplants for children.

Under the “Birthright by Rainbow” brand, the company offers women’s healthcare, including normal and high-risk obstetric care, multidisciplinary fetal care, perinatal genetics and fertility services, and a range of gynecology treatments.

The hospital serves patients seeking specialized medical procedures, routine check-ups, surgical care, maternity support, and pediatric care. Rainbow Children’s Medicare Ltd has a market capitalization of Rs. 13,493.66 crore. The stock closed at Rs. 1,328.65 on Tuesday, 14th October 2025.

Rainbow Children’s Medicare Ltd has recorded a bullish MACD crossover, with the MACD line rising above the signal line. This movement signals potential upward momentum, typically seen as a buy indicator, suggesting a possible new uptrend and prompting traders to consider positive positions or entering long trades.

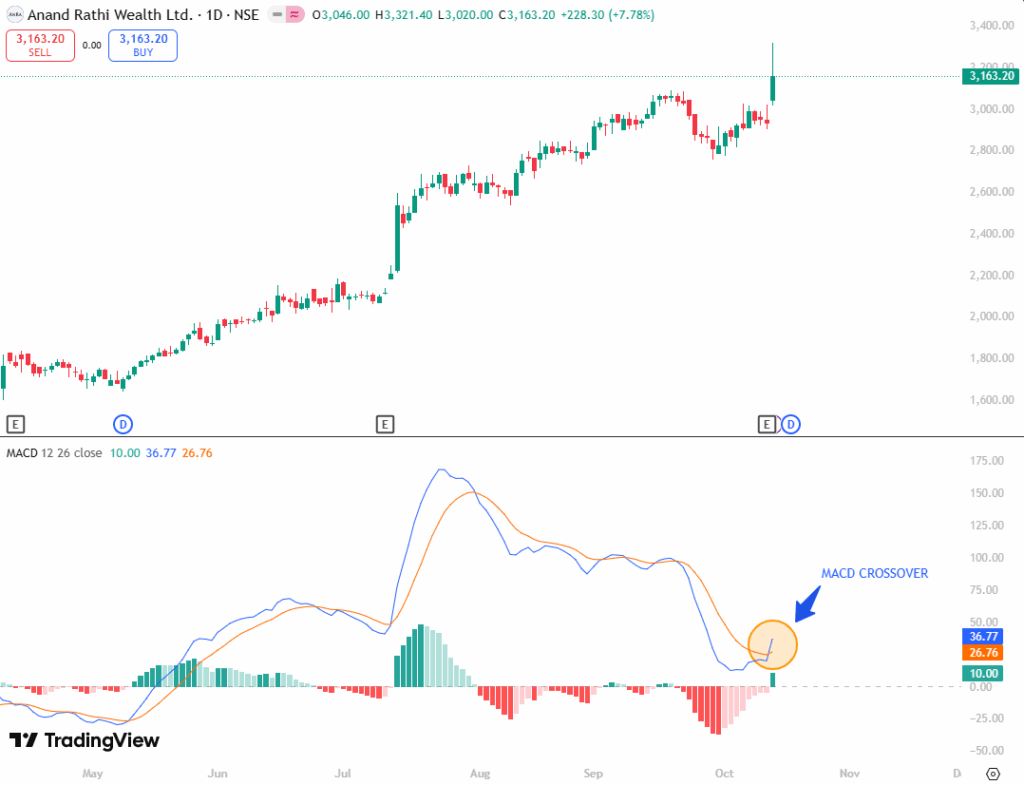

2. Anand Rathi Wealth Ltd

Founded in 1995, Anand Rathi Wealth operates as a wealth management and financial services firm, offering investment banking, portfolio management, and financial consultancy. The company also provides management advisory services and various financial solutions, focusing on wealth management tailored for High-Net-Worth Individuals (HNIs) and Ultra-High-Net-Worth Individuals (UHNIs). Anand Rathi Wealth is valued at a market capitalization of Rs. 26,193.01 crore. Its shares closed at Rs. 3,155 on Tuesday, 14th October 2025.

Anand Rathi Wealth has experienced a bullish MACD crossover, as the MACD line crossed above the signal line. This pattern is generally interpreted as a buy signal, indicating the likelihood of upward momentum and encouraging traders to adopt a favorable outlook or consider taking long positions.

