Synopsis: One of India’s largest contract manufacturers of air conditioners and components reported a disappointing Q2FY26 performance, swinging to losses on weak seasonal demand, higher finance costs, and muted profitability across divisions.

Shares of the leading consumer durable manufacturer slumped sharply after the company reported a quarterly loss for the September quarter, weighed down by muted demand in the room air conditioner (RAC) segment and a sequential decline in revenues. Investor sentiment turned negative amid margin compression and subdued order inflows.

Amber Enterprises Ltd opened at Rs. 7,155 against the previous close of Rs. 7,834.15 and hit an intraday low of Rs. 6,737.35, marking a decline of 14 percent. The company currently has a market capitalisation of Rs. 25,329.21 crore.

Financial Snapshot – Q2FY26

Revenue dropped 52.3 percent sequentially to Rs. 1,647 crore in Q2FY26 from Rs. 3,449 crore in Q1FY26. Operating profit fell 66.4 percent to Rs. 84 crore from Rs. 250 crore, while operating margin contracted from 7 percent to 5 percent. The company reported a loss before tax of Rs. 48 crore compared to a profit of Rs. 154 crore in the previous quarter. Net profit slipped from Rs. 106 crore to a loss of Rs. 32 crore. Earnings per share also fell from Rs. 30.66 to negative Rs. 9.35.

On a year-on-year basis, revenue declined 2.3 percent to Rs. 1,647 crore from Rs. 1,685 crore in Q2FY25. Operating profit decreased 24.3 percent to Rs. 84 crore from Rs. 111 crore, while margins contracted from 7 percent to 5 percent. The company posted a pre-tax loss of Rs. 48 crore compared to a profit before tax of Rs. 24 crore in the same quarter last year. Net profit slipped from Rs. 21 crore to a loss of Rs. 32 crore, while earnings per share dropped from Rs. 5.69 to negative Rs. 9.35.

Operational Highlights

In the Consumer Durables Division, the RAC industry witnessed a sharp 35 percent decline during Q2FY26 due to non-conducive weather conditions and deferment of purchases ahead of the GST rate reduction from 28 percent to 18 percent. Despite the challenging environment, the division recorded 15 percent revenue growth in H1FY26 but an 18 percent YoY decline in Q2FY26. The company remains optimistic about outpacing the industry’s growth for the full year.

The Electronics Division maintained its growth trajectory, reporting a 60 percent rise in H1FY26 and 30 percent YoY growth in Q2FY26. Under the ECMS scheme, Ascent Circuits received approval for an investment of Rs. 991 crore in multi-layer PCB manufacturing. IL JIN Electronics (India) Pvt Ltd, a subsidiary, also raised Rs. 1,750 crore from marquee investors to scale operations, enhance manufacturing capabilities, and explore acquisitions to strengthen its market position.

The Railway Sub-systems & Defense Division posted a 17 percent rise in revenue in H1FY26 and 7 percent YoY growth in Q2FY26. The division’s order book visibility expanded to Rs. 2,600 crore, supported by a broader product portfolio. Management expects long-term growth in this vertical, driven by healthy order visibility and new product additions.

Comments from the Management

Commenting on the results for Q2 & H1FY26, Mr. Daljit Singh, Managing Director said:

“We sincerely appreciate the Government of India for the GST reform and the reduction of GST on RACs from 28% to 18%, this will strengthen the industry growth by enhancing affordability, driving deeper penetration, and supporting premiumisation.

The RAC industry got impacted by non-conducive weather and deferment of purchase in between announcement & implementation of GST rate reduction, despite the challenges we delivered flattish Revenue of ₹ 1,647 Cr, and Operating EBITDA of ₹ 98 Cr, reflecting decline of 19% YoY and Loss after tax of ₹ 32 Cr in Q2FY26. The PAT during the period got further impacted by the higher financing cost owing to Power-One stake purchase & elevated inventory levels; and share of loss of JVs. On the way forward, inventories are getting to normalised levels.

Further, Amber Enterprises successfully raised equity funds of ~₹ 1,000 Cr from marquee investors through Qualified Institutions Placement, and we extend our sincere gratitude to the investors for their confidence in our growth journey.”

About the Company

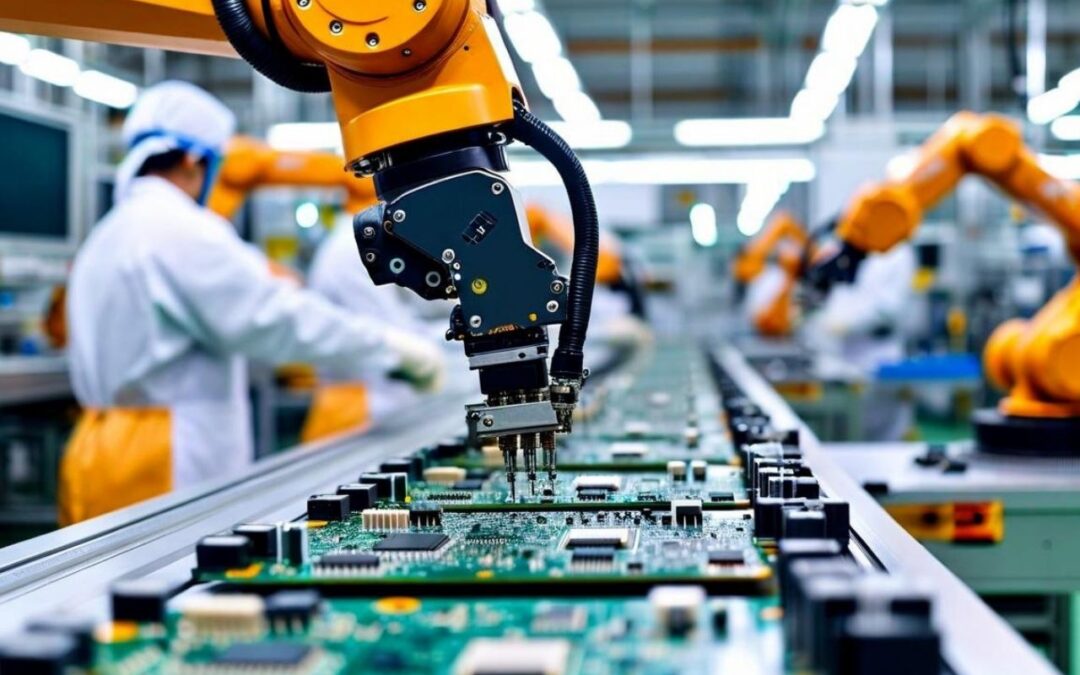

Incorporated in 1990 and headquartered in Gurugram, Haryana, Amber Enterprises Ltd is India’s largest contract manufacturer of room air conditioners and key functional components. As of March 31, 2025, the company operated 30 manufacturing facilities across eight states, catering to major brands such as Voltas, LG, Blue Star, Samsung and Daikin. Over the years, it has diversified into electronics and railway subsystems through strategic acquisitions and organic expansion.

-Manan Gangwar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.