Synopsis:

Several Nifty 500 stocks, including Kirloskar Oil Engines, Apollo Tyres, and Maruti Suzuki, are showing a MACD bullish crossover, signaling potential upward momentum and a positive short-term trend in their stock prices.

Technical indicators suggest a bullish trend emerging in certain Nifty 500 stocks, as the MACD shows a bullish crossover, indicating increasing buying momentum and potential short-term price gains.

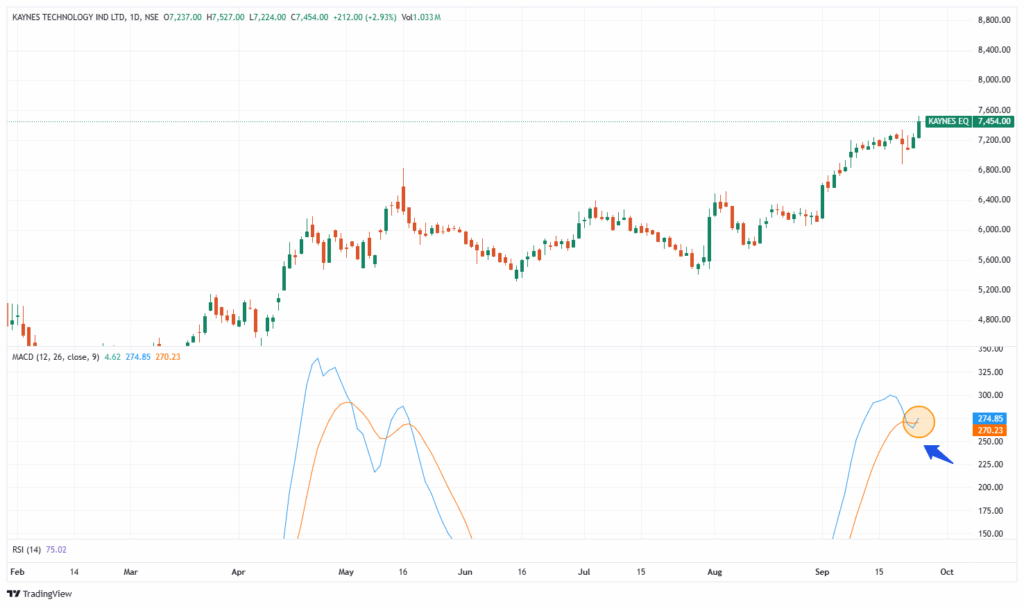

Kaynes Technology India Ltd

Kaynes Technology India Ltd is a leading electronics manufacturing services (EMS) provider headquartered in Mysuru, Karnataka, India. Established in 1988, the company offers end-to-end solutions across the electronics system design and manufacturing (ESDM) spectrum. Its services encompass conceptual design, process engineering, integrated manufacturing, and life cycle support for sectors including automotive, aerospace, defense, medical, railways, IoT, and IT.

With market capitalization of Rs. 49,987 cr, the shares of Kaynes Technology India Ltd are closed at Rs. 7,454 per share, from its previous close of Rs. 7,242 per share.

The stock shows a bullish MACD crossover, signaling upward momentum, potential near-term price increase, and a possible buying opportunity.