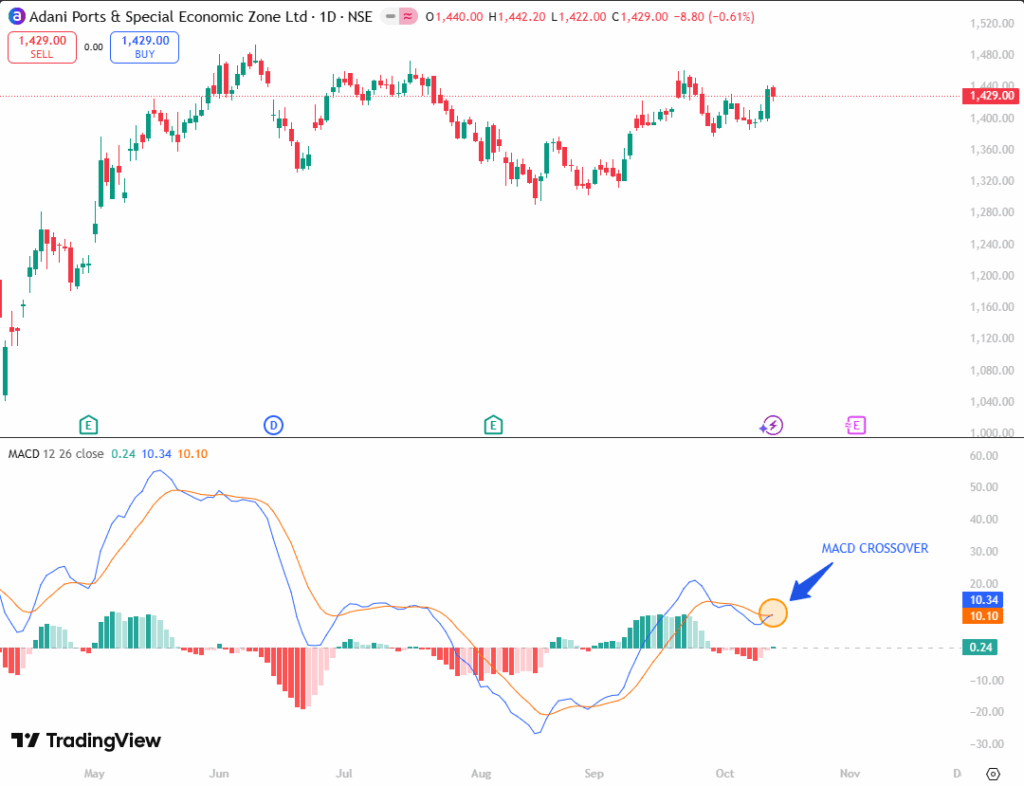

3. Adani Ports & Special Economic Zone Ltd (APSEZ)

Established in 1998, Adani Ports & SEZ Ltd is engaged in the development, operation, and maintenance of port infrastructure, along with associated services. The company manages a multi-product Special Economic Zone (SEZ) adjacent to its port at Mundra.

Through its subsidiary Adani Logistics, it operates logistics parks in Patli (Haryana), Kila-Raipur (Punjab), and Kishangarh (Rajasthan). APSEZ primarily serves B2B customers handling dry cargo, liquid cargo, crude, and containerized shipments, offering integrated services across ports, logistics, port-based operations, and SEZ infrastructure.

Adani Ports & Special Economic Zone Ltd has a market capitalization of Rs. 3,08,500.24 crore. The stock ended the day at Rs. 1,428.15 on Tuesday, 14th October 2025.

Adani Ports & Special Economic Zone Ltd has witnessed a bullish MACD crossover, where the MACD line moved above the signal line. This is typically considered a buy signal, reflecting potential upward momentum and hinting at the start of a new uptrend, prompting investors to explore long positions.

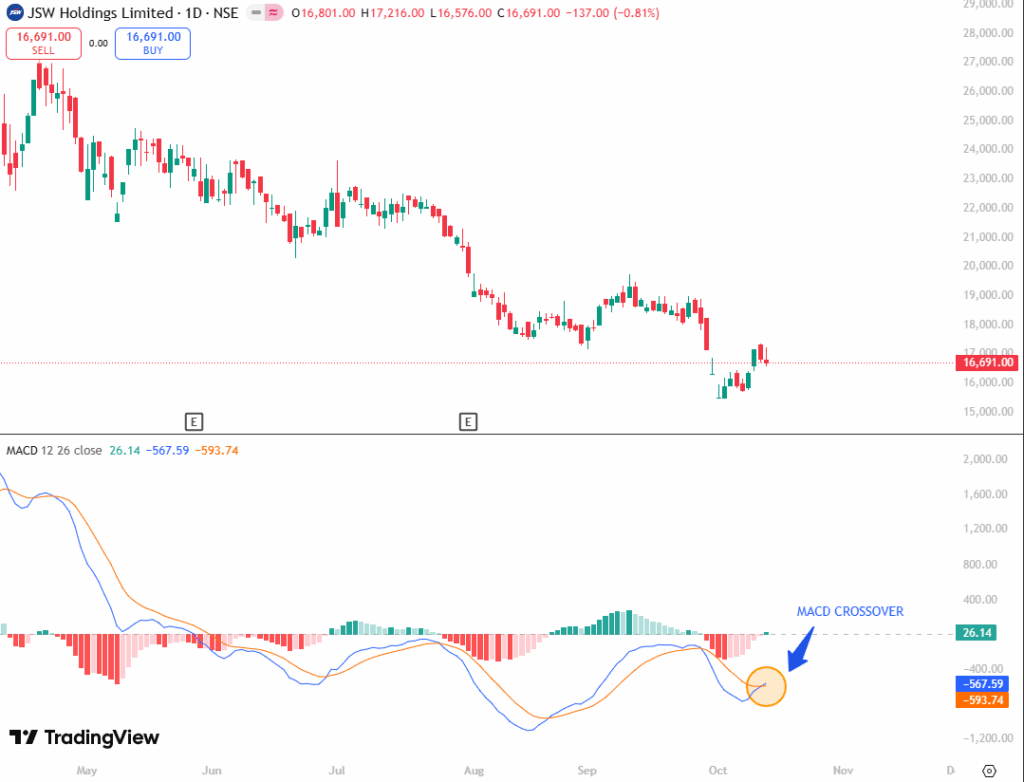

4. JSW Holdings Ltd

Incorporated in 2001 and based in Mumbai, JSW Holdings Ltd is a non-banking financial company focused on investing and financing activities in India. The company provides loans, invests in securities, and offers related financial services and solutions. JSW Holdings Ltd holds a market capitalization of Rs. 18,457.84 crore. The company’s shares closed at Rs. 16,629.25 on Tuesday, 14th October 2025.

JSW Holdings has seen a bullish MACD crossover, with the MACD line crossing above the signal line, signaling possible upward momentum. This development is commonly regarded as a buy signal, indicating a potential new uptrend and encouraging traders to consider entering long positions or maintaining a positive stance.

Written by – Manan Gangwar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.