Synopsis:

Kranti Industries Ltd, a micro-cap company, saw a stock price movement of 19% after securing two new work orders from international and domestic clients.

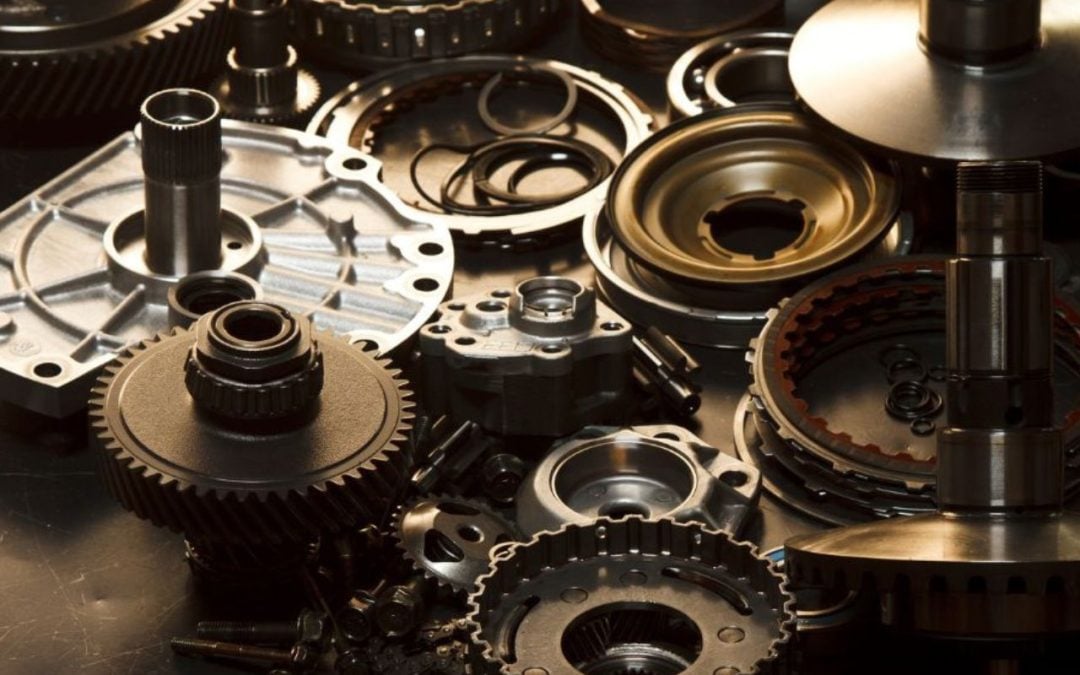

An auto ancillary stock that is engaged in the manufacturing and supply of machined components for OEMs in various industries is in the spotlight after receiving two work orders from domestic and international clients.

With the market capitalization of Rs. 115 crore, the shares of Kranti Industries Ltd are trading at Rs. 89.9, up by 12.63 percent from its previous day’s close price of Rs. 79.78 per equity share, and it has reached a high of Rs. 94.84 in the same trading day.

Work Orders

- Ingersoll-Rand Industrial U.S., Inc. has issued a purchase order to Kanti Industries Ltd. for about USD 2,21,000. The purchase order is for the production and delivery of tooling parts for housing components and must be completed on or before October 31, 2025.

- The Pune-based electric commercial vehicle manufacturer Pinnacle Mobility Solutions Pvt. Ltd. (Eka Mobility) has sent a purchase order to Kranti Industries Ltd. for about ₹5 lakh. The order pertains to the tooling cost for manufacturing and supply of machining parts, and will be executed as per the purchase order terms

Also Read: Defence stock in focus after receiving ₹294 Cr order from Ministry of Defence

About the Company & Others

Kranti Industries is a precision engineering company that was founded in 1981 and has its headquarters in Pune. It specializes in machined components for OEMs in industries such as electric vehicles, construction, automotive, and agriculture.

The company has over 40 years of manufacturing experience, operates five advanced facilities with 78+ high-tech machines, and offers a wide range of products, from transmission parts to axle components, with sizes ranging from 100 mm to 1200 mm.

Its revenue from operations declined by 13.07 percent from Rs. 90.28 crore in FY24 to Rs. 78.49 crore in FY25, accompanied by net loss of Rs. 3.09 crore in FY25 compared to 0.07 crore net profit in FY24. The debt-to-equity ratio stands at 1.07.

Written by Akshay Sanghavi

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.