A golden crossover is a bullish technical chart pattern that occurs when a short-term moving average, typically the 50-day, crosses above a long-term moving average, usually the 200-day.

This signals a potential shift in market momentum, indicating that buying interest is outweighing selling pressure. Traders and investors view it as a confirmation of a possible uptrend, often supported by higher trading volumes. Widely used in technical analysis as an indicator of long-term strength, here are four stocks currently exhibiting this golden crossover pattern, highlighting potential bullish opportunities for investors.

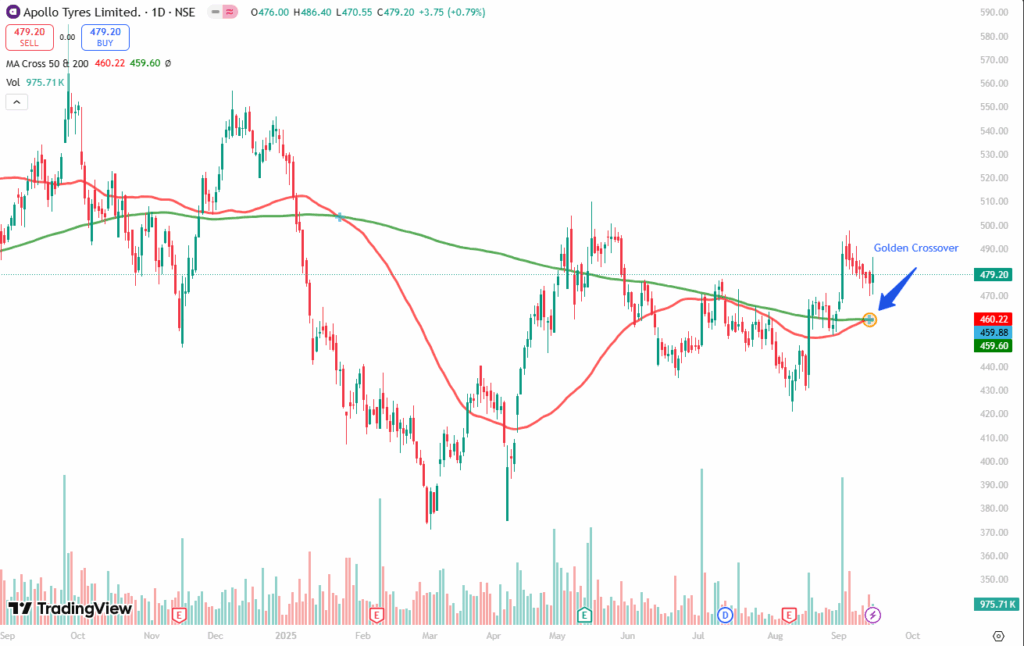

1. Apollo Tyres

Founded in 1972, Apollo Tyres manufactures and sells tyres, tubes, and flaps across categories like passenger, commercial, two-wheelers, farm, and industrial vehicles. Serving OEMs, fleets, distributors, and retailers, it operates facilities in India, Hungary, and the Netherlands, offering products under Apollo and Vredestein brands across all Indian states and 100+ countries.

The golden crossover took place on September 12, 2025, at a price of Rs. 459.88 with decent volumes of 1.39 M shares. The stock closed at Rs. 479.20 in Monday’s session, reflecting a 0.75 percent increase from the crossover date.

2. Huhtamaki India Ltd

Founded in 1935 and headquartered in Thane, Huhtamaki India Limited manufactures flexible packaging and labeling solutions for food, beverages, healthcare, pet food, and industrial applications. Offering advanced labels, anti-counterfeit features, and mono-material products under the blueloop brand, it also provides laser engraving and engraved cylinders. The company is a subsidiary of Huhtavefa BV.

The golden crossover took place on September 12, 2025, at a price of Rs. 222.54 with decent volumes of 75.96 K shares. The stock closed at Rs. 229.02 in Monday’s session, reflecting a 0.65 percent increase from the crossover date.

3. Emami

Incorporated in 1983, Emami develops and markets personal care and healthcare products, featuring leading brands like Boro Plus, Navratna, Zandu Balm, Fair and Handsome, Kesh King, and Dermicool. With distribution spanning general trade, modern trade, e-commerce, quick commerce, pharmacies, and D2C platforms, the company has a pan-India presence and serves consumers in 60+ countries globally.

The golden crossover took place on September 11, 2025, at a price of Rs. 588.31 with decent volumes of 221.44 K shares. The stock closed at Rs. 599.70 in Friday’s session, reflecting a 0.35 percent decrease from the crossover date.

4. National Aluminium Company

Formed in 1981, National Aluminium Company manufactures and sells alumina and aluminium domestically through MoUs and tenders, while global sales are routed via online tenders. It operates captive coal and bauxite mines, along with four wind power plants.

The golden crossover took place on September 11, 2025, at a price of Rs. 192.55 with decent volumes of 14.2 M shares. The stock closed at Rs. 216.79 in Monday’s session, reflecting a 1.12 percent increase from the crossover date.

Written By Manan Gangwar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.