Synopsis:

Several Nifty 500 stocks have shown bearish MACD crossovers, indicating weakening momentum and potential downward price movement. Traders may view these signals as cautionary or potential selling opportunities in a volatile market.

Some Nifty 500 stocks are showing bearish MACD (Moving Average Convergence Divergence) signals, suggesting potential downward momentum. The MACD, a popular technical tool, helps traders assess trend direction and strength, and a bearish crossover typically indicates weakening prices or the likelihood of further declines. Investors monitor these signals to adjust positions and manage risk in a volatile market.

What is MACD and why is it important?

The Moving Average Convergence Divergence (MACD) is a popular technical indicator used to analyze trend and momentum in the stock market. It is calculated by subtracting a longer-term moving average from a shorter-term moving average to form the MACD line, and a signal line, which is the moving average of the MACD line, helps identify trading signals.

When the MACD crosses above the signal line, it indicates a bullish signal (potential price increase), while a cross below the signal line signals a bearish trend (possible price decline).

Following are the list of Stocks with Bearish MACD Crossover

Apar Industries Limited

APAR Industries Limited, founded in 1958 and based in Mumbai, operates in electrical and metallurgical engineering in India and abroad. It offers a wide range of products including transformer and specialty oils, petroleum jelly, process oils, conductors, copper rods and wires, electrical and fiber optic cables, specialty elastomers, automotive lubricants, batteries, and vehicle care services, serving sectors like power transmission, telecommunication, petroleum, and general industrial applications, with both domestic sales and exports.

With the market capitalization of Rs. 33,793.60 crore, Apar Industries Limited was closed at Rs. 8,413 on Friday, up by 2.40 percent from its previous day close of Rs. 8,216.

Apar Industries Limited recently witnessed a bearish MACD crossover, where the MACD line moved below the signal line. This is generally viewed as a negative technical signal, indicating potential downward momentum and suggesting a possible selling opportunity for traders expecting a declining trend.

Ashok Leyland Limited

Ashok Leyland Limited, founded in 1948 and headquartered in Chennai, manufactures and sells a wide range of commercial and defense vehicles in India and internationally. The company also offers power solutions, spare parts, financing services, IT and manpower services, and operates retail and e-commerce stores for its products.

Ashok Leyland Limited, with a market capitalization of Rs. 82,075.65 crore, closed at Rs. 139.74 on Friday, marking a decline of 1.06 percent from the previous close of Rs. 141.23.

Ashok Leyland Limited, has recently shown a bearish MACD crossover, with the MACD line slipping under the signal line. Such a setup often signals weakening momentum, hinting at possible downside pressure and cautioning traders of a likely correction or continuation of a downward trend.