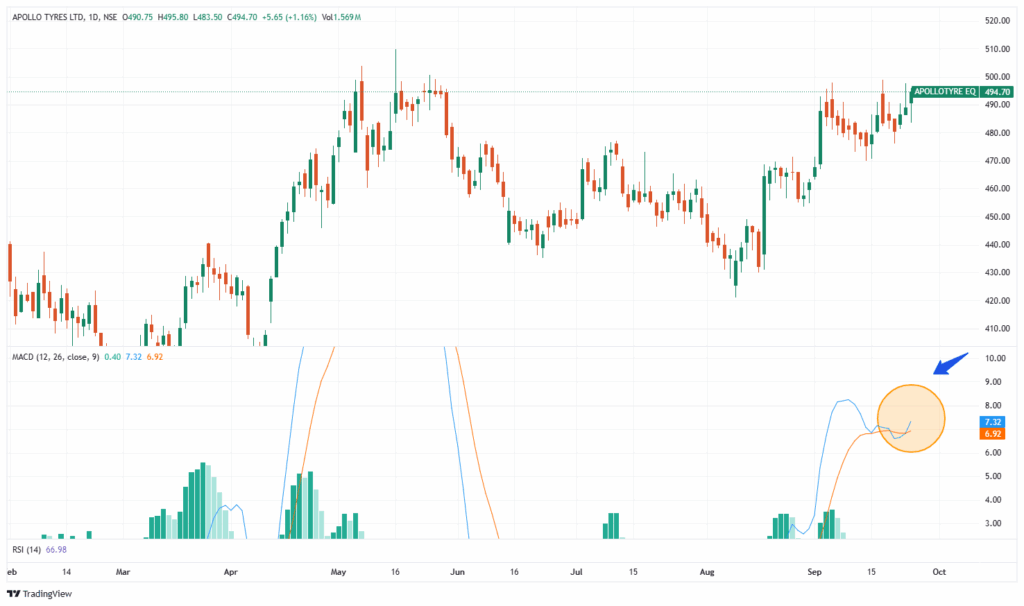

Apollo Tyres Ltd

Apollo Tyres Ltd is a leading Indian tyre manufacturer known for producing a wide range of tyres for cars, trucks, buses, and two-wheelers. With a strong presence both in domestic and international markets, the company focuses on innovation, performance, and safety in its products.

With market capitalization of Rs. 31,301 cr, the shares of Apollo tyres Ltd are closed at Rs. 494.70 per share, from its previous close of Rs. 489.05 per share. A MACD bullish crossover appears on the stock, indicating upward movement and possible near-term price appreciation.

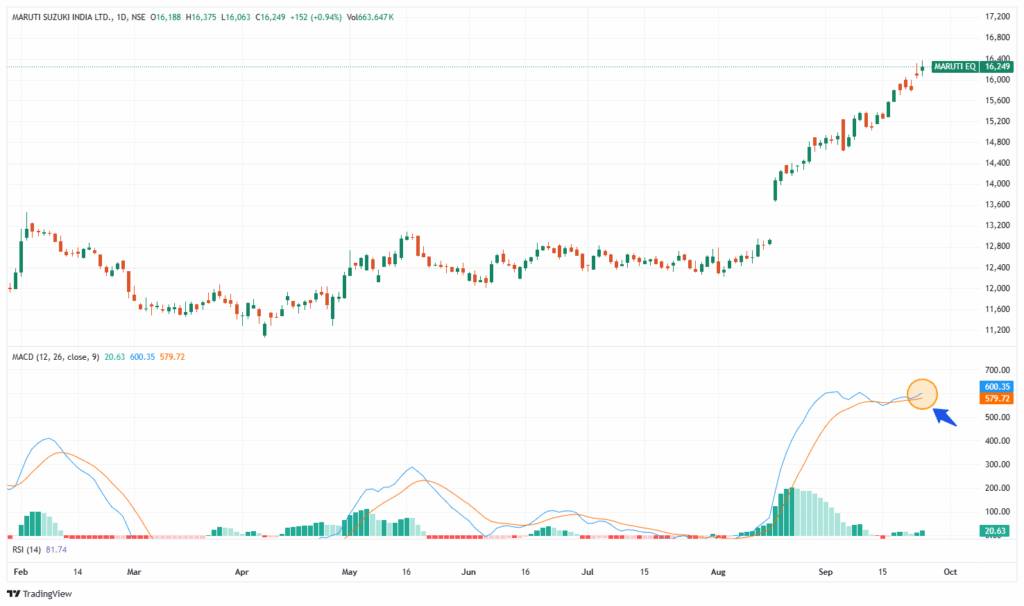

Maruti Suzuki India Ltd

Maruti Suzuki Ltd is India’s largest passenger vehicle manufacturer, renowned for its wide range of cars that combine reliability, fuel efficiency, and affordability. A subsidiary of Suzuki Motor Corporation, the company has a strong presence across urban and rural markets in India, offering products from compact cars to premium models.

With market capitalization of Rs. 5,10,560 cr, the shares of Maruti Suzuki India Ltd are closed at Rs. 16,249 per share, from its previous close of Rs. 16,097 per share. The stock is showing a MACD bullish crossover, suggesting potential upward momentum and possible short-term price gains.

Written by Manideep Appana

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.