Synopsis- SIPs in Nifty 50 ETFs such as Nippon India ETF Nifty 50 BeES presents a cost effective and disciplined approach to create wealth over a period of time. In this article, An SIP of ₹5,000 has been taken into consideration, where SIP XIRR is the key performance indicator. Vintage analysis documents the long-term compounding advantages of the strategy, with longer horizons generating good returns and also offering protection against timing risk. The low cost ratio ensures investors gain nearly full market linked growth.

Nippon India ETF Nifty 50 BeES

Nippon India ETF Nifty 50 BeES is the first and oldest exchange-traded fund in India which enables investors to easily track the performance of Nifty 50 index. It is typically held up as a benchmark of passive investing because of its low cost relative to other ETFs. The fund also trades in good volumes which offers high liquidity. As of 26th August 2025, the ETF has traded at ₹279.05 with a 52W High/Low of ₹231.30- ₹293.99. It has a large AUM of 48,923 crores and a low expense ratio of 0.04%

| Parameter | Details |

| Fund Name | Nippon India ETF Nifty 50 BeES |

| Market Price (26-08-2025) | ₹279.05 |

| 52-Week Low / High | ₹231.30 / ₹293.99 |

| Assets Under Management (AUM) | ₹48,923 Crores |

| Expense Ratio | 0.04% |

| Number of Stocks | 50 |

SIP Performance

| Duration | SIP XIRR (%) | Invested Amount (₹) | Current Value (₹) |

| 1 Year | 8.49% | 60,000 | 62,293 |

| 2 Years | 10.36% | 1,20,000 | 1,32,091 |

| 3 Years | 13.26% | 1,80,000 | 2,17,249 |

| 4 Years | 13.22% | 2,40,000 | 3,09,339 |

| 5 Years | 14.00% | 3,00,000 | 4,21,490 |

| 7 Years | 15.28% | 4,20,000 | 7,15,563 |

| 10 Years | 14.48% | 6,00,000 | 12,64,992 |

An SIP of ₹5,000 per month is considered*

Also read: 5 Worst Performing Flexi Cap Mutual Funds of 2025 – Is Your Money at Risk?

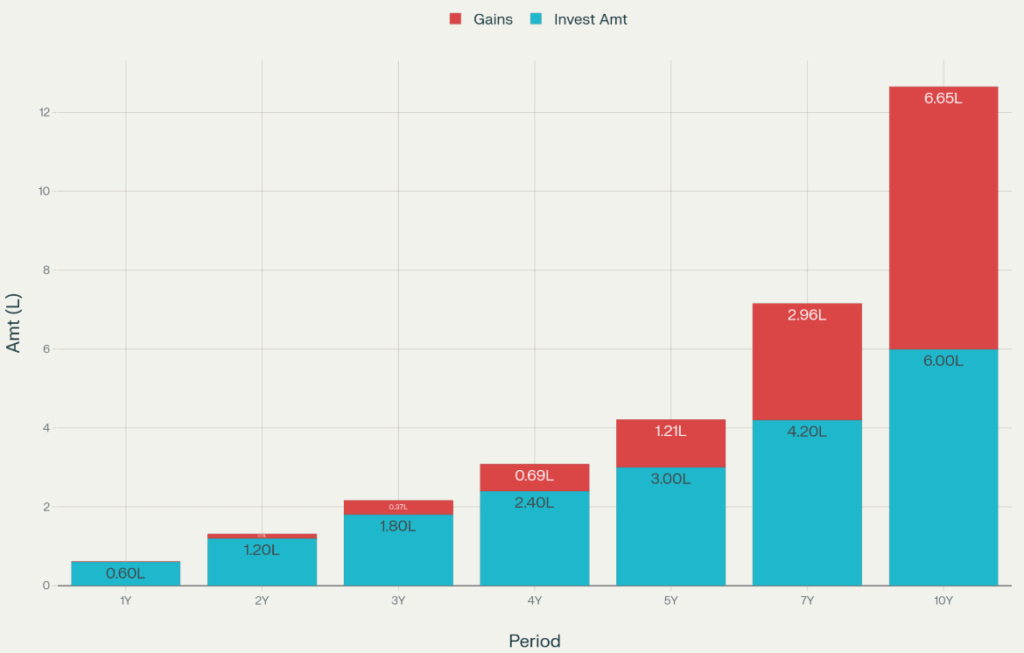

Graph showing NiftyBees SIP Performance

Key Insights:

- Strong long-term compounding: Returns are better over the years. The 1-year SIPs yielded slightly above average returns, whereas the 10-year SIP returns doubled the amount invested, owing to a compounding effect.

- Peak efficiency at medium-to-long terms: The best XIRR was noted after 7 years at 15.28% as the market experienced strong cycles. Although the 10-year returns fell a bit to 14.48%, the absolute wealth generated was much greater.

- Wealth scaling effect: In a 5-year period, the gains were ₹1.21 lakh but then in a period of 10 years the gains magnified more than 5 fold to ₹6.65 lakh. Absolute wealth increases faster than the linear growth in contributions.

- Volatility smoothing: SIPs eliminate timing risk by averaging over the market cycles. This is why medium to long horizons returns are in that range of 13-15% despite market variations.

- Cost efficiency: The expense ratio is 0.04% which is as low as zero, nearly all of the market returns can be transferred to investors. The compounding benefit of such savings over a 10-year SIP beats higher cost funds.

Final Thoughts

SIP in Nifty 50 ETF has been an attractive wealth creation strategy in the long run providing a steady return of 13-15% over time. The effect of compounding and its low cost is very effective in attracting investors who seek passive exposure in India’s growth. Notably, when markets experience a steep correction, investors are advised to purchase more units ( like lumpsum) along with SIP as this could greatly multiply returns achieved in the long-term as a result of cost averaging. Invest Wisely.

Written by Prajwal Hegde