A quick guide to open a demat and trading account in SBI (SBI Cap / SBI Smart): Last few months, I received a number of emails asking how to start trading using State Bank of India (SBI) account. Therefore, in this post, I am going to explain the complete procedure required to open your demat and trading account at SBI in a simple & easy way.

First of all, I would like to mention that you do not need to open a new SBI saving account if you already have an existing one. You can easily link your existing SBI saving account with the demat and trading account. However, if you do not have an SBI saving account, you can also open a 3-in-1 account i.e. a Saving + Demat + Trading account. All three accounts will be linked here.

Table of Contents

Documents Required

The photocopy of the following documents are required to open your demat and trading account at SBI:

- PAN CARD

- Aadhar Card (for address proof)

- One passport size photo

- Existing SBI saving account passbook (optional)

If you remember your SBI account number and its IFSC code, then the SBI saving account passbook photocopy is not required. You just have to fill your savings account details in the account opening form. However, it’s good to keep the photocopy, just in case.

Charges in SBI Demat & Trading Account

Here are the different charges applicable to the demat and trading account in SBI. This is available on SBI smart website in the ‘Charge’ section under ‘Quick access’ – https://www.sbismart.com/customer-service

Account opening Charges for SBI Demat & Trading

There are different plans which you can opt for while opening demat & trading accounts at SBI. However, most beginners are inclined towards the basic plan.

The basic charges for opening the demat and trading account in SBI is Rs 850 plus GST charges. The GST charged on this is 18% on the account opening charge i.e. 18% of Rs 850 = Rs 153. Therefore, the total amount for opening the account is Rs 850 + Rs 153 = Rs 1,003.

Moreover, this amount will be deducted directly from your SBI saving account with which you will be linking your demat and trading account. Therefore, there’s no need to pay it upfront.

Quick Note: Once your demat account is opened with SBI, you also have to pay an annual maintenance charges (AMC) of ₹500 per year to the bank.

Also Read:

- How to trade in ICICI Direct? Buy/Sell Stocks

- How to Open a Demat and Trading Account at Zerodha?

- How to Open [FREE] Demat Account at Angel Broking?

— Ongoing Cashback plan

Nevertheless, in the basic plan, SBI is also giving a cashback up to Rs 650 on the brokerage amount if you invest/trade in the first 6 months after opening your demat and trading accounts.

For example, let’s say you bought stocks of ITC worth Rs 50,000 within 6 months after opening the account. The brokerage charge for such investment is 0.5% on your investment amount (if you are investing in ‘delivery’ i.e. holding the stocks for more than 1 day).

Here, brokerage charge will be 0.5% of Rs 50,000 = Rs 250. SBI will cashback this Rs 250 in your savings account.

As the total cashback is up to Rs 650, therefore we can say that the effective account opening charge is (Rs 1,003 – Rs 650) i.e. around Rs 350, including GST Charges.

Also read: Different Charges on Share Trading Explained- Brokerage, STT & More

In addition, there are few other account opening plans also available which you can discuss with your SBI local relationship manager. Different plans have different cash backs options, annual maintenance charge rates, etc.

How to open a demat and trading account in SBI?

SBI Smart Website: https://www.sbismart.com

There are 3 ways in which you can open a demat and trading account in SBI as mentioned below:

- Visit the local SBI branch and open the accounts there.

- Fill the online application form available at SBI website.

- Contact the customer care and they will help to open your demat & trading account.

— Method 1: Visting SBI Branch

The first way is quite effective, although a little tiresome if the local SBI branch is far from your home. However, if you are able to visit the branch, then you can easily complete all the documentation work within a day. Further, you can get all your doubts cleared regarding brokerage charges, Annual maintenance charge (AMC) etc from the representatives present at the bank.

— Method 2: Online Process to Open SBI demat account

The second way is good for the young generations. They can easily fill the documents and upload it online. If you want to open your demat and trading account using the SBI website, here is the link: https://www.sbismart.com/customer-service

— Method 3*: Requesting SBI Relationship manager to visit home

The third way is the best and easiest. You just have to follow few simple steps to get your demat and trading account opened. Here are they:

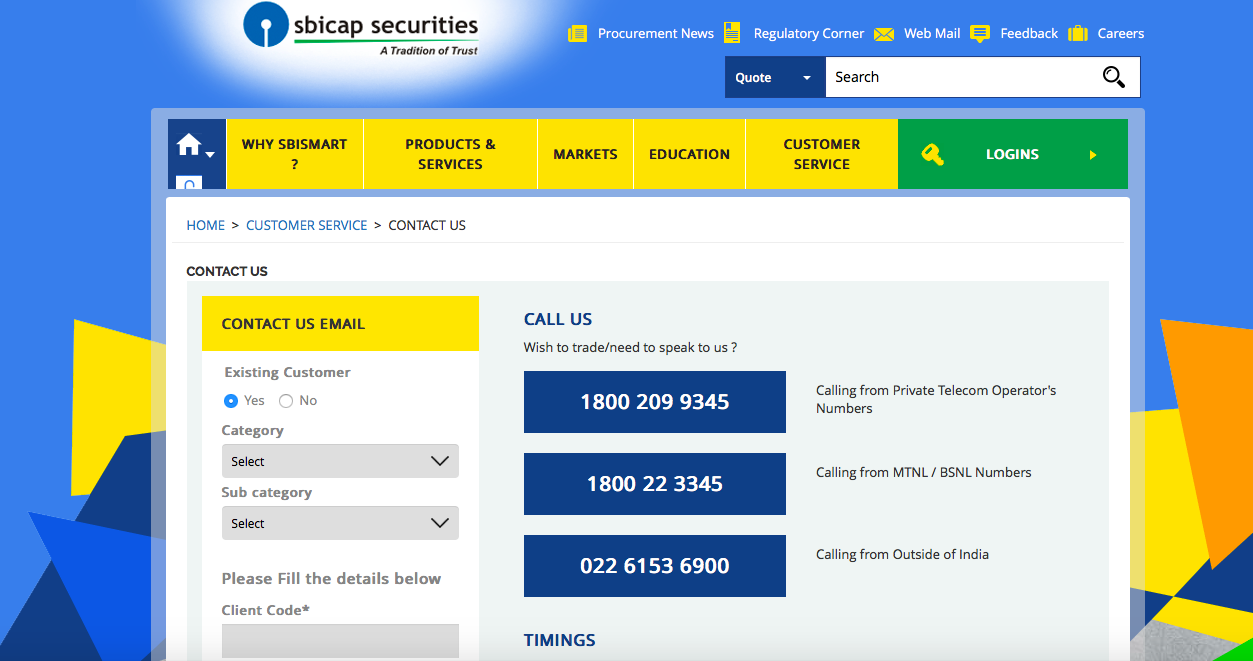

- Visit the Contact us page on SBI Smart website: https://www.sbismart.com/contact-us

- Fill the contact form or call the Toll free number and give your details. They will ask your name, city, pin code, and phone number.

- The local SBI Relationship manager from your city will call you within 2 working days and walk you through the process.

NOTE: You can fill be contact form by navigating on the ‘CUSTOMER SERVICE’ tab and clicking on ‘OPEN AN ACCOUNT’ option present on the right side of the screen.

Otherwise, you can call the SBI customer executive at 1800-209-9345 and tell your details.

Call from Local Relationship Manager

When your local relationship manager from your city will call, you can also request him to meet you at your address with the account opening form. Generally, they agree to visit your desired location to get the account opening form signed and collect the documents (Photocopy of PAN Card, Aadhar card & Passport size photo).

Once you have submitted the account opening form, your account will be activated within 15 days. You will get a mail from SBI smart with your username & password along with instructions for how to start investing/trading in SBI smart.

After receiving your login credentials, you can start trading by visiting the SBI Smart website (https://www.sbismart.com) and selecting ‘Trade Login’ present in the drop-down menu on ‘login’. Enter the credentials there and start trading.

Also read: How to buy a Stock using SBI demat account?

Also read: 8 Best Discount Brokers in India – Stockbrokers List 2020

Closing Thoughts

SBI demat and trading account offered by SBI Cap is a trusted brand and Subsidiary of State Bank of India, the country’s largest bank of India. As most Indian’s have a saving account in SBI, they might prefer to open a demat and trading account in SBI. Moreover, the account opening process involved with the SBI cap is similar to any other broker that you choose to open your account. You have to fill your application form (either online or offline) and submit the docs (Pan card, Aadhar Card & bank details) to them.

That’s all. Isn’t it simple? Now go and get your SBI demat and trading account opened. I hope this post on how to open a demat and trading account in SBI is useful to the readers. If you have any further doubts, please comment below. I will be happy to help you out. Happy Investing!

Kritesh (Tweet here) is the Founder & CEO of Trade Brains & FinGrad. He is an NSE Certified Equity Fundamental Analyst with +7 Years of Experience in Share Market Investing. Kritesh frequently writes about Share Market Investing and IPOs and publishes his personal insights on the market.