The shares of an Auto Ancillary company, specializing in manufacturing customized products for reputed OEMs across multiple industries, hit a 10 percent upper circuit upon announcing its entry into the heavy-duty gearbox segment.

With a market capitalization of Rs. 135.11 crore on Monday, shares of Kranti Industries Limited hit a 10 percent upper circuit, making a high of Rs. 116.30 per share compared to its previous closing price of Rs. 105.73 per share.

What Happened

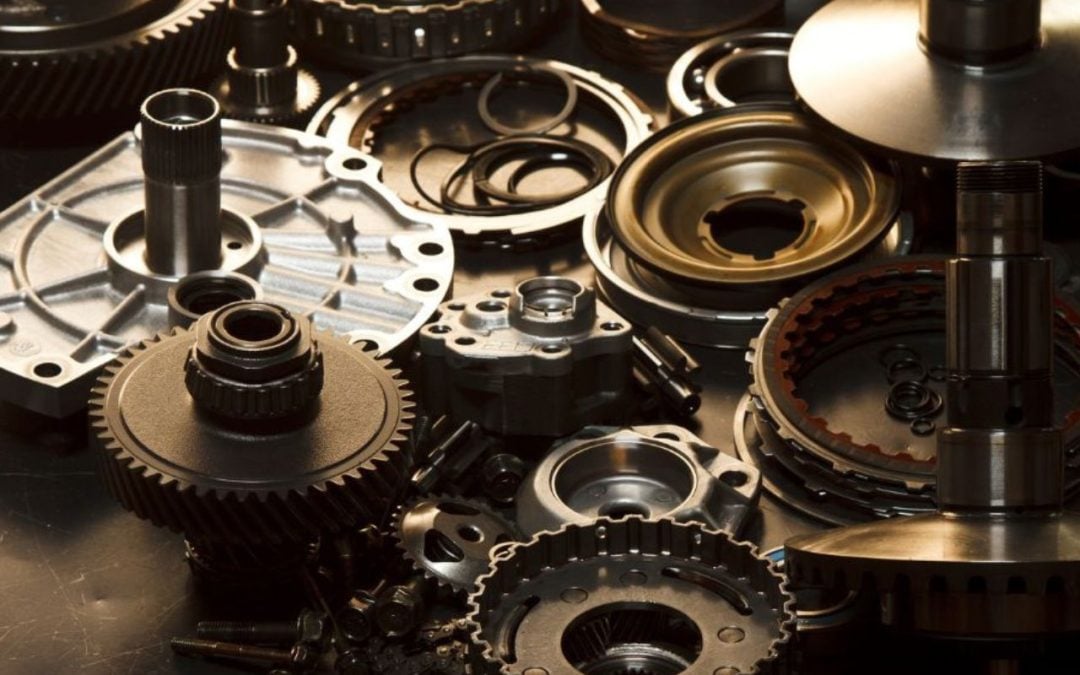

Kranti Industries Ltd, engaged in manufacturing customized products for reputed OEMs across multiple industries, announced its entry into the heavy-duty gearbox segment with a new sample order from Bonfiglioli Transmission Private Limited, a leading domestic client.

The project involves developing industrial machinery parts for heavy-duty gearbox systems, marking a significant step into a technically advanced product category for Kranti, with the new order offering an estimated annual business potential of approximately Rs. 6.84 crore and strong prospects for long-term growth.

Mr. Sachin Subhash Vora, Chairman &Managing Director of Kranti Industries Limited, stated: We are excited to partner with Bonfiglioli Transmission, as this collaboration highlights the company’s focus on technological progress and engineering excellence. Entering the heavy-duty gearbox segment allows Kranti to showcase its ability to deliver high-performance, complex components for demanding industrial applications. The initiative is expected to open up future opportunities, support long-term alliances, and reinforce the company’s position in specialized manufacturing.

About the Company

Kranti Industries Limited, established in 1981, is a BSE-listed company with over 40 years of expertise in precision component manufacturing for the auto ancillary sector. The company operates three advanced units in Pune, equipped with 80 production machines and world-class inspection setups across a 10,000 sq. mtr. facility.

Financials

The company’s revenue declined by 14.3 percent from Rs. 21.44 crore to Rs. 18.36 crore in Q3FY24-25. Meanwhile, the Net loss increased from Rs. 0.71 crores to Rs. 1.03 crores during the same period.

In FY24, Kranti Industries’ revenue was primarily from Tractors (63.4 percent), followed by Electric Vehicles (13.5 percent), Construction Equipment (11.5 percent), Automotive (1.9 percent), and Other Categories (9.7 percent).

Written by Sridhar J

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.