Shares of this micro-cap Electronics Manufacturing Services stock hit the 2 percent upper circuit after the company reported a strong 92 percent quarter-on-quarter surge in net profit for Q4 FY25. The sharp rise in earnings reflects improved operational performance and investor optimism, driving increased buying interest in the stock.

During Wednesday’s trading session, the shares of Kaycee Industries Ltd opened at an intraday high of Rs.1,502.75 per share, hitting the 2 percent upper circuit limit from its previous close of Rs.1,473.30 per share. Over the past five years, the stock has delivered over 2,600 percent returns.

Financial Performance

Kaycee Industries Ltd saw a notable rise driven by strong growth in both net profit and revenue, as highlighted in its latest financial results. In Q4 FY25, Kaycee Industries Ltd reported revenue of Rs.15.59 crore, registering a growth of 14.31 percent compared to Rs.13.64 crore in Q4 FY24. On a sequential basis, revenue increased by 30.56 percent from Rs.11.94 crore in Q3 FY25, indicating strong quarterly momentum.

The company’s net profit for the quarter stood at Rs.1.79 crore, reflecting a rise of 14.01 percent from Rs.1.57 crore in Q4 FY24. Compared to Rs.0.93 crore in Q3 FY25, net profit jumped by 92.47 percent, showcasing significant improvement in profitability.

For the full year FY25, Kaycee Industries posted a total revenue of Rs.53.94 crore, up 9.12 percent from Rs.49.43 crore in FY24. Additionally, annual net profit surged to Rs.5.77 crore, marking an increase of 28 percent compared to Rs.4.49 crore in the previous fiscal year.

The Board of Directors has recommended a final dividend of 20 percent, equivalent to Rs. 2 per equity share, on 31,73,500 equity shares of Rs.10 each for the year ended March 31, 2025. This matches the previous year’s dividend of Rs.2 per share, including a special dividend. The total dividend payout will amount to Rs.63.47 lakhs, subject to approval by shareholders at the upcoming Annual General Meeting.

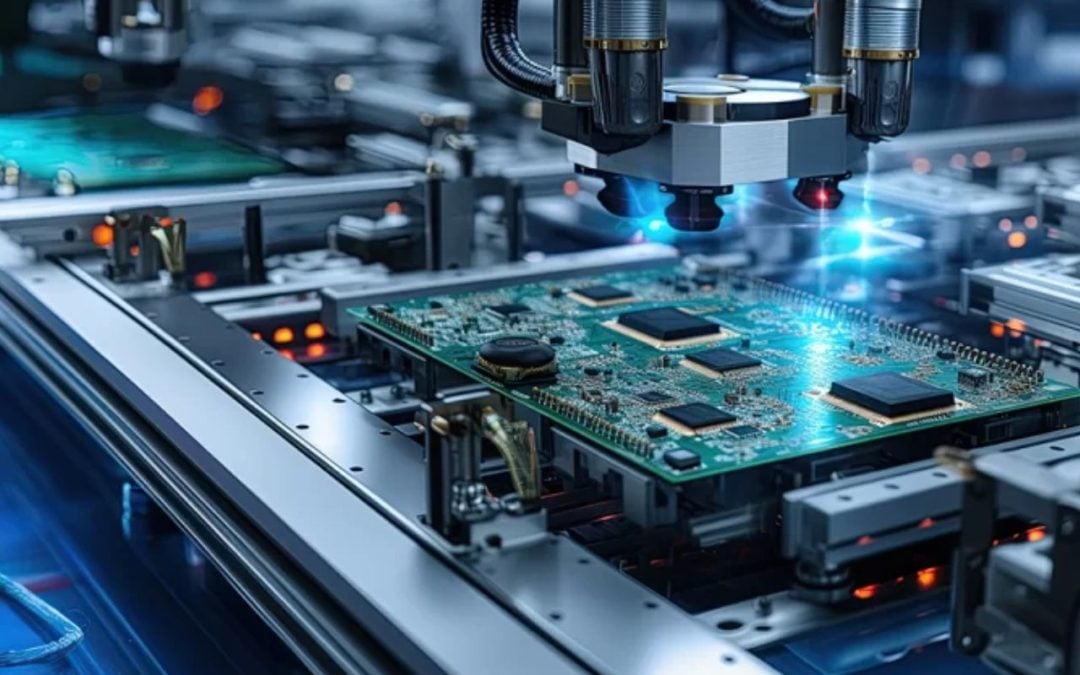

Kaycee Industries Limited is engaged in the manufacturing and trading of electrical installation products across India. The company operates through two main segments: Manufacturing and Trading. Its product portfolio includes a wide range of switches such as rotary, toggle, limit, cam, micro, breaker control, relay, foot, forward-reverse, and auxiliary switches.

Additionally, it offers timers, digital and mini time totalizers, measuring machines, revolution counters, cable lugs, temperature controllers, digital counters, push-button lamps, submersible cables, and earthing devices. Kaycee serves diverse sectors including power, telecom, renewables, panel builders, and machine tool manufacturers, while also exporting its products internationally.

Written by – Siddesh S Raskar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.