The 200-day Exponential Moving Average (EMA) is a popular long-term indicator that shows a stock’s average closing price over the past 200 trading days, giving more weight to recent prices. It helps reduce short-term ups and downs while still showing changes in the overall trend. If a stock trades above the 200-day EMA, it suggests positive momentum, while trading below it points to a negative trend.

When a stock breaks above the 200-day EMA with strong trading volume, it is seen as a strong bullish sign. This shows growing investor confidence and increases the chance of further price gains. High volume also makes the breakout more reliable, helping traders and long-term investors find better entry points.

Here are a few stocks that break above the 200-Day Exponential Moving Average with strong volume

Allied Digital Services Limited

Allied Digital Services Limited was established in 1995 in Mumbai. It is an IT company providing services like system integration, IT infrastructure management, and digital transformation. It serves over 700 clients across India with technology solutions to improve business efficiency and security. The company is known for innovation and service excellence.

On September 16, 2025, the stock broke its 200-day exponential moving average at Rs. 191.89, with a strong trading volume of 13 million shares. The stock closed above its 200-day moving average at Rs. 194.49 in Tuesday’s session, reflecting up to a 15.73 percent increase in the intraday trade.

Aegis Logistics Limited

Aegis Logistics Limited was established in 1956 and is headquartered in Mumbai. It is India’s leading integrated oil, gas, and chemical logistics company, specializing in LPG importing, handling, and distribution. The company operates advanced liquid and gas terminals and provides LPG services to industrial, commercial, and domestic sectors.

On September 15, 2025, the stock broke its 200-day exponential moving average at Rs. 800.45, with a strong trading volume of 4.88 million shares. The stock closed above its 200-day moving average at Rs. 800.45 in Tuesday’s session, reflecting up to a 5.48 percent increase in the intraday trade.

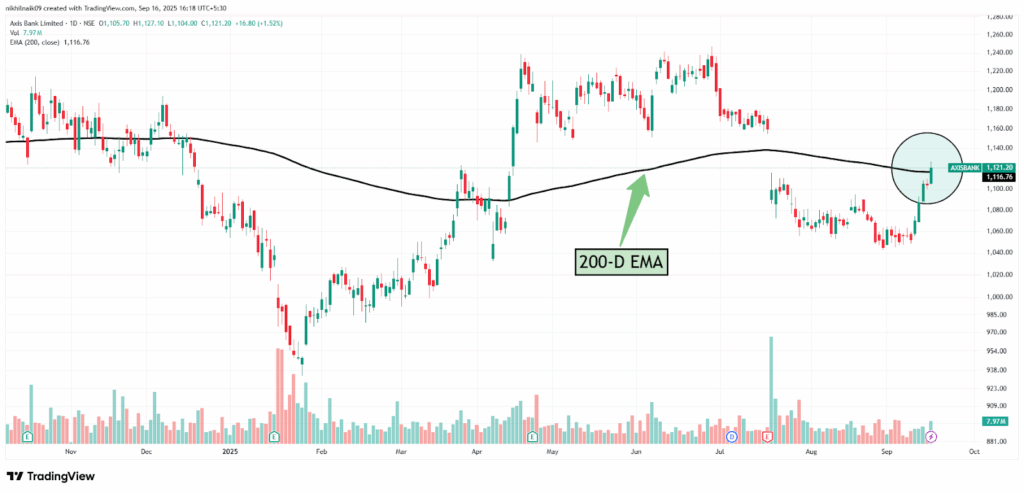

Axis Bank Limited

Axis Bank Limited was incorporated in 1993, originally named UTI Bank. It began operations in 1994 and was promoted by entities including Unit Trust of India and LIC. The bank was renamed Axis Bank in 2007. It is one of India’s largest private sector banks, offering a wide range of banking and financial services to individuals and businesses.

On September 16, 2025, the stock broke its 200-day exponential moving average at Rs. 1,116.76, with a strong trading volume of 7.97 million shares. The stock closed above its 200-day moving average at Rs. 1,121.20 in Tuesday’s session, reflecting up to a 1.52 percent increase in the intraday trade.

Rashi Peripherals Limited

Rashi Peripherals Limited was incorporated in 1989 and is a leading Indian distributor of global technology brands in the IT and communications sector. It offers a wide distribution network with services like pre-sale support, technical help, credit, and warranty management, serving over 10,000 customers across India.

On September 16, 2025, the stock broke its 200-day exponential moving average at Rs. 312.31, with a strong trading volume of 317.57 K shares. The stock closed above its 200-day moving average at Rs. 314.30 in Tuesday’s session, reflecting up to a 4.54 percent increase in the intraday trade.

Accelya Solutions India Limited

Accelya Solutions India Limited was founded in 1976 and is based in Mumbai. The company is a leading provider of software solutions for the airline and travel industry. The company offers advanced technology platforms to manage passenger services, cargo operations, and airline financial processes, helping airlines worldwide improve efficiency and revenue management.

On September 16, 2025, the stock broke its 200-day exponential moving average at Rs. 1,434.86, with a strong trading volume of 41.34 K shares. The stock closed above its 200-day moving average at Rs. 1,457.60 in Tuesday’s session, reflecting up to a 3.24 percent increase in the intraday trade.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.