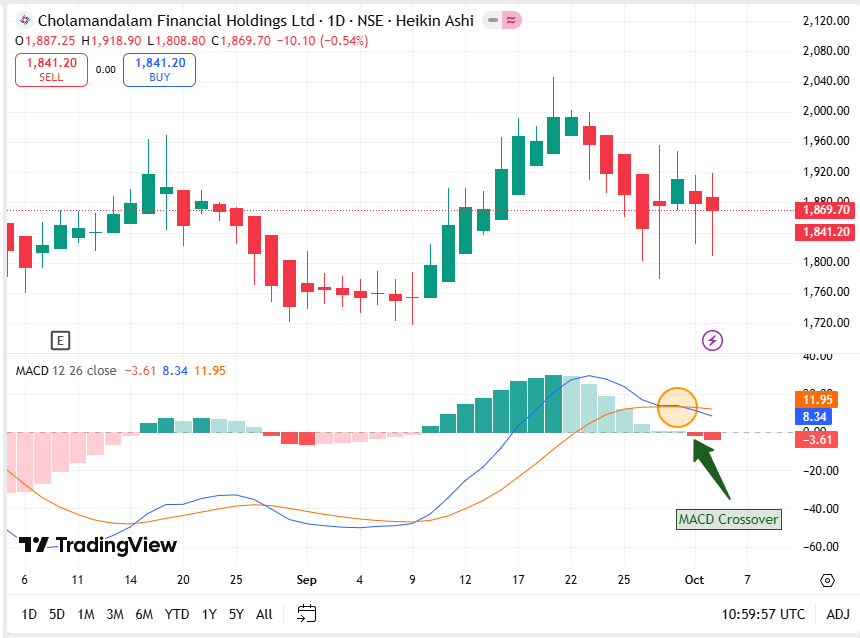

Cholamandalam Financial Holdings Limited

Cholamandalam Financial Holdings Limited, founded in 1949 and based in Chennai, is an investment company providing a range of financial services in India. It offers vehicle finance, loans against property, home and business loans, SME and personal loans, as well as general insurance products, serving individuals, first-time borrowers, corporates, and small to medium enterprises.

With the market capitalization of Rs. 34,556.69 crore, Cholamandalam Financial Holdings Limited was closed at Rs. 1,840.30 on Friday, down by 3.53 percent from its previous day close of Rs. 1,907.60.

Cholamandalam Financial Holdings Limited is showing a bearish MACD crossover, where the MACD line falls below the signal line. This typically indicates weakening momentum and a potential price decline, signaling traders to be cautious or consider selling.

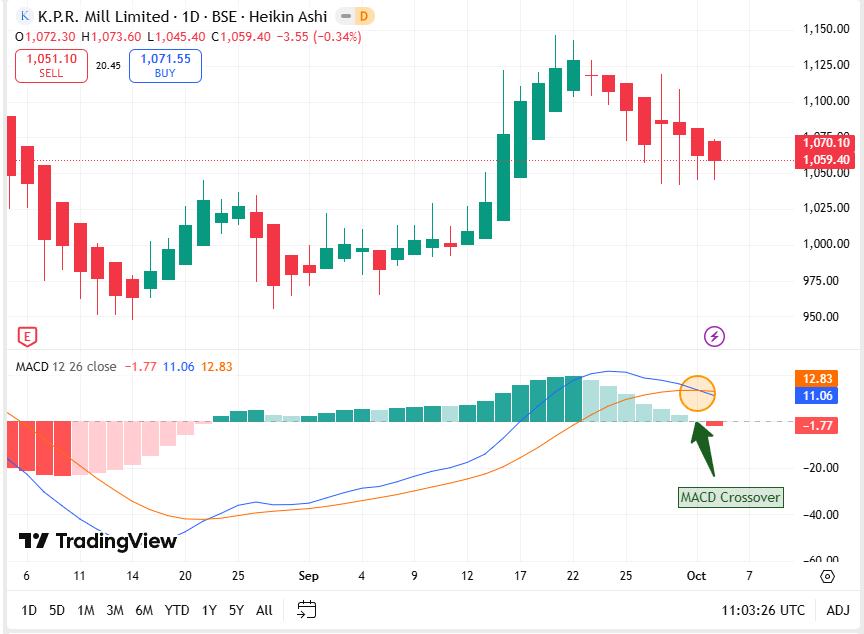

K P R Mill Ltd

K.P.R. Mill Limited, founded in 1984 and based in Coimbatore, is an integrated apparel and textile company operating in India and internationally. It produces a wide range of yarns, knitted fabrics, and readymade garments under the FASO brand, and also operates in sugar, ethanol, green energy, wind power, and car dealership segments.

K P R Mill Limited, with a market capitalization of Rs. 36,628.79 crore, closed at Rs. 1,071.60 on Friday, marking an incline of 1.75 percent from the previous close of Rs. 1,053.20.

K P R Mill Ltd has formed a bearish MACD crossover, with the MACD line crossing under the signal line. This suggests weakening momentum and potential downward movement, signaling a possible selling opportunity for traders.

Written by Akshay Sanghavi

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.